Chainlink (LINK) Explodes: US Government Deal Ignites Rally as Experts Predict $30 Breakout Imminent

Government adoption sends LINK soaring—proving even bureaucrats can't ignore blockchain's potential when it actually solves real problems.

Breaking the Institutional Barrier

Chainlink's oracle network just landed a major US government contract, triggering a massive price surge that's got everyone talking. This isn't just another crypto pump—it's validation that decentralized data feeds have real-world utility beyond speculative trading.

The $30 Target Zone

Analysts are circling $30 as the next major resistance level, with the government deal providing fundamental backing that most altcoins can only dream of. The move signals that institutional adoption isn't just coming—it's already here, and it's picking winners based on actual utility rather than hype.

Because nothing makes legacy finance move faster than the government writing checks to something they still don't fully understand—but at least they're using real infrastructure instead of just printing more money.

TLDR

- US government selected Chainlink to provide economic data feeds from Bureau of Economic Analysis

- LINK gained 3% on the news before falling back to around $25 level

- Token has rallied 61% since start of August from $15.43 low to current $24.13

- Technical analysis shows potential for $28-30 target by September if $26.50 resistance breaks

- RSI at neutral 54.04 with room for upward movement before overbought conditions

Chainlink has secured a partnership with the US government to publish economic data onchain. The Department of Commerce selected the oracle provider to deliver data feeds from the Bureau of Economic Analysis.

JUST IN: 🇺🇸 US Department of Commerce partners with chainlink $LINK to bring "government macroeconomic data onchain." pic.twitter.com/fd6hjkgT1b

— Watcher.Guru (@WatcherGuru) August 28, 2025

The partnership will see Chainlink publish real gross domestic product data, Personal Consumption Expenditures price index, and real final sales to private domestic purchasers. The company will add more data feeds based on consumer demand or government requests.

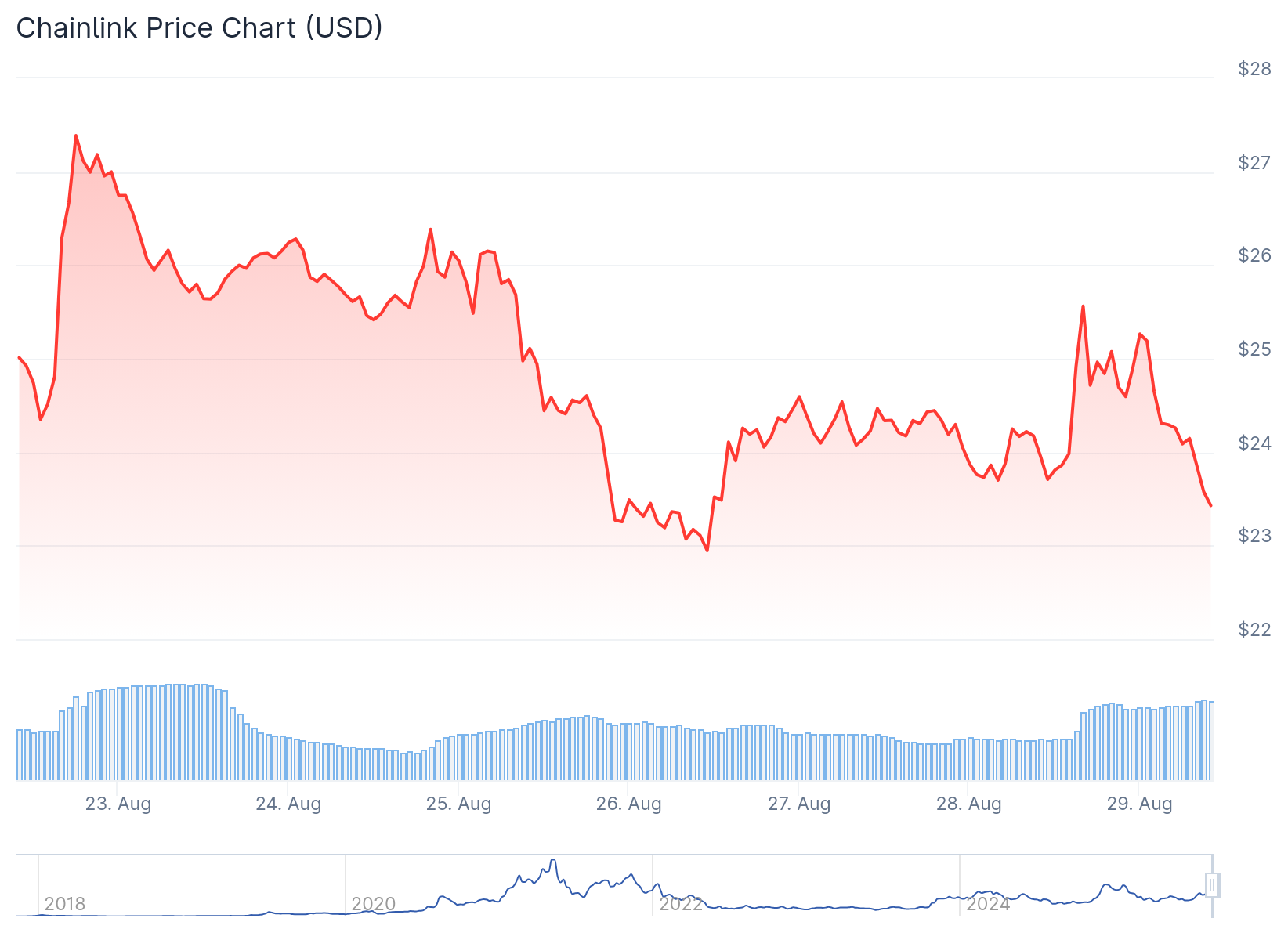

LINK price gained over 3% on the announcement before retreating to approximately $25. The token currently trades at $24.13 after a strong August performance.

The government data initiative forms part of the Trump administration’s plan to increase spending transparency. Officials aim to improve accountability and establish the US as a global crypto hub.

LINK has experienced a powerful rally since early August. The token climbed from a low of $15.43 to current levels, representing a 61% gain over the month.

Chainlink Price Prediction

Current technical indicators suggest potential for continued upward movement. The RSI reading of 54.04 places LINK in neutral territory with room for expansion before reaching overbought levels.

The token trades just 2% above its 20-day simple moving average of $24.18. This positioning indicates price consolidation NEAR key technical support levels.

LINK sits at a 0.49 position within its Bollinger Bands range. The upper band at $27.41 aligns closely with analyst price predictions for near-term targets.

The 50-day moving average provides strong support at $20.24. This level represents a 19% buffer below current trading prices.

Daily trading volume reached $336 million, indicating sustained institutional interest in the token. The 24-hour activity suggests continued engagement from large market participants.

Analyst Predictions Target $28-30 Range

Multiple analytical platforms converge on similar price targets for LINK. DigitalCoinPrice presents a conservative $28.18 short-term forecast representing 16.8% upside potential.

The $26.50 level represents critical resistance for bullish continuation. A break above this threshold could trigger momentum toward the $28-30 target zone.

All three analyses emphasize the importance of clearing the $26.50 barrier. This level aligns with technical resistance patterns observed in recent price action.

The 52-week high of $26.79 sits just 11% above current levels. This proximity makes initial breakout targets appear achievable based on recent volatility patterns.

Conservative entry strategies suggest accumulation on dips toward $23.50-24.00. The 20-day moving average provides dynamic support for potential buyers.

Risk management requires stop-loss placement below $22.30 support. This level represents the lower boundary of recent consolidation patterns.

Position sizing should account for LINK’s average true range of $1.98. This metric indicates potential daily price swings of 8-10% under normal conditions.

The timeline for target achievement extends through September 2025. Initial confirmation depends on breaking above $26.50 resistance within the next two weeks.

Government partnership with Pyth Network also announced GDP data publishing, with PYTH surging nearly 70% on the news.