Chainlink Surges to $24—Analysts Predict $47 Imminent as Bull Run Accelerates

Chainlink isn't just climbing—it's gunning for the stratosphere. With a fresh push past $24, traders are loading up for what could be the next leg of a historic rally. Targets? A cool $47. Not bad for an oracle network that Wall Street once dismissed as 'niche.'

Why the frenzy? The usual suspects: institutional interest, protocol upgrades, and that sweet spot where crypto hype meets actual utility. No magic here—just a market waking up to smart contracts needing reliable data feeds.

Of course, skeptics mutter about overleveraged degens and the inevitability of corrections. But try telling that to the algo traders already front-running the next liquidity surge. Remember: in crypto, 'irrational exuberance' is just another Tuesday.

TLDR

- Chainlink’s price surged 44% over the past week, with a target of $47 if it breaks through $25.

-

Google searches for Chainlink are at a 3-year high, signaling growing interest.

-

Whale transaction volume for LINK has increased, indicating strong market support.

-

Chainlink’s Total Value Secured (TVS) reached an all-time high of $93 billion, bolstering its fundamentals.

Chainlink (LINK) is seeing a remarkable surge in its price, up 44% over the past week and trading at $24.00. This upward momentum has traders speculating about a potential breakout towards $47. The price action has sparked significant interest in the altcoin space, with chainlink showing strong potential for the next phase of its rally.

Crypto trader Johnny, who has a significant following, pointed out that Chainlink is “ready for round 2,” indicating that the current bullish trend could be the beginning of an even more substantial rally. As of now, the price is just shy of the $25 resistance, and a decisive move beyond this level could set Chainlink on a path towards its $47 target, analysts say.

Whale Activity and TVS Driving Chainlink’s Bullish Momentum

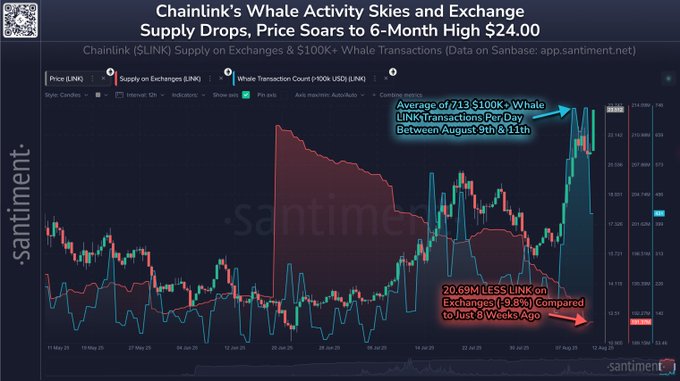

Chainlink’s recent price increase is supported by whale activity, which has surged to its highest level in three months.

According to data from Santiment, 713 large transactions per day have been recorded over the past five days, coinciding with the price surge. This suggests that institutional and high-net-worth investors are accumulating LINK, further fueling the bullish momentum.

Additionally, Chainlink’s Total Value Secured (TVS) has hit a record high of $93 billion, according to on-chain metrics. This increase in TVS reflects the growing adoption of Chainlink as a decentralized data infrastructure. As the network continues to expand its presence in the Real-World Asset (RWA) sector, these milestones contribute to Chainlink’s strengthening fundamentals.

Technical Analysis and Price Predictions for Chainlink

From a technical standpoint, Chainlink has completed the expected fifth wave of its uptrend and is now approaching the key $25 resistance.

If LINK surpasses this level, it could enter a direct breakout towards the $47 target, as indicated by analysts.

The chart shows that the next phase could be a continuation of the current bullish trend, with minimal likelihood of significant corrections in the short term. The $22–$23 range serves as a support zone, and should the price pull back, it could still find solid footing within this area.

Growing Demand and Community Support for Chainlink

The rising interest in Chainlink is evident from the increasing search volume on Google Trends, which recently hit a 3-year high. This uptick in interest indicates that Chainlink is becoming one of the most talked-about altcoins in the market.

The rising awareness could continue to drive demand for the token, especially as it solidifies its place in the growing tokenization and decentralized finance (DeFi) sectors.

Experts suggest that Chainlink’s fundamental strength, coupled with its community support, makes it one of the most obvious large-cap opportunities in this market cycle. The integration of Chainlink into more projects and its growing role in bridging blockchains with real-world assets positions it as a critical player in the evolving crypto ecosystem.