🚀 Ethereum ETF Inflows Surge to $220M This Week – Why Unilabs Is the Q4 Dark Horse Pick

Wall Street’s crypto love affair gets hotter: Ethereum ETFs just raked in $220 million in a single week. Meanwhile, analysts are whispering about Unilabs as the sleeper hit for Q4 gains—because nothing says 'bull market' like chasing the next shiny thing.

### The ETF Money Train Rolls On

Forget 'slow and steady'—Ethereum funds are vacuuming up capital like a hedge fund at an all-you-can-trade buffet. The $220M inflow marks a clear vote of confidence, even as Bitcoin maximalists grumble about altcoin distractions.

### Unilabs: The Analyst Darling No One Saw Coming

While ETH grabs headlines, institutional decks are quietly circulating Unilabs as a 'high-conviction' Q4 play. No promises, of course—just the usual mix of hopium and spreadsheet gymnastics that makes crypto so endearing.

### The Bottom Line

Smart money’s hedging its bets: Ethereum for the now, Unilabs for the maybe-later. Because in crypto, diversification just means being wrong in multiple exciting new ways.

Ethereum (ETH) Weekly Net Inflows Outshine Bitcoin ETF

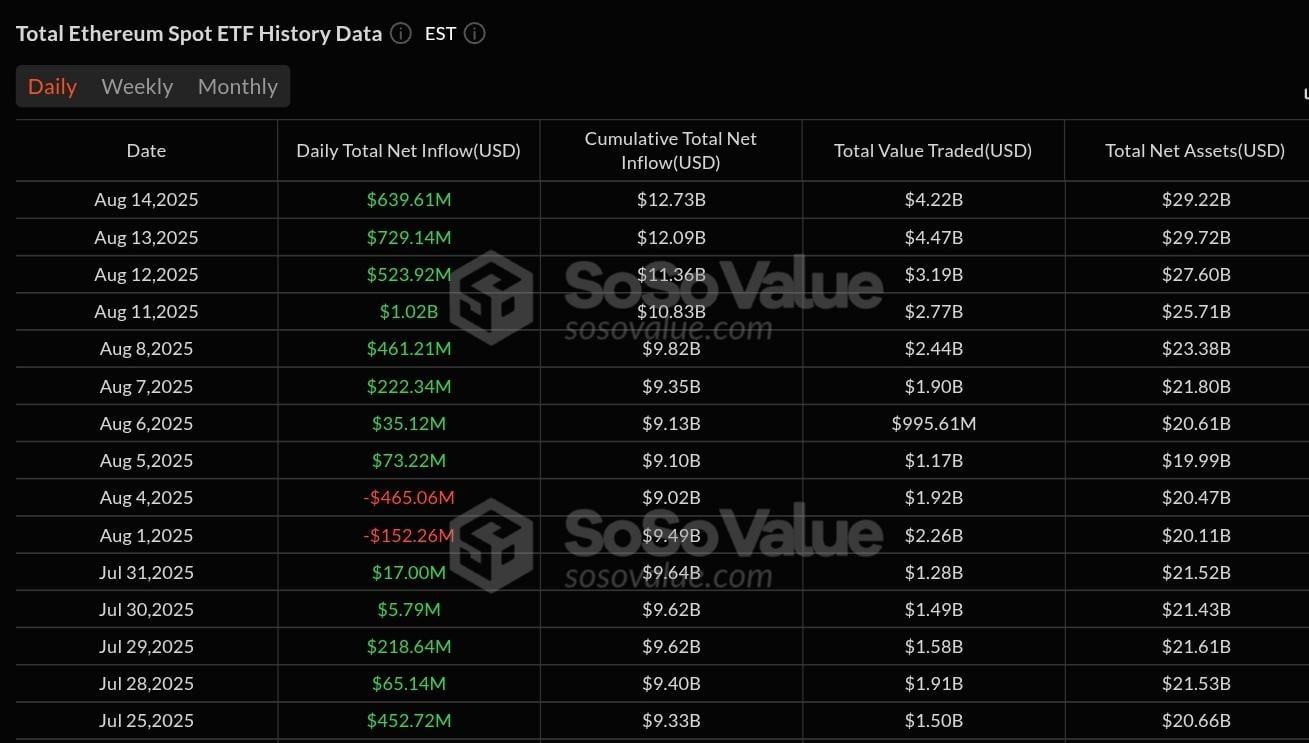

According to data from SoSovalue, the ethereum ETF has witnessed a huge surge in inflows over the past few weeks. This week, the data below shows huge inflows, signifying large interest from institutional investors. The Ethereum ETF stayed above $222 million from August 7-14, mirroring the positive sentiment in the market.

Ethereum ETF Inflows. SoSovalue

Interestingly, spot Ethereum ETF inflows have outshone Bitcoin’s in the past week. While the Bitcoin ETF recorded $561.95 million in weekly total net inflow, the Ethereum ETF posted $2.91 billion for the week ending August 14.

Capitalizing on the uptrend in the market and rising institutional interest, the ETH price performance has also been bullish this past week. Data from CoinMarketCap shows the ETH price soared to $4,704 this week, less than 5% away from its current all-time high of $4,891.

While the ETH price has corrected to former lows, it remains bullish on the 7D chart with a gain of 18.68%. Looking ahead, the ETH price currently faces a strong barrier around the $4,600-$4,800 level. A breakout from this range could push the ETH price to $5,000 in the coming days.

On the flip side, an RSI reading of 72 shows the ETH price is in overbought territory. So, the token could drop lower or consolidate for a while before trying another retest. TRACER forecasts that the ETH price might drop to $3,200 before soaring to $8,000.

Unilabs: A Comprehensive AI-Powered DeFi Asset Management Platform

Unilabs is an innovative decentralized finance (DeFi) platform that integrates cutting-edge AI with asset management solutions. Designed to provide investors with the tools they need to navigate the fast-evolving crypto market, Unilabs stands out by offering a suite of AI-driven features and tools that streamline the investment process, meeting the needs of new and expert investors. Some features that make Unilabs stand out include:

AI Market Pulse: real-time analysis and trend of on-chain and off-chain data, which can give users actionable information to make informed decisions.

Early Access Scoring System (EASS): ranks upcoming projects based on certain factors to allow investors to find better investments early.

Referral Program: rewards users to bring others to the platform by paying them a share of platform fees, a network effect that causes the community to grow.

Memecoin Detection Tool: helps users find good meme coins before they explode.

Multiple Investment Funds: Four diversified funds (AI Fund, BTC Fund, RWA Fund, and Mining Fund) offering tailored investment strategies for various risk profiles.

Staking Rewards: UNIL holders can get up to 122% APY for staking their coins.

Flash Loan Accelerators: Allow users to access instant capital for leveraged trading, enabling quick investment decisions without collateral.

Meanwhile, Unilabs has a native token called UNIL. It serves as both a utility and governance token within its AI-powered DeFi ecosystem. Such use cases make UNIL stand out as a more likely, better crypto to buy. Unilabs is in the sixth phase of its crypto ICO and has hit $13 million in funding.

If memecoins like Pepe could hit a $1 billion market cap in less than a month after launch, utility-driven coins like UNIL have the potential to do better. Those who want to be part of this growth could join its ongoing presale and get the UNIL coin at $0.0097 before prices pump to $0.50 in the fourth quarter.

Ethereum And Unilabs Emerge As Top Altcoins To Watch

As Ethereum ETFs experience all-time highs in terms of flows, Unilabs is preparing for take off in Q4. Smart investors are already flocking to its ongoing presale to get in at $0.0097 before prices skyrocket. The DeFi protocol is currently giving a 50% bonus to those who get the UNIL coin in the next few days using the code “CMC50.”

Discover the Unilabs Presale:

Presale: https://www.unilabs.finance/

Buy Presale: https://buy.unilabs.finance/

Telegram: https://t.me/unilabsofficial

Twitter: https://twitter.com/unilabsofficial