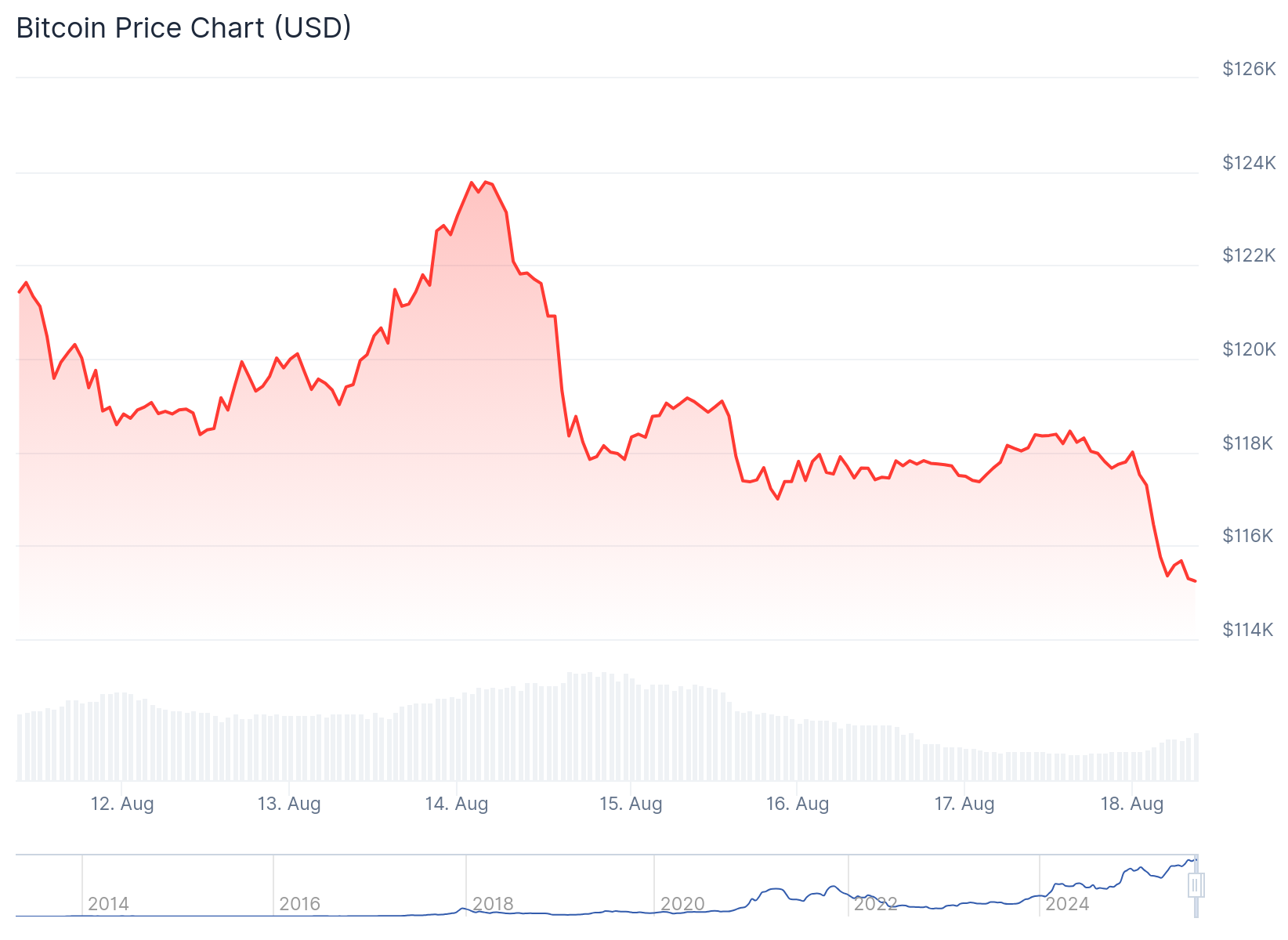

Bitcoin (BTC) at a Crossroads: Will Bulls Hold $116K Support or Collapse Under $800M Liquidation Pressure?

Crypto markets are holding their breath as Bitcoin teeters above a critical $116K support level—fresh off a brutal $800M liquidation cascade. Here’s what’s at stake.

The Bull Case: Institutional Lifelines

Whales are circling, derivatives open interest is recovering, and spot ETF flows hint at accumulation. If this level holds, it could signal a textbook ‘buy the dip’ moment.

The Bear Trap: Liquidation Dominoes

Another 5% drop would trigger $400M+ in additional liquidations—market makers know this, and they’re itching to hunt stops below $110K. Watch the order book for spoofing.

The Cynic’s Take

Meanwhile, crypto ‘analysts’ on X (formerly Twitter) are already spinning this as ‘healthy consolidation’—because nothing says ‘healthy’ like nine-figure vaporized leverage. Onward to the next narrative!

TLDR

- Bitcoin price dropped below $117K after $800M in long position liquidations but stabilized near $118K

- Key technical support lies at $116K-$117K zone with resistance at $120K and potential targets at $126K-$130K

- Treasury Secretary clarified US will not directly purchase Bitcoin for reserves, relying only on confiscated assets

- Whale accumulation continued during the downturn despite retail caution ahead of 2025 halving

- Q4 traditionally shows strong Bitcoin performance with analysts eyeing potential rally after August consolidation

Bitcoin faced intense selling pressure over the weekend as the cryptocurrency briefly dipped below $117,000 following massive liquidations exceeding $800 million. The decline sparked debate among market analysts about whether this represents a healthy consolidation or signals deeper correction ahead.

At press time, Bitcoin traded near $118,000 after finding stability above key technical levels. The sharp pullback came just days after the cryptocurrency reached new all-time highs above $124,000.

Technical analysts identified several critical price zones that could determine Bitcoin’s near-term direction. The $120,000 level emerged as immediate resistance, reinforced by volume profiles and anchored by the volume-weighted average price.

Support appeared NEAR $118,200 with stronger demand centered around $116,300. This area aligned with the 200-day exponential moving average and Fibonacci retracement levels.

Momentum indicators delivered mixed signals across different timeframes. The four-hour chart showed hidden bullish divergence on the relative strength index, suggesting potential rebound strength.

However, daily chart analysis revealed bearish divergence, indicating possible continued selling pressure. If sellers push below $116,000, downside targets range from $113,000 to $110,000.

Treasury Policy Shifts Market Dynamics

Market sentiment faced headwinds from policy developments in Washington. Treasury Secretary Scott Bessent clarified that the US government would not purchase bitcoin directly to expand reserves.

Instead, the Treasury plans to rely solely on confiscated assets for any Bitcoin holdings. Analysts noted this approach removes prospects for steady government accumulation.

The policy stance makes Bitcoin more vulnerable to macroeconomic shifts. Bessent indicated that reliance on seizures makes future supply growth less predictable than direct purchasing programs.

The Treasury announcement coincided with stronger-than-expected Producer Price Index data. The inflation figures pressured broader risk assets as investors adjusted interest rate expectations.

Market strategists observed that the combination of Treasury policy and inflation data created challenging conditions for risk appetite. Digital tokens faced additional selling pressure as traditional markets also declined.

Whale Activity Continues Despite Volatility

While smaller traders showed caution, blockchain monitoring firms reported continued accumulation by large holders. Data indicated whales increased Bitcoin holdings during the recent downturn.

Many institutional investors positioned ahead of the 2025 halving event. The halving will cut mining rewards in half, historically reducing supply growth and supporting price cycles.

Analysts noted that institutional adoption and scaling solutions like the Lightning Network could amplify halving impacts. Long-term holders appeared less concerned with short-term price fluctuations.

Research groups suggested retests of the $117,000-$118,000 area WOULD likely attract buyers. They identified deeper support levels at $113,000 and $110,000 if selling intensifies.

Some analysts projected potential longer-term upside toward $250,000 by 2026 if adoption trends continue. The cryptocurrency’s role as an inflation hedge remained intact despite recent volatility.

$BTC August has been pretty uneventful for Bitcoin so far. We've seen some movement but no clear direction as price consolidates in this current range.

Never in history, has BTC seen both a green August and September. We tend to see a quick flush followed by an explosive Q4 in… pic.twitter.com/cClxJUG6Vh

— Daan crypto Trades (@DaanCrypto) August 17, 2025

August has shown relatively calm consolidation patterns for Bitcoin. Historical data suggests Q4 typically brings strong performance for the cryptocurrency after quiet summer months.

The immediate outlook depends on whether bulls can defend the $116,000-$117,000 support zone, with potential upside targets at $126,000-$130,000 if momentum returns.