Crypto Market Tanks: What’s Driving the August 2025 Sell-Off?

Crypto's bleeding—again. Bitcoin nosedives 12% overnight as altcoins follow suit. Here's why the digital gold rush hit a pothole.

Macro Mayhem Strikes Back

The Fed's latest 50bps rate hike sent risk assets scrambling. Traders are dumping speculative holdings faster than a hot Bitcoin mining rig.

Liquidity Crunch Goes Viral

Three major crypto lenders froze withdrawals this morning—because nothing says 'decentralized finance' like good old-fashioned bank runs.

Regulatory Reaper Looms

The SEC just labeled seven more tokens as securities. Because apparently 2025's innovation is recycling 2023's playbook.

Don't count crypto out though. This is the same market that turned 'dead cat bounce' into an Olympic sport. Just ask the diamond-handed degenerates still buying this dip—between margarita sips on their private islands.

TLDR

- Crypto market cap dropped 2.54% to $3.96 trillion with Bitcoin at $118,883 and trading volume up 11.01%

- Profit-taking after monthly rally triggered $442 million in liquidations, with Ethereum hit hardest at $130 million

- Token unlocks worth $653 million pressured altcoins, including Dogecoin dropping 5.81% and Arbitrum falling 6.76%

- U.S. equity weakness and upcoming CPI report created macro uncertainty affecting crypto prices

- Market remains in “Greed” territory at 60 on Fear & Greed Index despite the pullback

The cryptocurrency market experienced a pullback today, with the total market capitalization declining 2.54% to $3.96 trillion. Trading volume increased 11.01% to $192.79 billion, indicating heightened activity despite the price decline.

Bitcoin maintained its dominance at 59.7% while trading at $118,883. Ethereum held 13.1% market share as the second-largest cryptocurrency by market cap.

The Fear & Greed Index remained in “Greed” territory at 60, suggesting investors maintain Optimism despite the correction. This pullback follows a strong monthly rally that saw the market gain 8.27%.

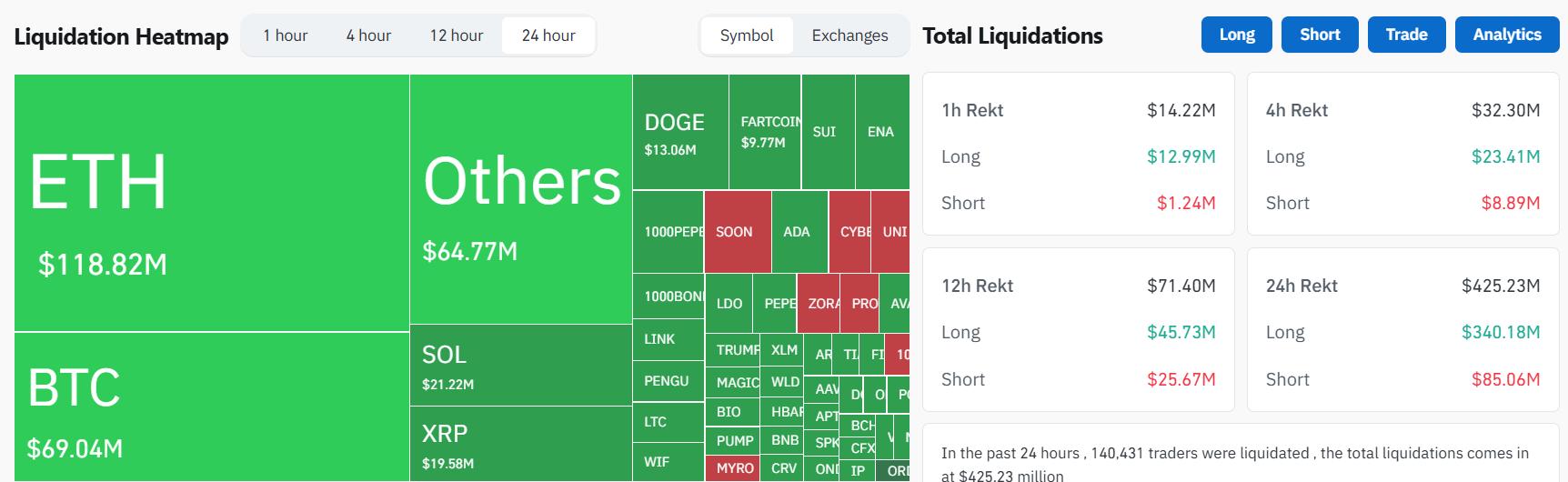

Liquidations Hit $442 Million

Bitcoin’s price decline triggered $72 million in long liquidations across the cryptocurrency market. Total liquidations reached $442.31 million in the past 24 hours.

Ethereum suffered the largest liquidation volume at $130.02 million, surpassing Bitcoin’s liquidation figures. The high liquidation numbers reflect Leveraged positions being forced closed as prices moved lower.

The market stalled NEAR its yearly high of $3.98 trillion. The RSI(7) indicator reached 88.6, signaling overbought conditions that often precede corrections.

Despite positive news including Metaplanet’s $61 million Bitcoin purchase and continued inflows into BlackRock’s ethereum ETF, traders chose to take profits. Bitcoin had gained 4% over the previous week before today’s decline.

Token Unlocks Add Selling Pressure

Weekly token unlocks totaling $653 million created additional downward pressure on altcoin prices. These unlocks increase circulating supply during periods of thin liquidity.

Dogecoin dropped 5.81% following an unlock of 95.49 million Doge worth $22 million. Large wallet holders moved 1 billion DOGE to exchanges, adding to selling pressure.

Arbitrum fell 6.76% while experiencing a 37% increase in open interest. sui declined 6.28% as unlock events affected multiple altcoins simultaneously.

The increased supply from unlocks makes it difficult for prices to maintain levels during bearish market conditions. Traders often anticipate these events and position accordingly.

Weakness in U.S. equity markets contributed to crypto’s struggles today. The Dow Jones fell 0.5%, the S&P 500 dropped 0.2%, and the Nasdaq declined 0.3%.

President Trump’s 90-day extension on China tariffs influenced equity market sentiment. Nasdaq futures fell 0.3% ahead of the upcoming Consumer Price Index report.

Bitcoin showed a 24-hour correlation of +0.75 with Gold but traded more like a risk asset. Gold gained 0.75% to $3,355 as inflation concerns supported safe-haven demand.

Investors are awaiting the U.S. CPI report, which could determine the market’s next direction. Cooler inflation data might revive buying interest, while higher inflation could push the market toward the $3.2 trillion 200-day exponential moving average.

Final Thoughts

The crypto market is down today primarily due to profit-taking following a strong monthly rally, which triggered $442 million in liquidations, with Ethereum experiencing the largest losses. Additionally, token unlocks worth $653 million added selling pressure, and broader macroeconomic uncertainty, including weakness in U.S. equities and the upcoming CPI report, further contributed to the market’s decline.