🚀 Gemini AI Predicts Cardano Surge to $1.50, Solana Plunge to $150 & Unilabs Exploding 10x Post-CEX Listing!

AI spots patterns humans miss—and this time, it's calling the shots on three major crypto movers.

Cardano's Chart Breakout

Gemini's algorithm detects a textbook bullish formation on ADA's chart. It projects a climb to $1.50—no emotions, just math.

Solana's Support Test

SOL looks shaky. The AI model forecasts a drop toward $150. Too much hype, not enough stability? Classic crypto.

Unilabs' Exchange Boost

Fresh off its CEX listing, Unilabs gets a 10x prediction. Because nothing pumps a token like easier access for the masses—and their FOMO.

Remember: past performance doesn't guarantee future results, but an AI's guess beats most financial advisors' sure bets.

Cardano is Testing the Important $0.9 Support as Trading Volume Surges

Cardano (ADA) is holding $0.90 after a 3.5% drop. Volume is up 12%, and technical signals are turning bullish – suggesting a breakout may be close.

Over the past four days, Cardano has been trading between the $0.9 and $0.96 levels. The futures market is also heating up. The volume hit $6.96, a five-month high. The accumulation is also increasing, with long-term holders taking over $25 million worth of Cardano off crypto exchanges.

Cardano’s Price Movement | Source: TradingView

Cardano’s Price Movement | Source: TradingView

Charts are backing bulls. TD Sequential shows a buy signal on hourly timeframes. A symmetrical triangle with higher lows is building pressure. If $0.90 holds, ADA could retest $0.969 and break $1.00. That opens a path to $1.08–$1.10, about 28% higher.

If $0.90 fails, ADA might slide to $0.835. Liquidation zones at $0.876 and $0.928 mark volatility points.

Meanwhile, ADA/KRW trading in South Korea is nearly double Coinbase’s ADA/USD volume. That regional demand could fuel the next move.

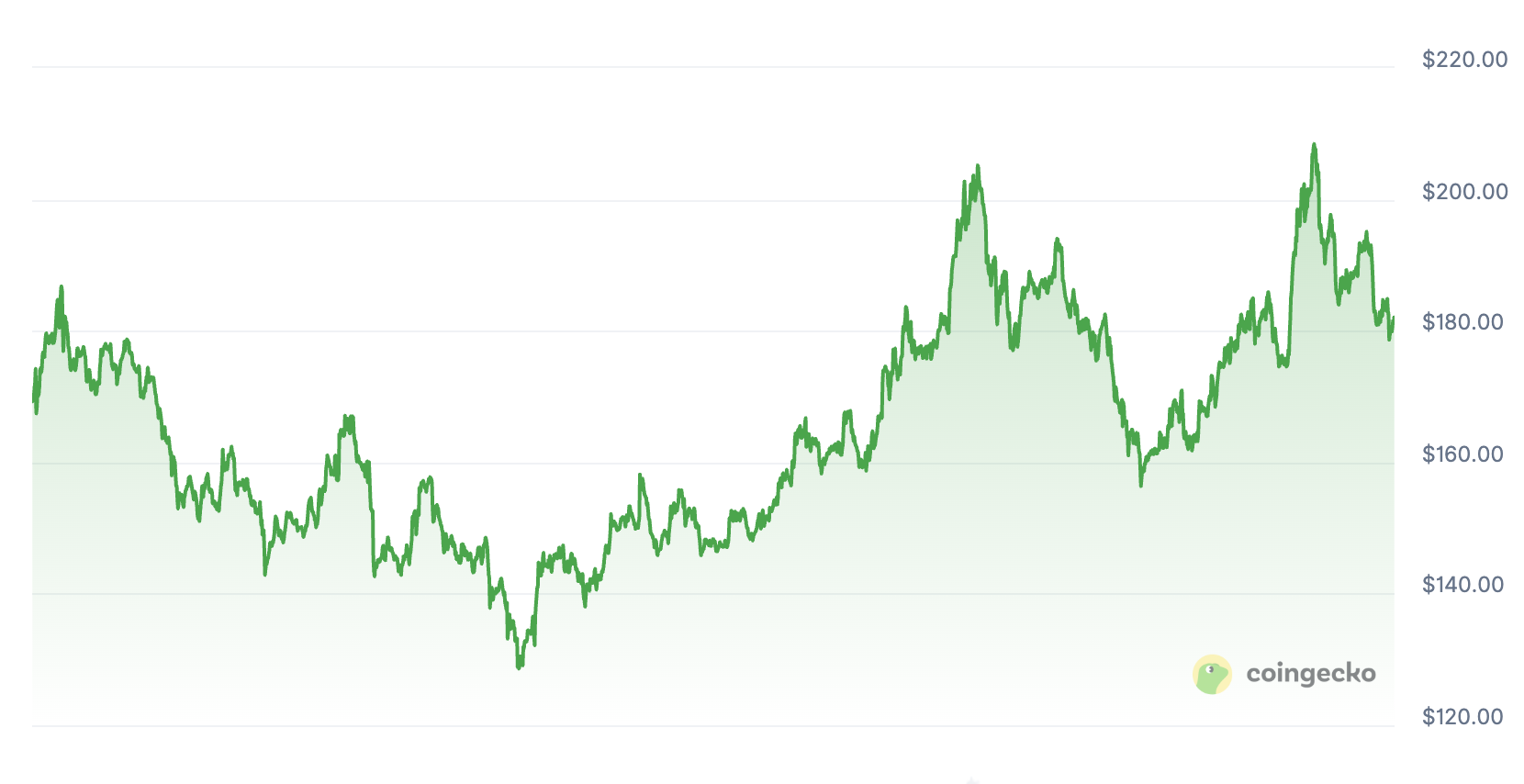

Solana’s Price is Down 10% This Week – More Weakness Incoming?

Solana’s price dropped 10% this week to $171.81, but long-term holders are buying the dip. If accumulation continues, $200 could be back on the table.

Glassnode data confirms it. The Liveliness metric – tracking long-held coins – has fallen since August 16. That means fewer selloffs, with more coins going into cold storage instead of pushing Solana’s price upwards.

Solana’s Price Movement | Source: CoinGecko

Another signal: Hodler Net Position Change jumped 64% in just two days. Smart money is stacking, not selling.

If this continues, Solana’s price could test resistance at $195.55. A breakout there puts $200 and February’s $219.21 high in sight.

But it’s not guaranteed. The Chaikin Money Flow indicator is turning red. This shows signs of slowing capital inflows. Without fresh capital, the rally could stall. Still, long-term holders are confident. That quiet conviction often comes before a big MOVE in Solana’s price.

Unilabs Finance – Manage Your Investments Smarter

Putting all your crypto into one asset like cardano may feel safe, but it limits upside. Instead of passively holding, Unilabs uses AI to build smart portfolios that adjust in real time.

Market Pulse scans both on-chain and off-chain data, spotting momentum early in DeFi, real-world assets, and best meme coins. When a trend forms, the AI rebalances your portfolio. You stay ahead without chasing hype.

This is real-time positioning based on data, not speculation. While the crowd holds Cardano or Solana, Unilabs is drawing new attention. Whales are buying in. UNIL trades at $0.0108 and is rising. Analysts say it could hit $1, backed by real traction.

Holders don’t just wait – they earn. Unilabs shares up to 30% of revenue with users. That’s passive income, not empty hope. Projects like Raydium and dYdX used this model to grow. Unilabs is next – and it’s powered by AI.

Holders don’t just wait – they earn. Unilabs shares up to 30% of revenue with users. That’s passive income, not empty hope. Projects like Raydium and dYdX used this model to grow. Unilabs is next – and it’s powered by AI.

Closing Thoughts

Cardano is holding steady, Solana’s price is showing quiet strength from its long-term holders, and Unilabs is emerging as a dark horse with real AI-backed momentum.

While ADA and SOL navigate familiar technical zones, Unilabs Finance offers something different – dynamic portfolio management, rising demand, and real passive income potential.

If the current trends hold, we could see Cardano break $1.50, solana reclaim $200, and Unilabs lead the next wave of altcoin growth with a 10x surge after its CEX listing.

Learn More About Unilabs Finance

Buy Presale

Website

Telegram