🚀 Ethereum (ETH) Price Prediction: $8,500 Target in Sight as ETF Inflows Shatter Records

Ethereum's rally isn't just hype—it's got the numbers to back it up. With ETF flows hitting all-time highs, analysts are doubling down on bullish targets.

The ETF Effect: Fueling the Fire

Wall Street's latest crypto crush keeps sending bags of institutional cash into ETH—because nothing screams 'validation' like suits chasing 20% yields.

Technical Tailwinds

The $8,500 call isn't just hopium. Chartists point to historical breakout patterns post-ETF approval, while DeFi TVL quietly absorbs the liquidity surge.

The Cynic's Corner

Of course, this could all end in tears when the SEC 'discovers' that Ethereum is, in fact, a blockchain. But for now? Enjoy the rocket ride.

TLDR

- Ethereum could reach $8,500 if Bitcoin hits $150,000, based on historical market cap ratios

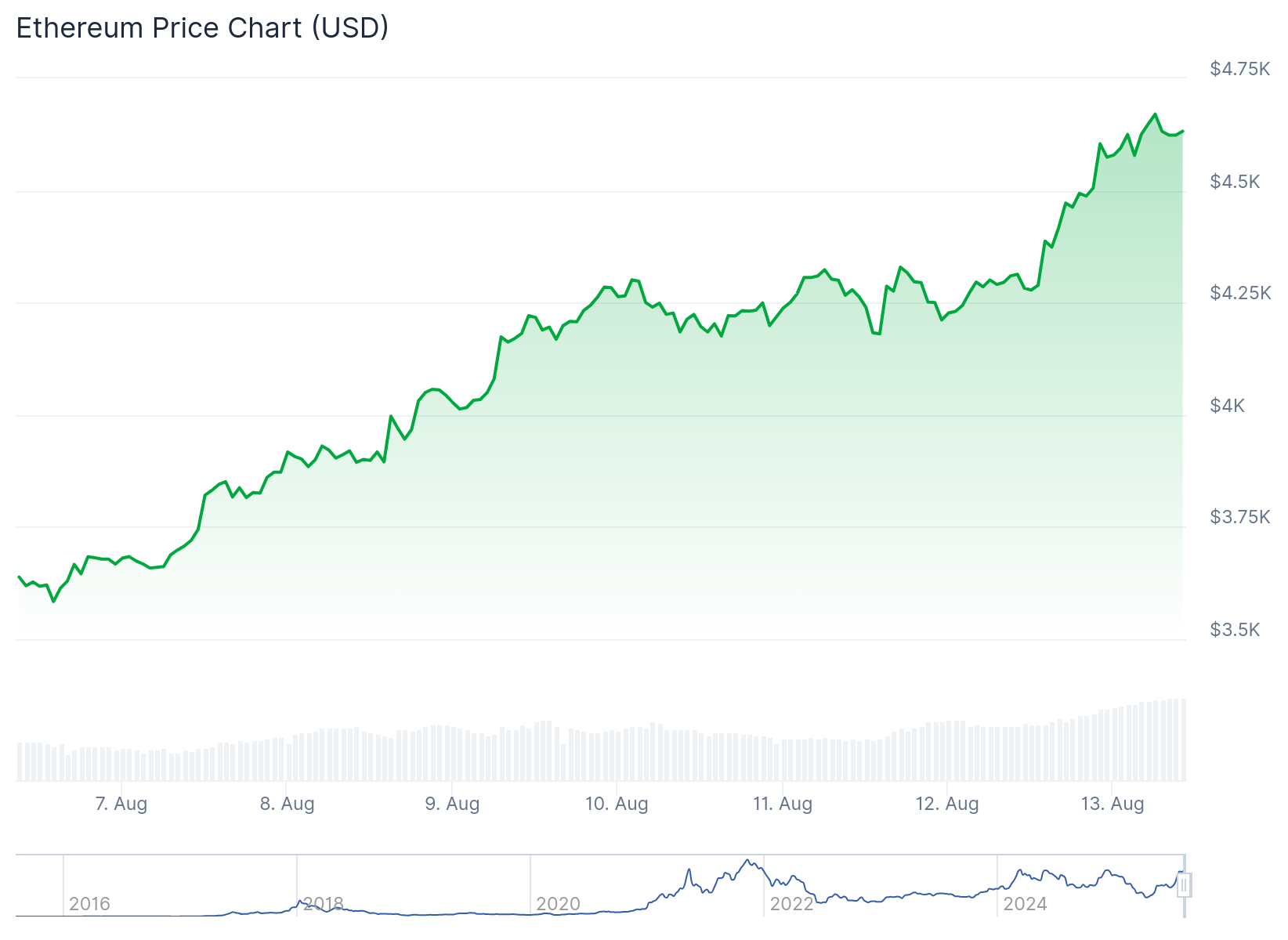

- ETH ETFs recorded their biggest day ever with $1.01 billion in net inflows on August 11th

- BlackRock’s ETHA fund crossed $10 billion in assets and gained 149,168 ETH in one day

- Ethereum outperformed Bitcoin with 19% weekly gains versus Bitcoin’s 4% rise

- Current ETH price sits about 5% below its all-time high of $4,878 from November 2021

Ethereum is showing strong momentum as analysts predict the cryptocurrency could reach $8,500 if Bitcoin climbs to $150,000. The projection comes from crypto trader Yashasedu, who analyzed historical market patterns.

During major bull runs, ethereum typically reaches 30-35% of Bitcoin’s market capitalization. In the 2021 bull run, ETH reached 36% of Bitcoin’s market cap.

If Bitcoin reaches $150,000 from its current price around $119,785, Ethereum could trade at $8,656 assuming it hits 35% of Bitcoin’s market cap. Even at lower ratios between 21.70% to 30%, ETH could trade between $5,376 and $7,420.

The analysis suggests this pattern is set to repeat. Ethereum’s total value locked recently topped $90 billion, while institutional interest continues growing.

Record ETF Inflows Drive Momentum

Ethereum ETFs recorded their biggest day ever on August 11th with $1.019 billion in net inflows. BlackRock’s iShares Ethereum Trust led the surge.

ETHA saw its largest single-day inflow since launch, adding 149,168 ETH worth approximately $640.68 million. The fund’s daily trading volume reached $1.8 billion that day.

BlackRock’s ETHA has now crossed $10 billion in net inflows. This milestone came just three months after the fund doubled from $5 billion.

The fund now holds over 3.3 million ETH in its portfolio. ETHA’s share price hit a new record of $33.02 after jumping 5% on August 11th.

In the past month, ETHA’s value surged 41%. From its April low of $11.50, the ETF has climbed almost 200%.

Ethereum Price Prediction

Ethereum has outperformed Bitcoin in recent trading. Over the past week, ETH surged 19% while Bitcoin gained just 4%.

ETH currently trades at around $4,630, approximately 5.35% below its November 2021 all-time high of $4,878. bitcoin trades near $119,785 after recent declines.

BitMine Immersion Technologies announced plans to raise up to $20 billion for ETH purchases. This institutional interest adds to the bullish sentiment.

Several analysts expect Bitcoin to reach $150,000 by year-end. Fundstrat’s Tom Lee, BitMEX co-founder Arthur Hayes, and Unchained’s Joe Burnett all predict Bitcoin could hit $250,000 by end of 2025.

Trader Yashasedu doesn’t expect ETH to cool off until it reclaims its all-time high. MN Trading Capital’s Michaël van de Poppe expects a new all-time high followed by consolidation.

Vitalik Buterin outlined his long-term vision for Ethereum this week, emphasizing ultra-light nodes and built-in privacy features. BlackRock transferred 2,544 BTC and 101,975 ETH to Coinbase Prime on August 5th, sparking speculation about strategic positioning.