Ethereum Primed to Overtake Bitcoin as Lubin’s Bold Prediction Gains Traction Amid Market Shakeup

Ethereum’s rally defies gravity while legacy players stumble—could this be the flippening’s tipping point?

Lubin’s prophecy gains steam as ETH outpaces BTC

The ‘ultrasound money’ narrative bites back as Bitcoin maximalists clutch their grayscale bags. Meanwhile, TradFi dinosaurs still can’t tell a smart contract from a Starbucks receipt.

Market dynamics shift beneath our feet—ETH’s deflationary burn meets institutional FOMO while Bitcoin’s ‘digital gold’ thesis tarnishes under its own energy gluttony. The only certainty? Crypto’s hierarchy won’t resemble last cycle’s pecking order.

One hedge fund manager’s ‘generational buy’ is another’s reckless speculation—welcome to decentralized finance, where the house always wins (unless it’s a DAO).

TLDR

- Ethereum surged to $4,300, recording a 21% weekly rally and reaching a $520 billion market capitalization.

- The market cap rise allowed Ethereum to surpass major corporations like Mastercard, Netflix, and Exxon Mobil.

- Ethereum co-founder Joseph Lubin stated that Ethereum could overtake Bitcoin’s market capitalization within a year.

- At Bitcoin’s current valuation, ETH would need to trade near $20,000 to achieve the flip.

- Inflows into spot Ether ETFs have increased significantly, boosting institutional interest in Ethereum.

Ethereum surged to $4,300 after a 21% weekly rally, lifting its market capitalization above $520 billion and surpassing Mastercard, Netflix, and Exxon Mobil. This rally placed ethereum as the 22nd largest global asset, fueling speculation of further gains. Analysts expect Ethereum to challenge Visa’s market position in the near term.

Ethereum Overtakes Corporate Giants

Ethereum’s latest price jump followed a rebound from $3,500, breaking past $4,000 resistance with strong market momentum. The market cap rise allowed Ethereum to overtake major corporations in global rankings. Analysts suggest a further 25% rally could see Ethereum surpass Visa’s valuation.

Corporate adoption trends are also strengthening Ethereum’s position in the market. According to Companies Market Cap data, flipping Visa WOULD mark another major milestone for Ethereum. Arthur Hayes projected that ETH could rally to $10,000, supported by growing corporate treasury interest.

This momentum has been driven partly by inflows into spot Ether ETFs. Such investments have accelerated in recent days, adding more buying pressure. The trend indicates sustained institutional confidence in Ethereum’s long-term potential.

ETH Could Flip BTC Within a Year

Ethereum co-founder Joseph Lubin told CNBC that ETH could surpass Bitcoin’s market capitalization “within the next year or so.” He cited the role of treasury companies in driving this shift. At Bitcoin’s current valuation, Ethereum would need to trade NEAR $20,000 to achieve the flip.

Lubin emphasized that corporate adoption could accelerate Ethereum’s trajectory. The increased flow of capital from Bitcoin to Ethereum supports this outlook. Market analysts view the trend as part of a broader altcoin season.

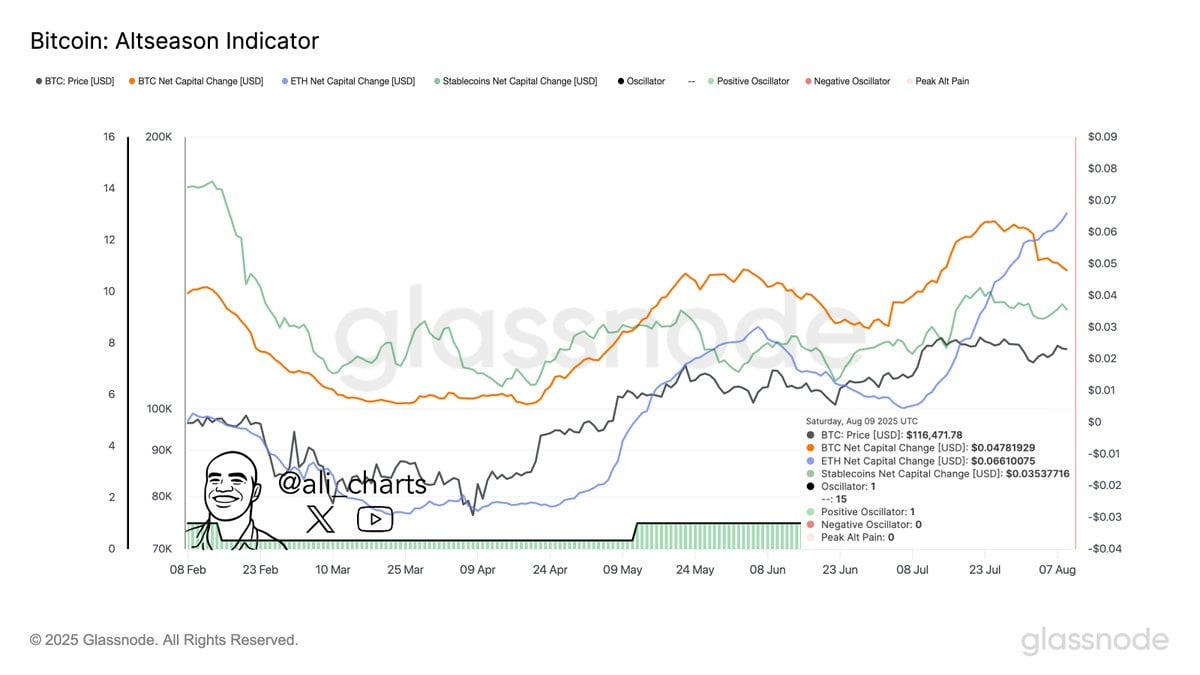

Crypto analyst Ali Martinez reported that Ethereum’s net capital change has surpassed Bitcoin’s. He called this “the clearest signal yet” that the altcoin season has started. The statement reinforced expectations of Ethereum gaining market dominance.

Whales Accelerate Accumulation

On-chain data shows that Ethereum whales have increased large-scale purchases in recent days. Galaxy Digital facilitated over $158 million worth of ETH over the counter in 14 hours, which underscores confidence from high-net-worth investors.

A notable whale address, 0x3952, withdrew 8,745 Ethereum worth $37.6 million from Binance within the last hour. Over two months, the address acquired 65,001 ETH worth $281 million at an average price of $2,611. The holdings now reflect over $111 million in unrealized gains.

Such accumulation patterns suggest expectations of further price appreciation. Combined with institutional inflows, these factors strengthen the case for ETH’s continued rise.