Cardano (ADA) Whales Gobble $166M—Is a $1 Breakout Inevitable?

Whales are circling Cardano like it's a Black Friday sale—$166 million worth of ADA scooped up in weeks. Retail traders? Still waiting for their coffee to brew.

Bulls eye $1 like a target on a dartboard. The last time ADA flirted with this level, DeFi was still a twinkle in Vitalik's eye. Now? The smart money's betting history repeats—just with fewer gas fees.

Technical charts show consolidation tighter than a banker's grip on bonus season. MACD humming, RSI coiling—classic spring-loaded action before a potential breakout. Though let's be real: in crypto, 'potential' does 90% of the heavy lifting.

One cynical footnote: Wall Street would call this 'strategic accumulation.' In crypto? We call it 'panic buying with extra steps.'

TLDR

- Cardano whales accumulated over 200 million ADA worth $166 million in 48 hours

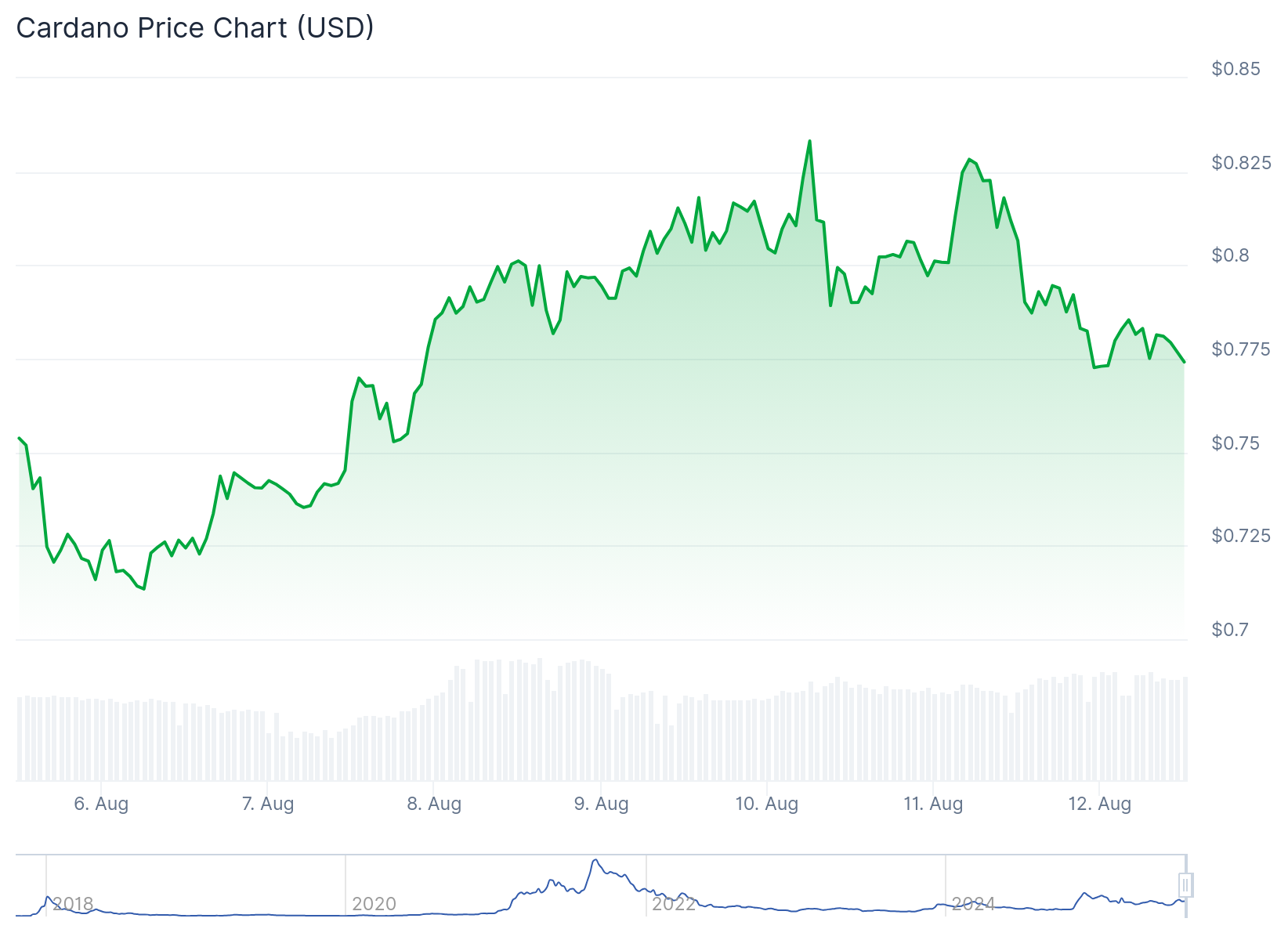

- ADA trades at $0.81 with key resistance at $0.84-$0.88 zone before targeting $1

- Spot exchange inflows totaled $11 million while perpetual trading volume dropped 21.49%

- On-chain bubble risk remains moderate, suggesting room for sustainable upside

- $0.83 acts as critical make-or-break level for ADA’s next rally attempt

Cardano price trades at $0.81 following a 2.82% gain in 24 hours. The altcoin remains steady despite broader market volatility.

Large investors have been active in recent days. Whale addresses holding between 100 million and 1 billion ADA purchased 200 million tokens worth approximately $166 million between August 9-10.

Over 200 million Cardano $ADA bought by whales in the last 48 hours! pic.twitter.com/FCgCX15P3b

— Ali (@ali_charts) August 11, 2025

This buying activity extended beyond whales. Spot exchange data shows $11 million in net inflows during the same period. An additional $3.61 million in spot purchases followed shortly after.

The accumulation comes as ADA approaches key technical levels. The $0.84 to $0.88 resistance zone represents the first major hurdle for bulls.

Analyst JRNY crypto identified the psychological $1 level as the next target. Breaking above the immediate resistance could open a clear path toward this milestone.

Technical Structure Shows Room for Growth

On-chain data from Into The Cryptoverse indicates Cardano’s bubble risk remains at moderate levels. The reading sits well below overheated zones seen during past market peaks.

$ADA Short Term Bubble Risk pic.twitter.com/HARkBhaVu1

— Into The Cryptoverse (@ITC_Crypto) August 10, 2025

This suggests speculative excess remains contained. Historical patterns show ADA often gains momentum when bubble risk readings climb from low-to-mid ranges.

The current setup aligns with ADA’s long-term ascending trendline. Analyst Crypto Dream notes this multi-year trendline remains intact and acts as a technical magnet for price.

Key resistance at $1.30 serves as the next major hurdle after $1. A clean break could confirm the shift from accumulation to expansion phase.

Volume analysis reveals ADA remains compressed within its largest visible volume cloud. Analyst Trend Rider explains this zone often acts as a liquidity magnet.

The ideal buy zone sits between $0.75 and $0.77 according to volume profile analysis. This area aligns with prior demand and visible range support.

Mixed Signals from Derivatives Markets

Perpetual trading activity shows mixed signals despite spot market strength. Long-to-short ratios fell below 1 in the past 24 hours.

Trading volume declined 21.49% to $2.14 billion representing a $459 million decrease. This hints at fading activity among derivative traders.

However, the Open Interest Weighted Funding Rate maintains a positive reading of 0.0108%. This indicates long positions continue to dominate despite higher short volumes.

The funding rate structure suggests long position holders are paying fees. This typically occurs when sentiment remains bullish in derivative markets.

Bitcoin dominance currently retests key support levels for the second time. This factor could influence capital FLOW toward or away from altcoins like ADA.

A breakdown in Bitcoin dominance could release pressure on altcoins. This scenario would allow ADA to challenge upper resistance levels more effectively.

The $0.83 level represents a critical make-or-break point for ADA’s rally. Previous attempts at this level triggered declines exceeding 20%.

Insufficient momentum at $0.83 could risk another decline. However, a clean break above this resistance could set the stage for a strong rally toward $1.

Current whale accumulation of 200 million ADA in 48 hours represents the largest buying activity from this cohort in recent months.