Stagflation Fears Mount as Bitcoin Pivots: Top Crypto Picks for August 2025

Economic uncertainty triggers crypto market shakeup—here's where smart money flows next.

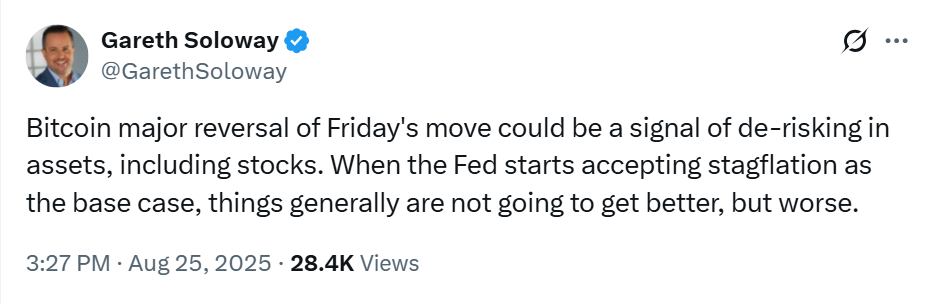

Bitcoin's sudden reversal catches traders off guard as traditional indicators flash warning signs. Stagflation concerns push investors toward alternative stores of value beyond conventional assets.

Defi protocols see surge in institutional interest as yield-hunting accelerates. Ethereum's merge completion positions it as prime candidate for risk-off rotation.

Layer-1 alternatives gain traction amid network congestion debates. Solana's throughput advantages attract developers while Cardano's research-driven approach appeals to long-term holders.

Stablecoin innovation accelerates as regulators scramble to keep pace—because nothing says financial stability like bureaucrats reacting to market moves six months late.

NFT markets show surprising resilience despite macro headwinds. Blue-chip collections maintain floor prices while utility-focused projects outperform speculative assets.

Crypto's next bull run won't wait for traditional finance to catch up. The question isn't if—but which digital assets position best for the coming inflation hedge frenzy.

What does stagflation mean for crypto markets?

Powell’s Jackson Hole speech was a double-edged signal. Markets cheered the prospect of rate cuts, but his emphasis on tariffs pushing inflation higher fed the word no investor wants to hear: stagflation.

For Wall Street, stagflation is code for slowing growth paired with sticky prices, a mix that erodes both equities and bonds.

Bitcoin’s stumble below $111k shows how quickly “safe” liquidity can get drained.

On the good side, Ethereum’s strength shows that capital is still hunting performance, just not in the same places.

In these moments, capital often seeks asymmetric bets with faster upside potential.

Is DeepSnitch the best crypto to buy in 2025?

DeepSnitch is lining up as the AI presale to APE into this cycle. Five agents rolled into one dashboard bring value and the upper hand to retail traders: one tracks whales, another sniffs early tokens, one shreds contracts on the spot, and the rest turn news and on-chain data into pure signal.

With this uncertainty in the markets, the good news is that DeepSnitch works in both directions. Even in a bear market, traders still need alerts and tools to keep their bags alive. This gives DeepSnitch higher potential than hype-only coins that vanish when sentiment cools.

The best part is that DeepSnitch is still at the very beginning. Stage 1 has already moved, from $0.01571 to $0.01602, with $165k flowing in.

At this point, the runway is wide open, with price discovery only just beginning. Early buyers also secure first access to the AI stack as it launches, which means plugging into practical tools on top of pure upside.

Ethereum hits new ATH, what’s next?

Powell’s nod to a possible September cut has traders front-running liquidity, and ETH is soaking it up, holding steady at around $4,428 after setting a new ATH on August 24th. It’s up nearly 20% in the past month, while Bitcoin has slipped into the red at $110k since Jackson Hole.

A whale has recently unloaded 22,769 BTC worth $2.59B to buy nearly 473,000 ETH at $2.22B, then reinforced the move with a $577M perpetual long on Hyperliquid. In a stagflation setup where capital hunts for assets that can still run, this suggests ethereum is being lined up as the cycle’s workhorse while Bitcoin stalls.

ETH’s already ripped 250% since the April lows, juiced by institutions and treasuries. If this trend holds through September, it could be the fuse that lights full-blown alt season. Targets are lining up at $5,200–$5,500, but in a stagflation world where capital needs somewhere to run, this may just be the beginning.

Solana price prediction: Is $400 possible this year?

SOL’s been grinding higher, fueled by upgrades to its validator framework and deeper reserves that keep the chain fast and liquid. These tweaks have pulled in more devs, more capital, and more confidence in the network’s potential.

Meanwhile, Sharps just dropped a $400M bomb to spin up a solana treasury, meaning more TradFi money sniffing around SOL.

SOL ripped past $212 before cooling NEAR $190, up almost 8% in two weeks. Volume’s rising with it, a classic sign of accumulation, and traders are eyeing $220 as the next breakout level. If momentum fades, downside support comes in way lower, around $130 and $95.

In other words: classic Solana. Fast, volatile, and built for traders who don’t mind a little whiplash chasing the upside.

Final verdict

If stagflation becomes the Fed’s base case, markets won’t crawl out clean. Stocks chop, bonds wobble, bitcoin loses its shine.

But for crypto traders, this could mean rotation. Majors like ETH and SOL catch the first flows, but the outsized bets, the best cryptos to buy, land earlier, in presales that solve real problems.

At presale size, even a small pump in demand can send DEEP Snitch AI multiples higher, something ETH or SOL can’t deliver at their massive valuations.

Majors MOVE the market, but only an early project priced at only $0.01602 could easily 100x.

Visit the official website for more information.

FAQs

- What is the best crypto to buy right now in 2025?

Ethereum and Solana remain top altcoins to watch for stability and scale, while small-cap presales like DeepSnitch AI offer higher-risk, higher-reward upside. - How does stagflation impact the best crypto to buy now?

If stagflation pressures traditional markets, capital tends to rotate into asymmetric bets. Majors like ETH and SOL may hold strength, but emerging Web3 tokens such as DeepSnitch AI can benefit most from new inflows. - Can small-cap crypto picks like DeepSnitch really 100x?

Small-cap cryptos move faster because even modest demand can pump the price dramatically. DeepSnitch’s presale price has already ticked higher with demand, and compared to majors with multi-billion-dollar caps, it has much more room to multiply.