OKB (OKB) Rockets 200% to ATH: Supply Shock Sends Traders Scrambling

Supply crunches don't just happen to toilet paper and GPUs—OKB just proved crypto markets aren't immune. The exchange token blasted past previous records as buy orders overwhelmed available liquidity.

Anatomy of a supply shock

When circulating tokens get vacuumed up faster than exchanges can restock, even stablecoins start sweating. OKB's 200% vertical climb suggests either genius tokenomics or a classic case of 'number go up' psychology.

Wall Street's gonna hate this one

While traditional markets obsess over P/E ratios, crypto assets like OKB rewrite the playbook weekly. This rally didn't need earnings calls or SEC filings—just good old-fashioned supply and demand (and maybe a few leveraged longs).

Memo to exchanges: might want to check those wallet balances twice before opening tomorrow's trading session.

TLDR

- OKX permanently burned 65.26 million OKB tokens worth $7.6 billion, reducing total supply by 52%

- OKB price jumped over 200% to $142 before settling around $102, with trading volume up 13,000%

- 553,000 OKB tokens worth $58 million entered exchanges in 24 hours, creating selling pressure

- Top 100 OKB holders increased their positions by 25%, adding 59.98 million tokens

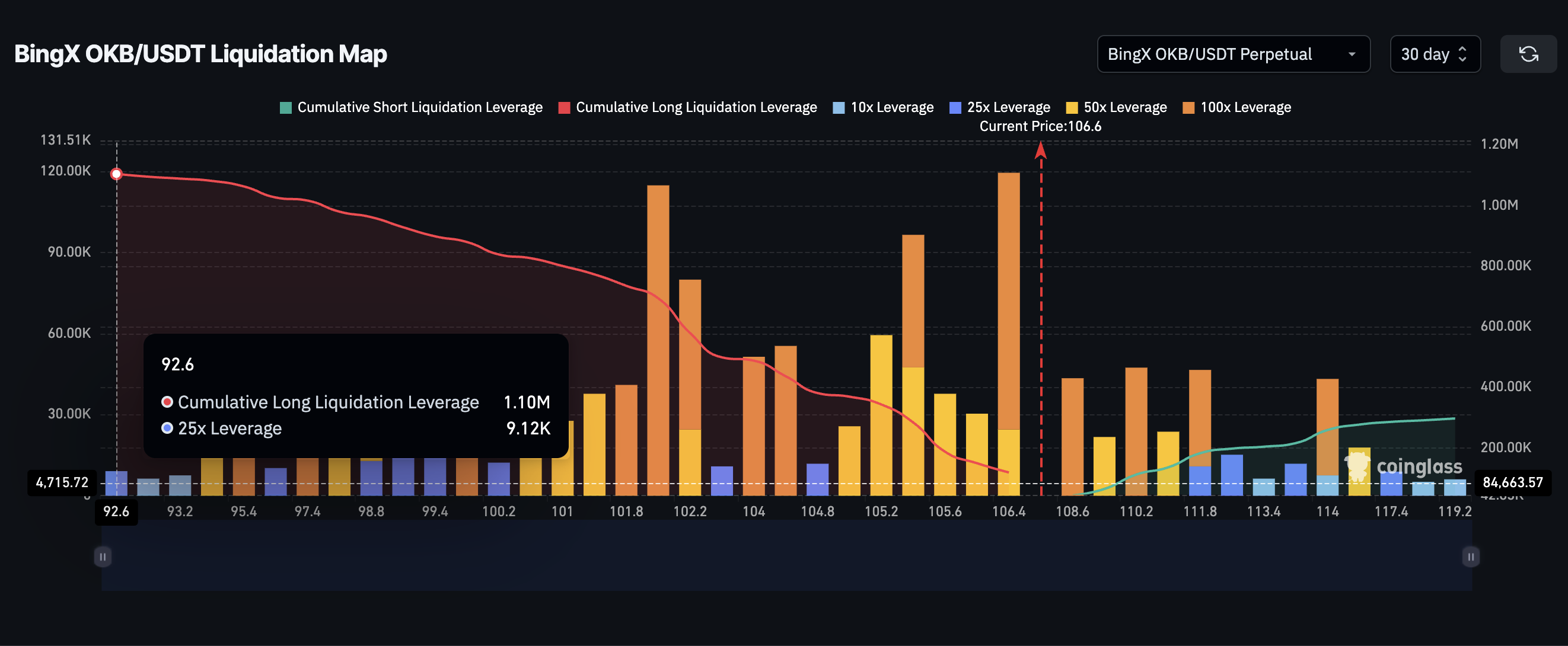

- Technical analysis shows potential weakness despite price gains, with liquidation risks at $92.6

OKX executed one of the largest token burns in crypto exchange history on August 13, permanently removing 65.26 million OKB tokens from circulation. The burn eliminated $7.6 billion worth of tokens from the market.

The action cut OKB’s total supply by 52% and capped the maximum at 21 million tokens. This mirrors Bitcoin’s hard cap structure and represents a major deflationary MOVE for the exchange token.

OKB’s price reacted immediately to the news. The token spiked from $46 to a record high of $142, delivering gains of over 200% in a single day.

Trading volume exploded alongside the price movement. Daily volume jumped 13,000% to reach $723 million as traders rushed to capitalize on the supply shock.

The token has since pulled back from its peak to trade around $102. This retracement occurred as market participants began taking profits from the massive rally.

Exchange Flow Patterns Emerge

Data from Nansen shows 553,000 OKB tokens entered exchanges in the past 24 hours. This represents roughly $58 million worth of tokens at current prices.

The 36% increase in exchange balances suggests some holders are preparing to sell. Large inflows to exchanges typically indicate potential selling pressure ahead.

However, whale activity tells a different story. The top 100 OKB addresses increased their holdings by 25% during the same period.

These major holders added approximately 59.98 million tokens to their positions. This accumulation far exceeds the tokens that flowed into exchanges.

The whale buying may be absorbing immediate sell pressure. Large holders often take long-term positions rather than engaging in short-term trading.

Technical Risks Surface

BingX liquidation data reveals $1.1 million in long positions clustered NEAR the $92.6 price level. Additional positions sit just above $100.

These liquidation clusters could trigger cascade selling if the price drops to those levels. Forced liquidations often create self-reinforcing downward pressure.

The current price sits relatively close to the first major liquidation zone. This proximity increases the risk of a sharp decline if momentum shifts negative.

Weekly chart analysis shows the Chaikin Money FLOW indicator forming a lower high despite record prices. This divergence suggests weakening capital inflows during the latest rally.

The CMF pattern indicates the price surge may be running primarily on news rather than sustained buying pressure. Such moves can reverse quickly when headlines fade.

Key support levels exist at $102, $90, and $78 according to weekly chart analysis. A break below $102 could trigger the next phase of selling.

Blockchain Transition Plans

OKX plans to migrate OKB fully from ethereum to its X Layer blockchain. The exchange is already allowing holders to redeem Ethereum-based tokens for X Layer versions.

The company aims to increase transaction speeds and reduce gas fees on X Layer. These improvements could drive more usage of the blockchain and OKB token.

Sustained price momentum will depend on adoption of the X LAYER platform. The blockchain serves as the native environment for OKB going forward.

The token burn strategy follows Binance’s approach with BNB. Binance conducts quarterly burns that often precede short-term price rallies.

OKB’s turnover ratio jumped from 0.03 to 0.093 following the announcement. This metric measures trading activity relative to available supply.

The higher ratio indicates both speculative trading and strategic positioning by market participants. Such activity levels typically accompany major supply events.

Current market conditions show mixed signals for OKB’s near-term direction. While whale accumulation continues, exchange inflows and technical indicators suggest caution.

The $102 support level remains critical for maintaining the current trading range. A break below this level could accelerate selling toward lower support zones.