CME Ether Futures Open Interest Shatters Records at $10 Billion

Institutional money floods into crypto's second-largest asset as derivatives demand explodes.

The Big Money Moves

Chicago Mercantile Exchange's ether futures contracts just hit a staggering $10 billion in open interest—wall street's latest vote of confidence in Ethereum's staying power. Traders are piling into leveraged positions despite regulatory uncertainty, betting big on ETH's next price move.

Traditional finance finally gets it—or at least, they're pretending to while chasing yields their bond portfolios can't deliver. CME's crypto products keep attracting capital that would've sat on the sidelines two years ago. The institutional infrastructure is building, whether crypto purists like it or not.

Let's be real—half these traders probably still can't explain how a smart contract works, but they'll sure as hell speculate on its price. When the suits start playing with fire, you know there's real heat building.

TLDR

- CME’s ether futures open interest hits record $10 billion as institutional investors increase participation

- Large open interest holders reach record 101, showing growing professional involvement in ether markets

- Ether price surged 23% this month, hitting lifetime highs above $4,900

- Ether ETFs attracted $3.69 billion in August while Bitcoin ETFs saw $803 million outflow

- Bitcoin futures open interest remains subdued at $15.3 billion, down from December highs

The CME’s ether futures market reached a new milestone as open interest surpassed $10 billion for the first time. This record comes as institutional investors show increased participation in ethereum-based derivatives.

The number of large open interest holders hit a record 101 early this month. These holders maintain at least 25 ether contracts at any given time and represent the institutional and professional trading community.

Open interest measures the dollar value of active contracts in the market. The CME offers standard contracts sized at 50 ETH and smaller micro contracts at 0.1 ETH for different investor types.

The exchange also reported record-breaking activity in other ether products. Micro ether contracts exceeded 500,000 for the first time while ether options open interest topped $1 billion.

Giovanni Vicioso, global head of cryptocurrency products at CME Group, confirmed the institutional trend. He cited the record number of large holders as a key indicator of strengthening professional participation.

Growing Institutional Interest

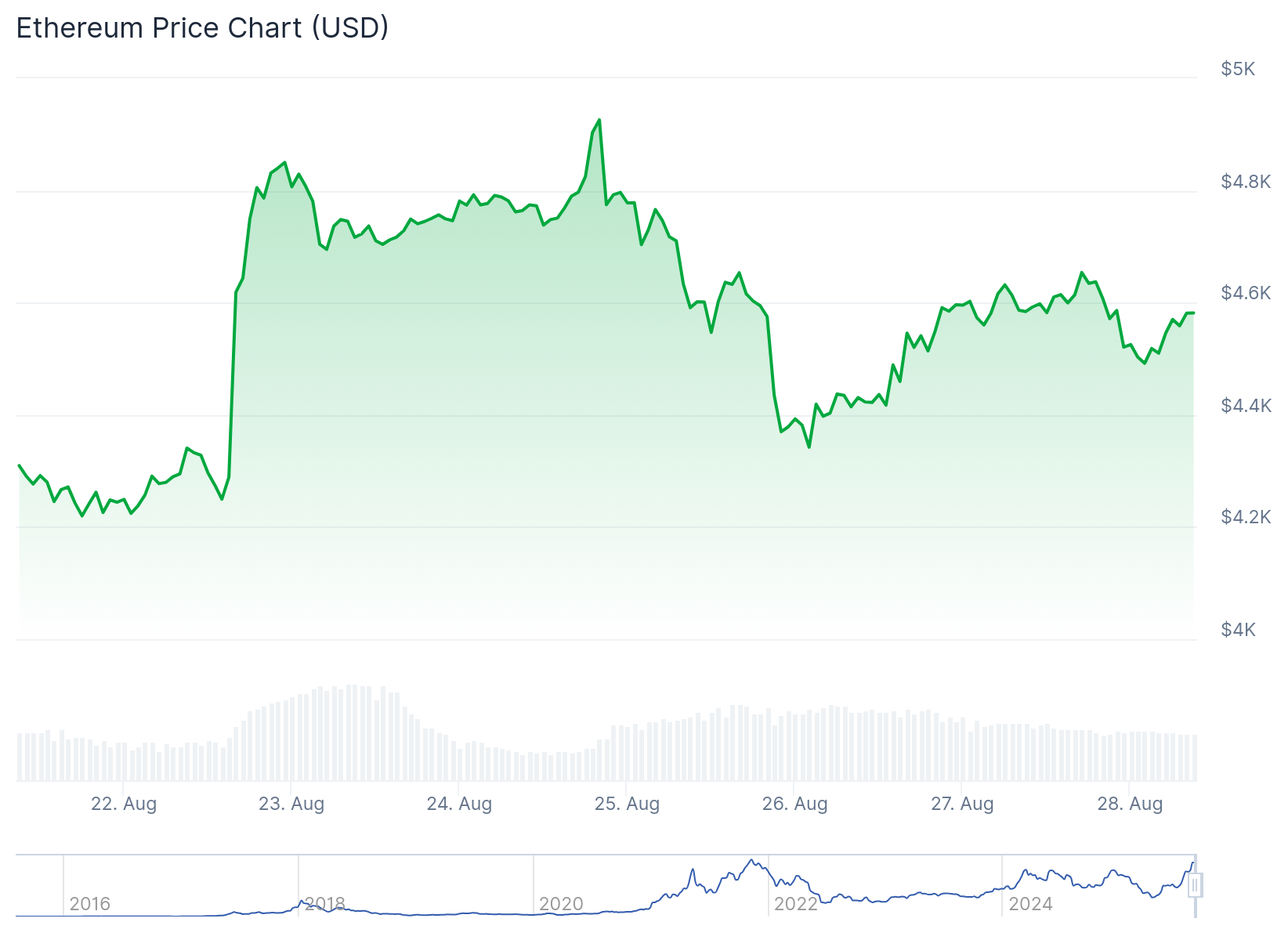

The institutional shift extends beyond futures markets into other areas. Ether has gained 23% this month and reached lifetime highs above $4,900 according to market data.

U.S.-listed spot ether ETFs attracted $3.69 billion in August alone. This marks the fourth consecutive month of positive net investments for these products.

The ETF flows show a clear preference shift among institutional investors. While ether funds gained billions, Bitcoin ETFs registered net outflows of $803 million during the same period.

This rotation appears in futures markets as well. Bitcoin futures open interest remains at 137,300 BTC or $15.3 billion, well below the December peak of 211,000 BTC.

The CME data shows micro ether contracts performing particularly well. These smaller-sized products allow retail and smaller institutional investors to participate in the regulated derivatives market.

Market Performance Drivers

Several factors contribute to ether’s recent performance according to CME officials. Increased network activity on ethereum has drawn more attention to the underlying asset.

Corporate treasury accumulation of ether has also supported prices. Companies are adding ether to their balance sheets alongside or instead of bitcoin holdings.

Regulatory developments have created a more favorable environment for ether-based products. This includes approval processes for various Ethereum derivatives and investment vehicles.

The options market shows similar growth patterns to futures. Ether options open interest reached over 4,800 contracts, marking a year-to-date high for the product category.

CME’s regulated environment attracts institutional investors who require compliance frameworks. The exchange’s position as a traditional financial institution helps bridge cryptocurrency and conventional markets.

The record metrics come as ethereum continues technological development. Network upgrades and scaling solutions maintain investor interest in the platform’s native token.

Current data shows ether futures open interest at its highest level since the contracts launched in 2021.