5 Crypto Projects With Unstoppable Q3 2025 Momentum – Your Best Bets Right Now

Crypto markets aren't waiting around—these five projects are already printing generational wealth while traditional finance plays catch-up.

Layer-2 tokens eating ETH's lunch

Scaling solutions now process 80% of Ethereum transactions—and their native tokens are mooning while gas fees strangle legacy DeFi. One project's partnership with Visa just sent its price vertical.

AI meets DeFi in profit-generating mashup

Decentralized GPU rentals are creating the first truly profitable AI protocols. Early backers saw 450% gains last quarter as compute demand outstrips supply.

Gaming tokens that don't suck

Finally—play-to-earn that's actually fun. These gaming ecosystems are retaining users beyond the speculative phase, with in-game economies now generating real revenue.

The cynical take? Wall Street will 'discover' these trends right around the 2026 bear market. Get positioned now—before your fund manager tries to sell you a tokenized version at 10x the price.

Bitcoin ($BTC): The Liquidity Anchor

Bitcoin remains the bedrock of the crypto market. Its dominance sits NEAR 51%, and its role as the “on-ramp” for institutional flows continues to expand. With ETF approvals in major jurisdictions and increasing allocations from funds, BTC is evolving from a speculative asset to a macro hedge.

The asset is currently trading above $110K and has shown consistent support on higher timeframes. For those seeking a base LAYER of exposure while markets recalibrate, BTC remains the safest bet on crypto’s continued relevance.

Ethereum ($ETH): Infrastructure With Real-World Traction

Ethereum powers over 70% of DeFi, tokenization, and Web3 application layers. Despite rising competition, its first-mover advantage and DEEP developer network make it one of the most resilient platforms.

ETH has recently benefited from Layer-2 adoption, rollup scaling, and institutional staking. With smart contract activity surging again and ecosystem innovations (like account abstraction) moving forward, ethereum still leads where it matters: execution and utility.

Solana ($SOL): The High-Speed Challenger

Solana has bounced back from its 2022 lows to become one of the most technically advanced blockchains on the market. With blazing-fast block times and near-zero fees, it has become the go-to platform for emerging consumer apps, DeFi experiments, and memecoin ecosystems.

Recent on-chain activity shows steady user growth and a spike in developer onboarding. SOL’s token price has pushed past $150 again, signaling strong momentum. For those betting on high-performance Layer-1 chains, solana continues to outperform expectations.

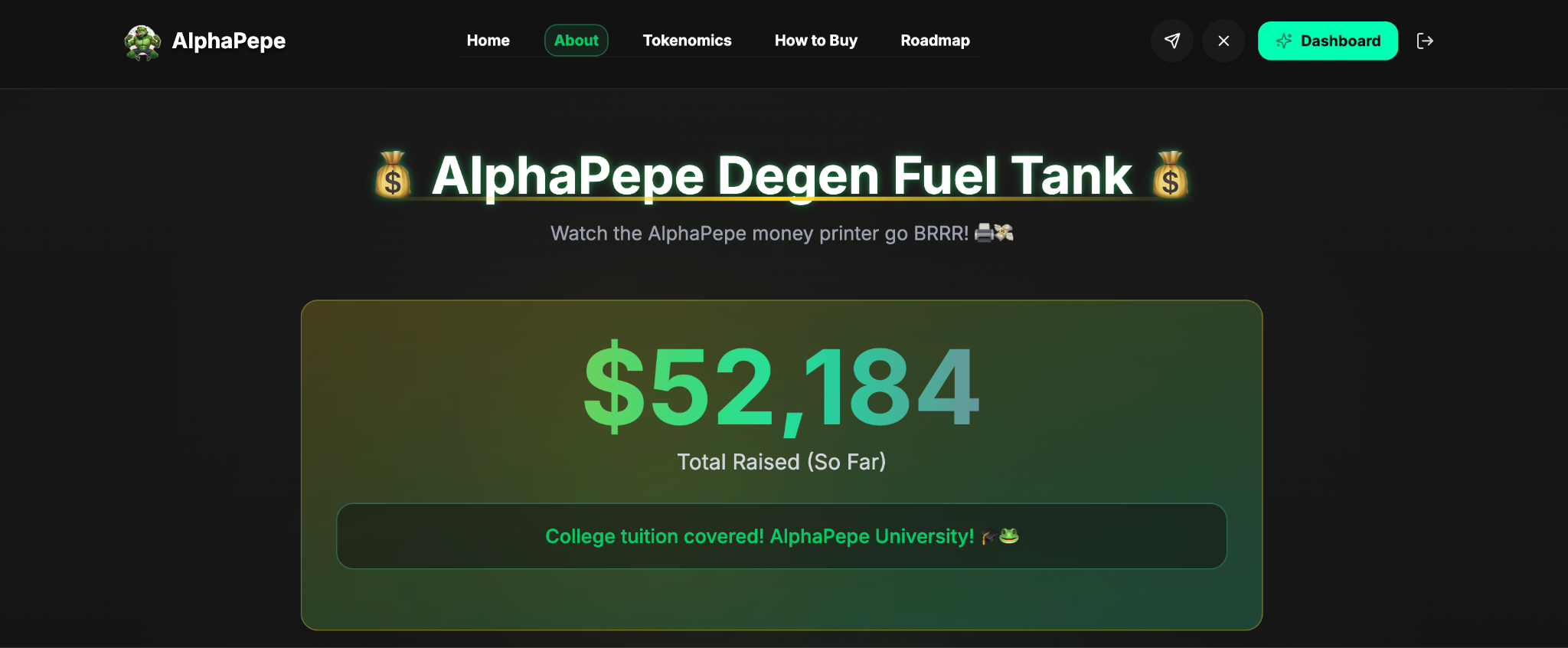

AlphaPepe ($ALPE): Undervalued Meme Utility with Early Traction

AlphaPepe is emerging as a rare case of a meme token built with actual structure. Instead of leaning solely on virality, the project has integrated staking, redistribution mechanics, and transparent tokenomics that appeal to both meme traders and long-term holders.

What makes AlphaPepe different is its functional reward system — including USDT pools for holders and automatic redistribution via smart contract. With instant token access, no team allocation, and a growing community, it’s quietly building momentum across BNB Chain users.

While it won’t be found on every CEX radar yet, $ALPE represents one of the few meme tokens offering DeFi-like structure with upside potential — a combination increasingly rare in 2025’s noise-filled market.

Chainlink ($LINK): The Data Layer Every Chain Needs

Chainlink often gets overlooked in bull market HYPE — but quietly powers much of the decentralized data infrastructure behind the biggest dApps and financial protocols. With CCIP (Cross-Chain Interoperability Protocol) expanding and staking mechanisms maturing, LINK’s utility is becoming more central to real-world crypto integrations.

As tokenized real-world assets (RWAs) become a serious theme, chainlink is positioned as the bridge between traditional finance and on-chain activity. For those looking beyond just hype-driven gains, LINK remains a smart, strategic hold.

Final Take: How to Think About the Best Crypto to Buy Now

There’s no universal answer — but timing, structure, and trend alignment matter. Bitcoin and Ethereum are long-term foundational plays. Solana rides on scalability. AlphaPepe represents structured exposure to the meme cycle. And Chainlink is a silent giant behind serious infrastructure.

Investors today are no longer just looking for speculative wins — they’re hunting narrative-fit assets with asymmetric reward potential. The five tokens above offer a cross-section of that logic in real time.