Pi Network (PI) Primed for Breakout: Double Bottom Pattern Signals Imminent Rally

Bulls are circling Pi Network as a classic double bottom pattern hints at explosive upside potential.

Technical setup screams accumulation

The PI chart just printed back-to-back troughs near support—a textbook reversal signal that historically precedes rallies. No guarantees in crypto, but traders are betting the pattern holds (again).

Mining token defies bear market gravity

While legacy finance clings to fractional reserve banking, PI keeps building organic momentum. The mobile-minable asset dodged recent altcoin bloodbaths—now threatening to flip resistance into launchpad territory.

Just don't tell the SEC about those 'organic' Telegram trading volumes.

TLDR

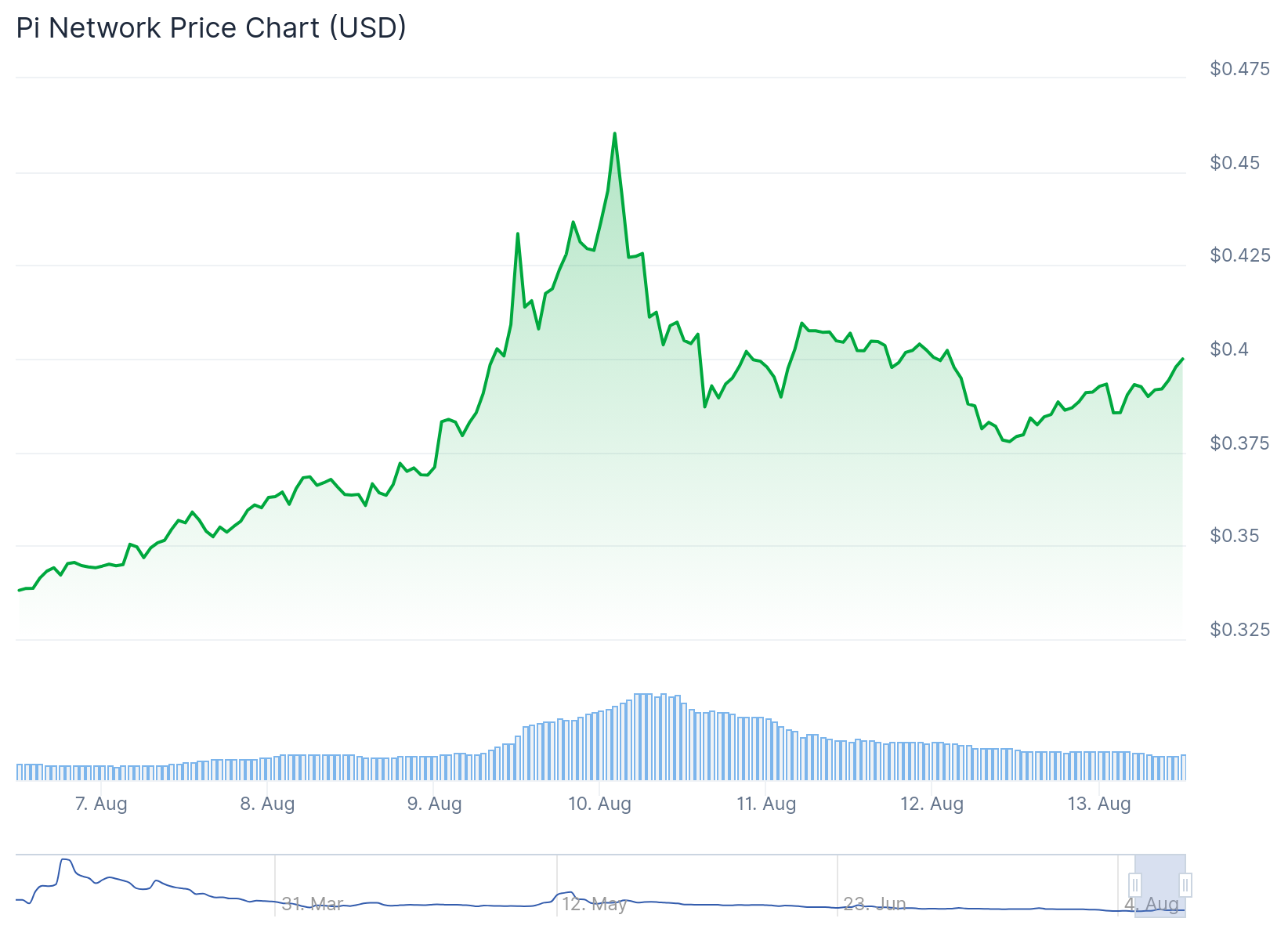

- Pi Network has dropped over 3% on Tuesday, falling from Sunday’s peak of $0.4661 to below $0.4000

- Trading volume decreased by nearly 30% in the last 24 hours, showing weakened market participation

- Technical analysis reveals a potential 10% correction risk if the $0.3700 neckline support fails

- Some analysts see bullish potential with a double bottom pattern suggesting possible 154% rally

- Major exchange listings could provide fresh momentum for the token

Pi Network has experienced a pullback after reaching $0.4661 on Sunday. The token now trades below $0.4000 as Tuesday’s session shows continued downward pressure.

The recent decline extends a pattern that began with Sunday’s 9% drop. Pi has failed to maintain its position above the 200-period Exponential Moving Average at $0.4253 on the 4-hour chart.

This failure has created a bearish setup. The token broke below both the $0.4000 support level and the 50-period EMA at $0.3884.

Trading activity has declined sharply. Volume dropped nearly 30% over the past 24 hours, indicating reduced market participation.

The current price action mirrors a previous pattern from mid-July. During that period, PI reversed from the 200-period EMA and invalidated its neckline support at $0.4734.

That reversal led to a 10% correction. Similar risks now exist as Pi approaches the current neckline at $0.3700.

Technical Indicators Paint Mixed Picture

The Relative Strength Index has crossed below its central line on the 4-hour chart. The RSI currently sits at 43, suggesting room for further correction before oversold conditions emerge.

The Moving Average Convergence Divergence indicator shows declining trend lines. Red histogram bars below the zero line indicate rising bearish momentum.

However, longer-term analysis presents different signals. On the 12-hour chart, Pi has formed a double bottom at $0.40 with a neckline at $1.66.

This pattern suggests potential for a 154% rally from current levels. The token has also developed a descending wedge pattern, which often precedes bullish breakouts.

PI Coin Price Prediction

A break below the $0.3700 neckline could trigger a 10% decline. This WOULD test the $0.3334 support level, marked by last Wednesday’s low.

For bullish momentum to return, Pi must reclaim the $0.4000 level. Success there would target the 200-period EMA at $0.4253 as the next resistance.

The RSI has climbed from 19.7 to 52 on longer timeframes. The Percentage Price Oscillator lines have also shown a bullish crossover.

Several factors could drive future price movement. The current crypto market rally, led by Bitcoin, may benefit altcoins like Pi.

A listing on major exchanges such as Binance, Coinbase, or Upbit could provide fresh momentum. Other recently listed tokens have seen price increases following exchange additions.

Developer announcements regarding increased decentralization could also impact price. Additional token sales or ecosystem developments may influence trading activity.

Pi Network has faced challenges since its mainnet launch in February. The token’s performance has been mixed as the project develops its ecosystem.

Market participants are taking a wait-and-see approach based on current volume patterns. The decreased trading activity suggests uncertainty about near-term direction.

Pi Network currently trades below the $0.4000 level with volume remaining 30% lower than previous sessions.