Ethereum (ETH) Price Prediction: Wall Street’s New Crypto Darling Obliterates Bitcoin ETF Demand

Wall Street's shifting allegiances just sent shockwaves through crypto markets—and Bitcoin's feeling the squeeze.

ETH's Institutional Takeover

Forget what you knew about crypto adoption. Ethereum isn't just competing; it's rewriting the rulebook. While Bitcoin ETFs once dominated headlines, smart money now flows toward ETH's programmable ecosystem. The shift isn't subtle—it's a tidal wave of institutional capital chasing real utility over digital gold narratives.

The ETF Demand Crunch

Bitcoin's flagship products watched demand evaporate as Ethereum's staking yields and defi integrations offered something ETFs never could: actual revenue. TradFi giants finally realized holding static assets beats inflation about as well as a savings account from 2008. Who needs synthetic exposure when you can earn yield on-chain? Classic finance never saw that coming.

Price Trajectory: Breaking Conventional Wisdom

Analysts scramble to update models that never accounted for ETH outpacing BTC in institutional portfolios. The convergence of defi, tokenization, and layer-2 scaling created a perfect storm—one that leaves Bitcoin's store-of-value thesis looking downright archaic. Prediction models now factor in something Wall Street rarely acknowledges: network effects actually matter more than brand recognition.

As Bitcoin maximalists clutch their ETF prospectuses, Ethereum's building the financial infrastructure they're still trying to explain to compliance departments. Sometimes disruption doesn't ask for permission—it just renders old models obsolete.

TLDR

- Spot Ether ETFs attracted $1.83 billion in inflows over five trading days, compared to just $171 million for Bitcoin ETFs

- ETH price recovered 5% from Tuesday lows while Bitcoin gained only 2.8% in the same period

- Investment advisers hold $1.3 billion in Ether ETF exposure, with Goldman Sachs leading at $712 million

- ETH/BTC trading pair shows technical strength at 0.04126 BTC with potential upside targets

- Total Ether ETF inflows reached nearly $10 billion since July, driven by stablecoin legislation and institutional adoption

Spot Ether exchange-traded funds have captured Wall Street’s attention in a big way. Over the past five trading days, these funds pulled in $1.83 billion compared to just $171 million for Bitcoin ETFs.

The trend continued on Wednesday with nine Ether ETFs seeing $310.3 million in inflows. bitcoin funds managed only $81.1 million across 11 products.

$310 million into the ETH ETFs today.

$81 million into the BTC ETFs.

Brutal.

— sassal.eth/acc 🦇🔊 (@sassal0x) August 28, 2025

This massive shift has pushed Ether ETF inflows close to $10 billion since July. The funds have been trading for 13 months and reached $13.6 billion in total inflows.

Bitcoin ETFs still hold the overall lead with $54 billion in aggregate inflows over 20 months. However, the recent momentum clearly favors Ethereum.

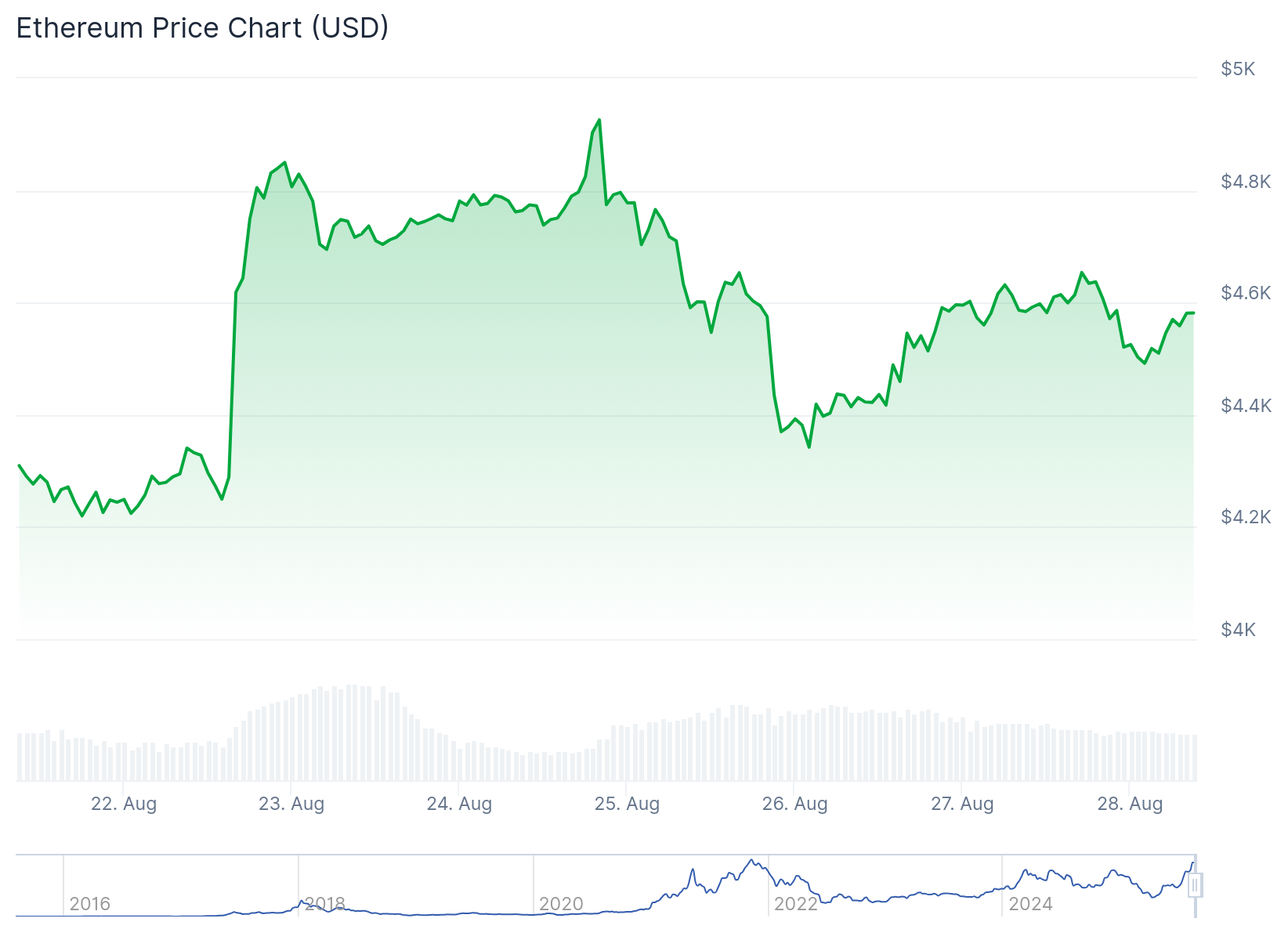

ETH prices have outpaced Bitcoin’s recovery this week. Ether climbed 5% from Tuesday’s low while Bitcoin gained 2.8% over the same timeframe.

The price action reflects growing institutional interest in Ethereum’s ecosystem. VanEck CEO Jan van Eck called ETH “the Wall Street token” during a Fox Business interview.

Investment Adviser Adoption Drives Growth

Investment advisers have emerged as major holders of Ether ETFs. They control $1.3 billion in exposure according to recent data.

Goldman Sachs leads the pack with $712 million in Ether ETF holdings based on SEC filings. This institutional backing provides strong support for continued inflows.

The GENIUS Act stablecoin legislation passed in July has helped boost confidence in Ethereum. The network dominates both stablecoin transactions and tokenized real-world assets.

Ethereum Price Prediction

From a technical perspective, ETH is showing strength against Bitcoin. The ETH/BTC pair trades around 0.04126 BTC after bouncing from key support levels.

Ethereum still has massive upside against Bitcoin.

Fair value is far from reached! pic.twitter.com/dLyojzQQeH

— crypto Rover (@rovercrc) August 27, 2025

Analysts see room for further gains. The pair defended critical support between 0.02000-0.02500 BTC, historically a launching pad for rallies.

Next resistance levels sit at 0.050 BTC and 0.065 BTC. A break above 0.050 BTC could signal the start of a sustained rally.

The weekly charts display strong green candles indicating renewed buyer confidence. As long as ETH holds above 0.030 BTC, the bullish setup remains intact.

Ethereum’s fundamentals continue improving with growth in DeFi protocols and layer-2 solutions. Staking rewards provide steady income for long-term holders.

The combination of institutional inflows and technical strength positions Ether well against Bitcoin. Market participants are watching to see if this momentum can be sustained.

ETH traded at $4,560 at recent checks, down 1.2% on the day according to CoinGecko data.