$RUN Rockets 20% as Sunrun Inc. Smashes Q2 Earnings—Analysts Scramble to Raise Targets

Sunrun just flipped the switch on Wall Street’s expectations.

The solar energy juggernaut’s stock ($RUN) surged after posting knockout Q2 results—proving once again that green energy plays can print serious green for investors. Analysts, caught off guard like shorts in a gamma squeeze, rushed to hike price targets.

Why the Street’s buzzing:

No fluff—just hard performance metrics that blew past estimates. Residential solar installations? Up. Battery attachment rates? Soaring. Margins? Flexing. The numbers told a story even the most cynical trader couldn’t ignore (though some still muttered about subsidies).

What’s next for the runaway stock?

With upgraded targets and momentum building, $RUN bulls see clear skies ahead. Bears? Still waiting for that ‘overvalued clean energy bubble’ pop they’ve predicted every earnings season since 2020. Meanwhile, Sunrun keeps quietly electrifying both homes and portfolios—one solar panel at a time.

TLDR

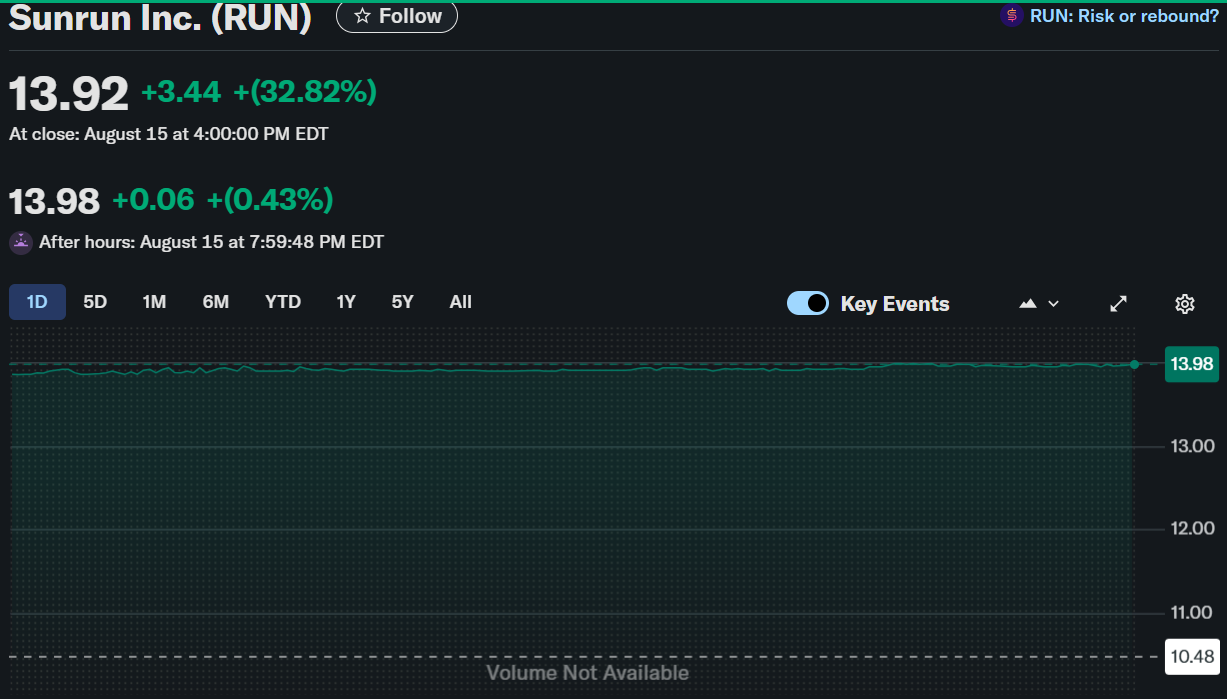

- Sunrun shares surged 32% after Q2 earnings on August 15, 2025, with EPS of $1.07 and revenue of $569.34M.

- JPMorgan and Oppenheimer lifted price targets to $20 and $21, reflecting strong contracted value and growth outlook.

- Gross margin stood at 59.9%, with robust cash flow and a 70% storage attachment rate highlighting operational strength.

- Sunrun hit a historic summer record for distributed energy capacity, reinforcing its market leadership.

- Despite near-term volatility, analysts remain bullish on Sunrun’s long-term positioning in renewable energy.

Sunrun Inc. (NASDAQ: RUN) stock soared 32.82% to $13.92 on August 15, 2025, after reporting impressive Q2 results that surpassed Wall Street estimates. After hours, shares edged slightly higher to $13.98.

Sunrun Inc. (RUN)

The solar energy leader posted earnings per share of $1.07, a significant jump from $0.55 in the prior year. Revenue also beat expectations, coming in at $569.34 million.

The strong results reflected Sunrun’s ability to expand its distributed power model during a record-setting summer. With a 70% storage attachment rate, the company reinforced its market leadership in distributed clean energy solutions.

Sunrun shares surged 32% after Q2 EPS jumped to $1.07 from $0.55 a year ago, crushing estimates for a loss. Revenue topped forecasts at $569.34M, driven by record storage growth and a 15% rise in new subscribers. JPMorgan and Oppenheimer raised targets to $20 and $21, while Wells… pic.twitter.com/p40X3yZnAr

— Stock Sharks (@stocksharks_) August 16, 2025

Financial Highlights

Gross margins improved to 59.9%, underlining efficient operations and expanding profitability. Revenue per share climbed to $8.83, representing a 20.12% growth over five years. Cash flows strengthened, while debt levels were strategically managed with current and quick ratios at 1.4 and 0.6, respectively.

The company’s long-term leverage strategy and reduced creation expenses helped widen margins and boost profitability. With a price-to-book ratio of 0.9, Sunrun maintains financial flexibility while continuing to grow contracted net value.

Analyst Confidence Builds

Investor confidence surged as analysts raised their outlook. JPMorgan lifted its price target to $20, while Oppenheimer boosted its target to $21, citing strong contracted value and growth prospects. Wells Fargo also raised its target to $14, signaling further Optimism around Sunrun’s positioning in the solar market.

The upgrades reflected Sunrun’s execution in Q2 and its ability to deliver growth in a competitive sector. Investors interpreted the moves as validation that Sunrun’s strategy is set to yield long-term benefits.

Operational Momentum

Beyond financial metrics, Sunrun achieved a milestone by leading the nation in distributed power plants during the summer season. The company also completed a successful transition to Oracle’s Warehouse Management, highlighting its focus on scaling operations efficiently.

Such operational improvements, paired with robust subscriber value and storage attachment rates, have strengthened the company’s trajectory in renewable energy deployment.

Performance Overview

While Q2 brought a sharp rebound, Sunrun’s longer-term stock performance shows challenges. Year-to-date returns stand at 50.49%, far outperforming the S&P 500’s 9.66%. However, over one year, shares are down 29.02% compared to the index’s 16.35% gain. Over three and five years, Sunrun recorded steep declines of 61.96% and 69.49%, while the S&P 500 ROSE 50.10% and 91.23%, respectively.

The sharp contrast underscores Sunrun’s volatility, though recent results suggest a potential turning point as clean energy adoption accelerates.