Bitcoin (BTC) Price Prediction: Whales Gobble Up 16,000 BTC as Market Holds Breath for Powell Speech

Whales are making waves while everyone watches the Fed.

Major Accumulation Underway

Bitcoin's biggest players just snapped up 16,000 BTC in a single move—that's serious conviction despite regulatory theater and macroeconomic posturing. These aren't retail investors chasing hype; these are calculated bets placed against the backdrop of Powell's upcoming speech.

Powell's Shadow Looms Large

All eyes turn to Jerome Powell as the crypto market holds its collective breath. Will he signal dovish relief or hawkish pain? History suggests traditional finance will overreact either way while crypto builds its own reality. The Fed's words move markets, but Bitcoin's fundamentals keep grinding forward.

Price Speculation Heats Up

With whale accumulation at these levels, smart money's positioning for volatility. They're betting Powell's speech becomes just another blip in Bitcoin's long-term ascent. After all, the Fed prints dollars—Bitcoin prints certainty. Another day, another central banker trying to steer the ship while whales chart their own course.

TLDR

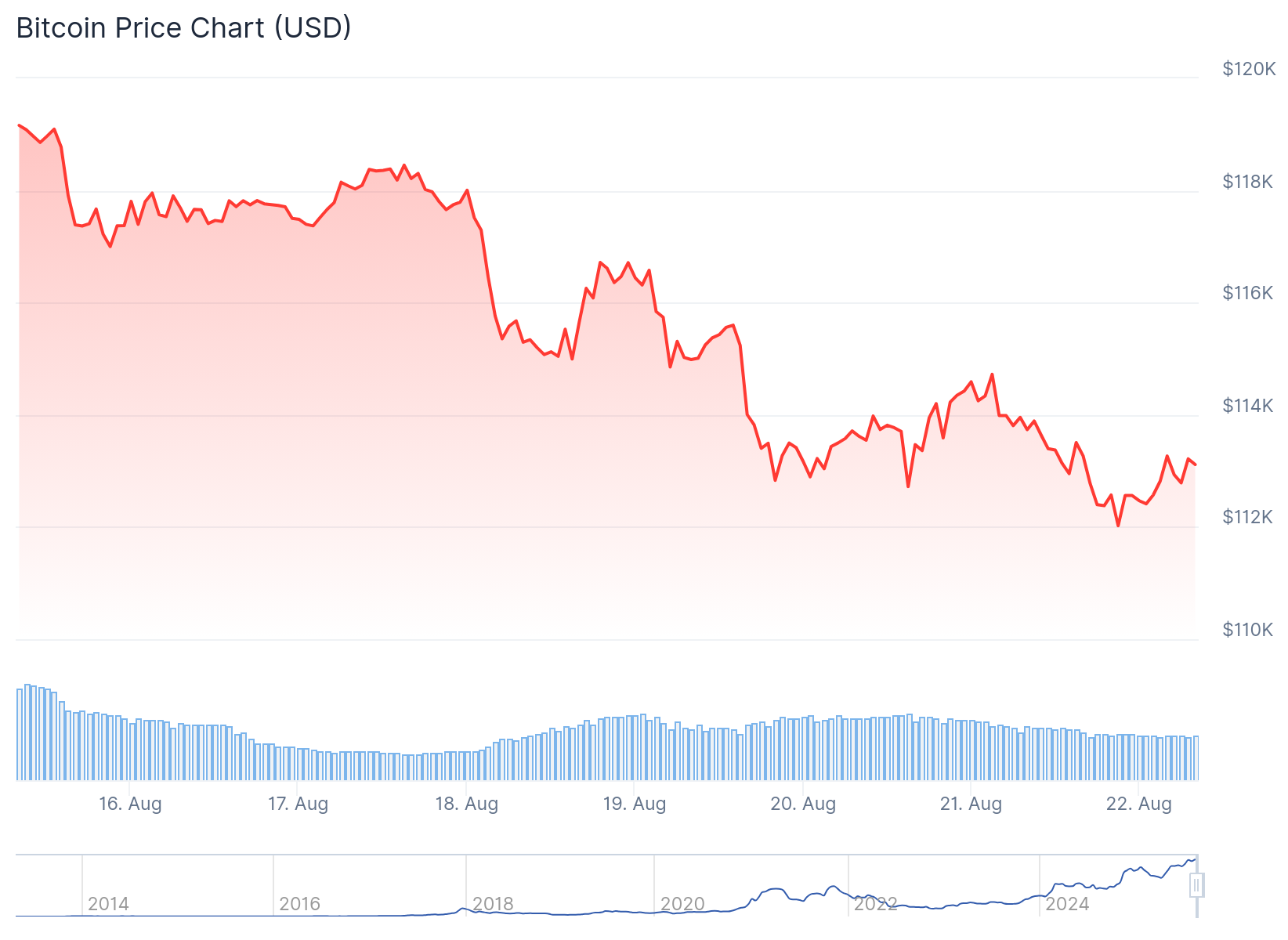

- Bitcoin dropped 0.74% to $113,018 as traders await Fed Chair Jerome Powell’s Jackson Hole speech

- Whales accumulated over 16,000 BTC during the recent dip while retail investors sold at losses

- BlackRock transferred 10,584 BTC worth $1.19 billion to Coinbase, sparking sell-off concerns

- Technical indicators show oversold conditions with RSI at 32.93 but MACD remains weak

- September Fed meeting has 81% odds of 0.25% rate cut, though September historically weak for Bitcoin

Bitcoin trades near $113,000 as market participants brace for Federal Reserve Chair Jerome Powell’s Jackson Hole speech on Friday. The world’s largest cryptocurrency fell 0.74% in the past 24 hours to $113,018.

Ethereum also declined, dropping 0.1% to $4,284 during the same period. The broader crypto market remains steady but cautious ahead of Powell’s remarks.

Market analysts expect Powell to take a hawkish stance based on recent economic data. Vincent Liu from Kronos Research warned that hawkish comments could deepen selling pressure across crypto markets.

A dovish surprise from Powell could spark a rally in Bitcoin and other digital assets. However, if the Fed Chair remains neutral without clear rate hints, the crypto market will likely continue consolidating.

Whale Accumulation Contrasts Retail Selling

Data from CryptoQuant shows bitcoin whales accumulated more than 16,000 BTC during the recent market downturn. This accumulation occurred while smaller retail traders sold their holdings at losses.

Whales Take Advantage of Dip to Accumulate Bitcoin

“In the last seven days, wallets of major Bitcoin network players have accumulated more than 16,000 BTC, indicating a pattern of absorption in the price drop known as ‘buy the dip.’” – By @caueconomy pic.twitter.com/YTl31FWKS8

— CryptoQuant.com (@cryptoquant_com) August 21, 2025

The whale buying pattern mirrors behavior seen during August’s initial correction. Large players increased their positions while retail investors exited the market.

Analysts suggest this accumulation could signal the formation of a local bottom. The buying activity from sophisticated investors may indicate oversold conditions in the short term.

This divergence between whale and retail behavior highlights the different risk tolerances and market outlooks between investor classes.

Bitcoin Price Prediction

BlackRock moved 10,584 BTC valued at approximately $1.19 billion to Coinbase in a single transaction. The massive transfer immediately raised concerns about potential large-scale selling pressure.

Exchange transfers typically signal intent to sell, making this movement particularly concerning for market participants. The timing of the transfer coincided with Bitcoin’s decline toward key support levels.

Bitcoin now trades NEAR the $112,000 support level, which previously served as a launching pad for the rally to its all-time high of $123,000. Market watchers closely monitor whether this level will hold again.

The support level remains critical for Bitcoin’s near-term price action. A break below could trigger further selling pressure from both institutional and retail investors.

Technical indicators present a mixed picture for Bitcoin’s outlook. The Relative Strength Index sits in oversold territory at 32.93, suggesting bearish sentiment may be exhausted.

The MACD indicator continues showing weakness with the line remaining below the signal line. This indicates continued negative momentum despite oversold RSI readings.

If Bitcoin maintains support above $112,000, a bounce could materialize in the coming sessions. However, continued fund outflows like BlackRock’s transfer could intensify downward pressure.

The September Federal Reserve meeting on September 15-16 looms as the next major catalyst. Markets currently price in an 81% probability of a 0.25% rate cut.

While rate cuts typically benefit risk assets like Bitcoin, September historically proves challenging for both Bitcoin and traditional equities. The S&P 500 has averaged 1% declines in September over the past 35 years.

Bitcoin has followed similar patterns during multiple September periods. Increased macroeconomic uncertainty and policy actions often contribute to heightened volatility during the month.

The combination of Fed policy uncertainty and seasonal weakness could create additional headwinds for Bitcoin. Market participants remain cautious as multiple factors converge in the coming weeks.

Powell’s Jackson Hole speech represents the immediate catalyst for Bitcoin’s direction. The speech could provide clarity on the Fed’s September rate decision and broader monetary policy outlook.