🚀 Bitcoin (BTC) Eyes $137K as Whale Accumulation Intensifies—Fed Rate Cut Probability Hits 90%+

Whales are circling—and this time they’re betting big on a $137K Bitcoin.

With the Fed’s rate-cut odds now above 90%, crypto’s ultimate game of chicken just got a turbocharge. Here’s why the smart money’s loading up.

The Fed Effect: Liquidity Tsunami Ahead?

When central banks flip the money printer back on, crypto doesn’t just rally—it goes vertical. History says so. The last time cuts loomed this large, BTC ripped past its ATH in weeks.

Whale Math: $137K or Bust

On-chain data shows mega-wallets aggressively accumulating between dips. Target? A clean 2x from current levels. Because why settle for lambos when you can buy the dealership?

Of course, Wall Street will pretend they saw it coming—right after they finish shorting it.

TLDR

- July US CPI data held at 2.7% year-over-year, boosting Federal Reserve rate cut odds to 94% for September

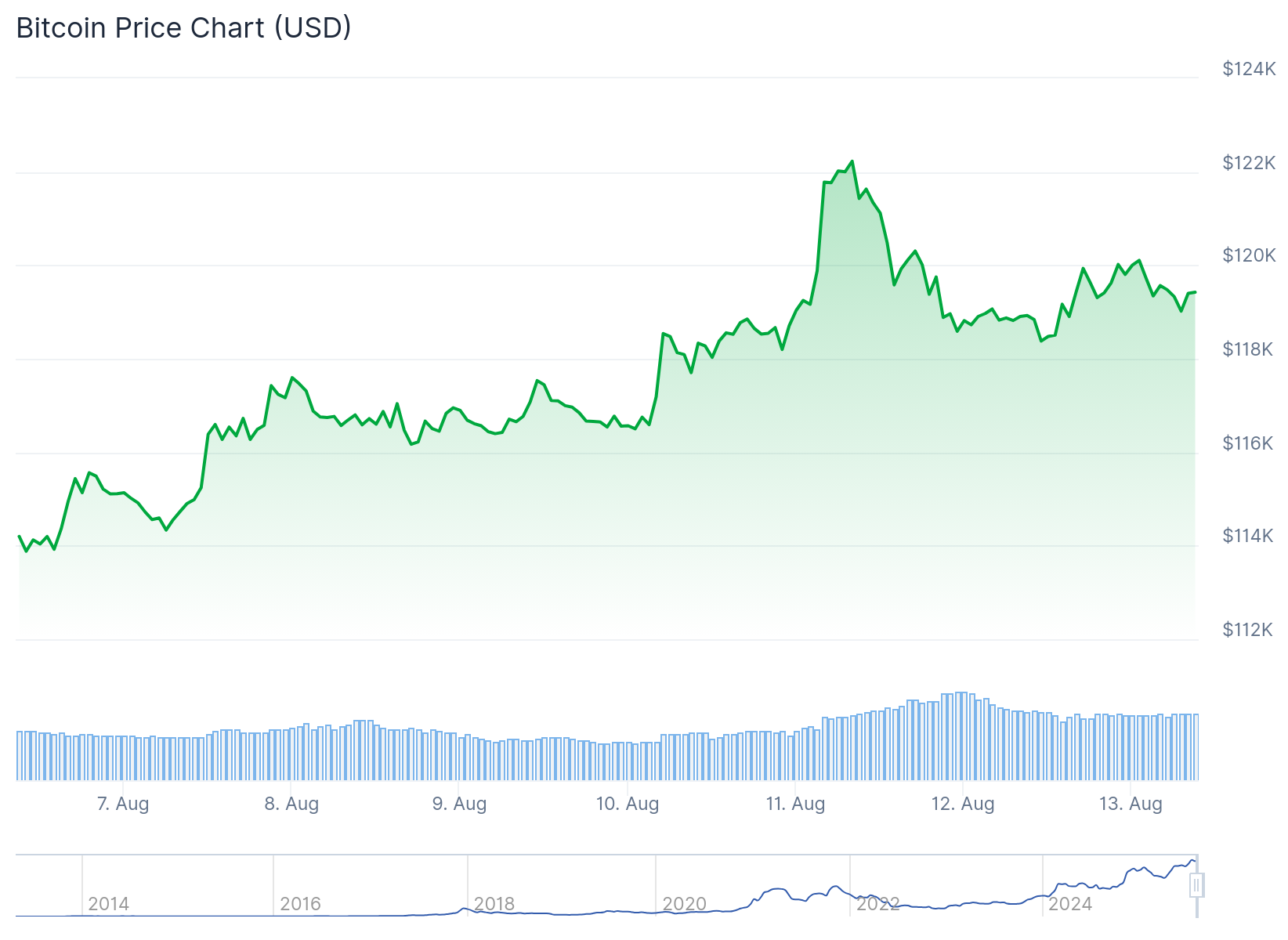

- Bitcoin price surged to $122,190 on Monday before pulling back to around $119,500 after CPI release

- Technical analysts target $130,000-$137,000 based on bullish flag pattern and trendline breakouts

- Record-high accumulation from whales and long-term holders, with 94% of Bitcoin supply currently in profit

- Key support levels identified between $117,650-$115,650, with deeper correction potentially testing $95,000

Bitcoin price action gained momentum following the release of July Consumer Price Index data that showed inflation holding steady at 2.7% year-over-year. The reading matched June levels and came in below the 2.8% forecast.

💥BREAKING:

🇺🇸 CPI DATA CAME IN AT 2.7%

EXPECTATIONS: 2.8%

RATE CUTS ARE COMING! 🚀 pic.twitter.com/mTiKrbMRj4

— crypto Rover (@rovercrc) August 12, 2025

Core CPI excluding food and energy rose 3.1% annually, meeting expectations. Monthly CPI increased 0.2%, down from 0.3% in June, while Core CPI rose 0.3% compared to the previous 0.2% gain.

The inflation data strengthened expectations for Federal Reserve monetary easing. CME FedWatch shows market odds for a September rate cut jumped to 93.9% following the release.

Lower interest rates typically reduce the opportunity cost of holding Bitcoin. This environment often draws fresh capital into cryptocurrency markets as investors seek higher-yielding assets.

Bitcoin reached Monday highs of $122,190 before quickly declining 3% to $118,500. The price failed to secure a daily close above the $120,000 level.

Following the CPI release, Bitcoin rebounded to $119,500. A decisive close above $119,982 remains crucial for confirming immediate upward momentum.

Technical Analysis Points to Higher Targets

A bullish flag pattern on the daily chart recently broke to the upside. The current pullback could represent a retest before continuation toward the primary target of $130,000.

Technical analyst Titan of Crypto projects a bullish scenario targeting $137,000. This forecast is based on a descending trendline breakout observed on Sunday.

A daily close above $120,000 WOULD mark a historic first for Bitcoin. This milestone could potentially trigger the next phase of the current rally.

However, failure to reclaim $120,000 could invite short-term downside pressure. Immediate support lies in the $117,650 to $115,650 zone.

This support area coincides with a CME gap formed over the weekend. The gap makes this zone particularly important for traders to monitor.

Bitcoin Price Prediction

Bitcoin accumulation has reached an all-time high, driven by buying from whales and long-term holders. This occurs despite 94% of Bitcoin’s supply currently sitting in profit.

Nakamoto CEO David Bailey announced plans to purchase $1 billion worth of Bitcoin. MicroStrategy added another $18 million to its holdings, bringing total reserves to 628,946 BTC.

Network activity shows increasing demand with Active Addresses climbing 8% to 793,000 last week. Transaction fees ROSE 10% over the same period.

The high profit levels place the market in a zone where sentiment can shift quickly. Short-term traders may rush to lock in gains if momentum weakens.

At current levels, bitcoin trades at $118,724, holding above both 9-day and 21-day simple moving averages. The RSI hovers near 58, indicating neutral momentum territory.

MACD lines are converging, suggesting a possible bullish crossover if buying pressure continues. The recent spike briefly pushed Bitcoin price above $120,000 before sellers stepped in.

Next week’s Producer Price Index data could provide additional clarity. Estimates call for PPI at 2.3% and CORE PPI at 2.5%. Softer-than-expected readings could reinforce the bullish macro setup.

Bitcoin currently trades at $119,500 as accumulation from major players continues despite elevated profit levels across the network.