Fed Rate Chatter Nears Peak - Analysts Sound Alarm on Crypto Top Formation

Fed-speak hits fever pitch as monetary policy hawks circle - and crypto markets are feeling the heat.

Wall Street's Crystal Ball Gazers

Analysts spot troubling patterns as interest rate uncertainty triggers classic risk-off behavior. The 'everything bubble' narrative gets fresh ammunition when traditional finance gets jittery.

Digital Gold or Digital Fool's Gold?

Bitcoin's correlation with tech stocks reasserts itself at the worst possible moment. Suddenly, that 'uncorrelated asset' thesis looks about as solid as a meme coin's fundamentals.

Institutional players hit pause on crypto allocations while retail FOMO cools faster than a NFT project's trading volume. Because nothing sobers up speculative euphoria like the Fed reminding everyone that free money isn't actually free.

Another day, another reminder that when central bankers whisper, 'risk assets' crumble - proving crypto hasn't quite escaped traditional finance's gravitational pull despite all the decentralization talk.

TLDR

- Powell hinted at September rate cuts, sending crypto and stocks higher.

-

Ethereum touched $4,834, near its record $4,866 peak from 2021.

-

Social media mentions of Fed and cuts surged to an 11-month high.

-

Chainlink hit $27.11, showing strength as it decoupled from the market.

Federal Reserve Chair Jerome Powell’s speech at Jackson Hole ignited a strong rally across digital assets and equities. He noted that conditions in inflation and the labor market “may warrant adjusting” monetary policy. Markets interpreted the comment as a signal that interest rate cuts could begin as early as September.

The CME FedWatch Tool shows that 75% of market participants now expect a September cut. This fueled optimism, lifting Bitcoin above $117,000 and driving ethereum to $4,834, just below its all-time high of $4,866. The S&P 500 also posted a record high, reflecting the growing correlation between traditional markets and crypto assets.

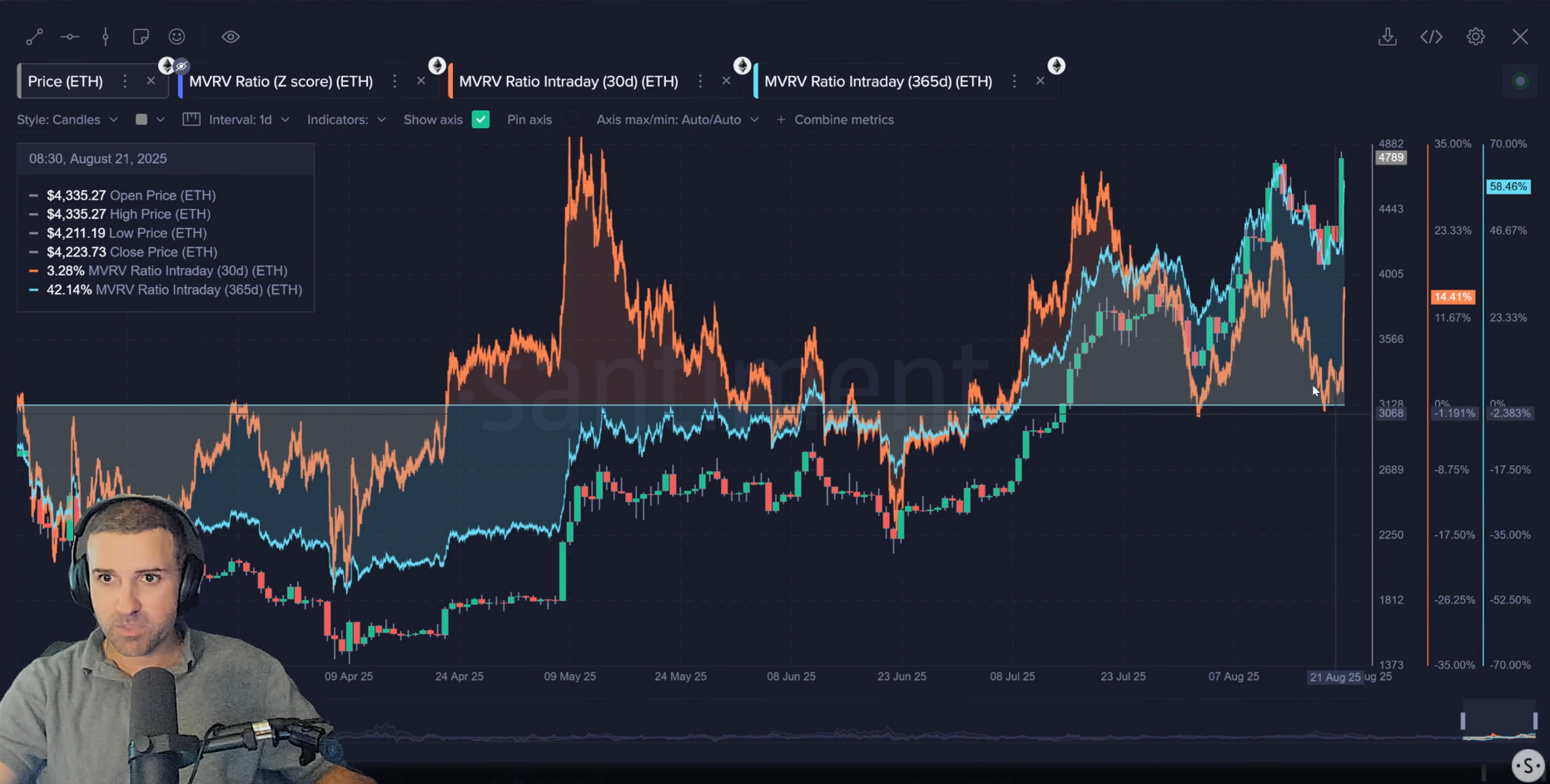

Ethereum and Bitcoin Show Diverging On-Chain Signals

Ethereum is trading close to new highs, yet on-chain data suggests caution. Santiment reported Ethereum’s short-term MVRV ratio has entered levels often followed by corrections. The long-term MVRV ratio is even higher at +58.5%, showing that many holders are in profit and may be tempted to sell.

In contrast, Bitcoin’s on-chain data reveals a more cautious outlook. Exchange balances have risen by nearly 70,000 BTC since June, breaking a long trend of coins moving to cold storage.

Historically, this pattern has preceded increased selling pressure. Positive funding rates also indicate that many traders are betting on further upside, leaving room for potential long squeezes.

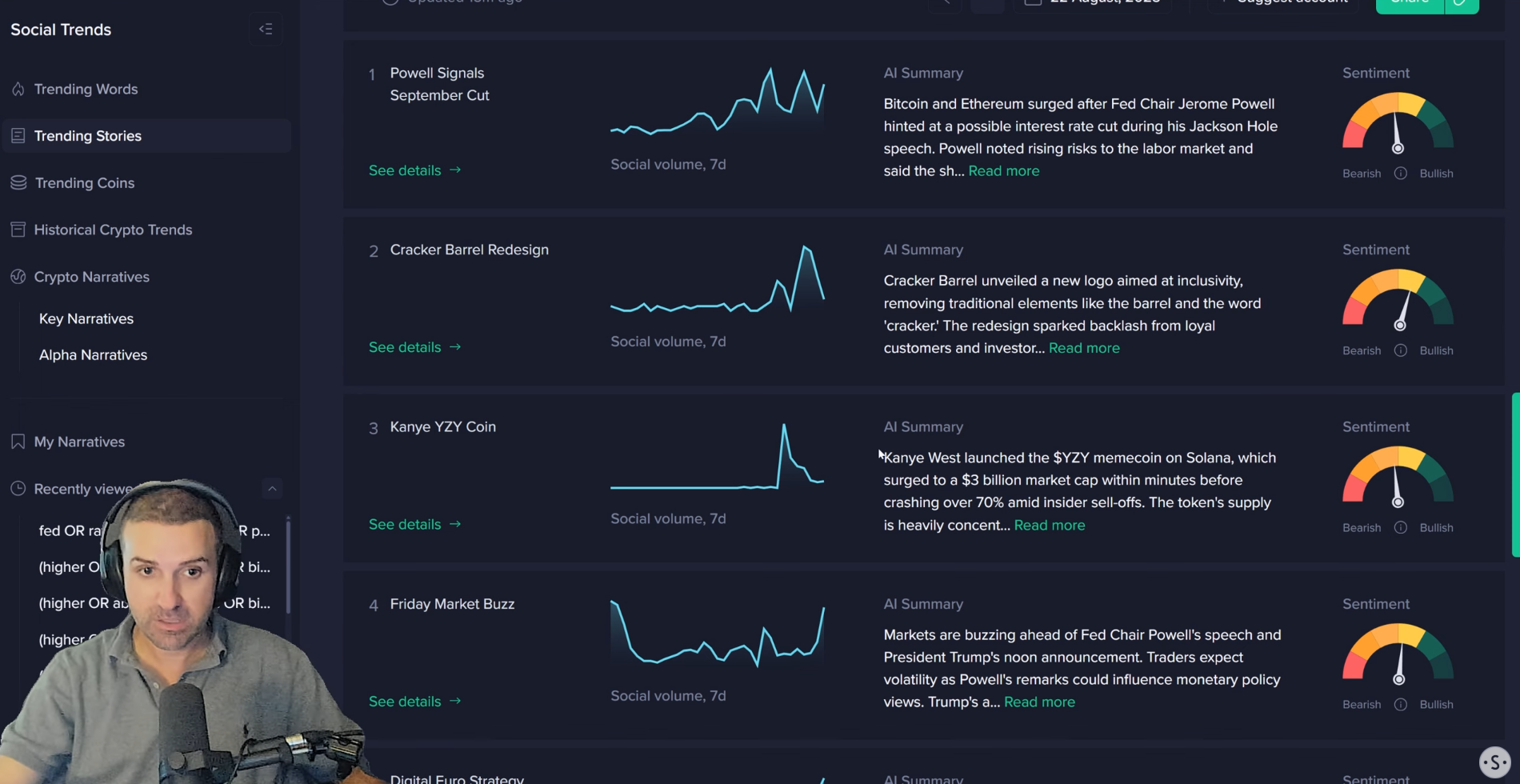

Rising Fed Rate Chatter May Signal Overheating

Santiment warned that the surge in Fed-related discussion across social media may signal excessive market optimism. Mentions of “Fed,” “rate,” and “cut” reached their highest point in 11 months.

The platform noted that such spikes often coincide with short-term market tops, as investors crowd into a single bullish narrative.

“Historically, such a massive spike in discussion around a single bullish narrative can indicate that euphoria is getting too high,” Santiment said. This aligns with previous cycles where heavy focus on macro news preceded corrections in crypto prices.

Altcoin Market: Chainlink and Yeezy Memecoin in Focus

Chainlink has broken away from broader market trends, rising to $27.11, its highest price since December 2024. The project is experiencing strong network growth, with whale transactions and active addresses climbing steadily. Analysts note this “decoupling” could make LINK a leader in the next phase of the market cycle.

Meanwhile, volatility in the memecoin sector was illustrated by the sharp boom and crash of Kanye West’s Yeezy token. The Solana-based coin peaked at a $3 billion market cap before collapsing below $1 billion, leaving over 56,000 wallets with losses. The event reinforced the risks of celebrity-linked tokens, where HYPE can quickly reverse.

Before the rally, social sentiment toward crypto had fallen to its lowest point since early July. Retail frustration over stagnant prices acted as a contrarian signal, suggesting that a reversal was near. The subsequent bounce reinforced the usefulness of monitoring social data as a market indicator.

Analyst Brian noted that Ethereum could push toward $5,000 if Optimism continues. However, the biggest risk remains any shift in the Federal Reserve’s stance. A delay or cancellation of expected cuts could quickly reverse the current bullish momentum across crypto markets.