Dogecoin (DOGE) Surges: Weekend Rally Fuels Trader Optimism for Major Reversal

Meme coin defies gravity—again. Dogecoin (DOGE) stages a weekend rebound, sparking fresh bullish chatter among traders betting on a trend reversal. No fundamentals? No problem.

### The Weekend Pump: Hope or Hype?

DOGE’s sudden uptick has the crypto crowd buzzing. Traders—ever the optimists—are eyeing charts like astrologers reading tea leaves. Could this be the start of a sustained climb, or just another dead-cat bounce? Place your bets.

### The Bull Case: Sentiment Over Sense

Forget utility. Dogecoin’s strength lies in its cult following and Elon Musk’s occasional tweets. This time, the weekend action suggests retail traders are piling back in—because nothing screams 'sound investment' like a joke currency mooning on vibes.

### The Cynic’s Take: Same Story, Different Day

Wall Street shakes its head. While DOGE fans cheer, traditional finance scoffs at the 'greater fool theory' in action. But hey—if it works, it works. Just don’t mortgage your house.

### What’s Next: Ride the Wave or Bail?

Volatility is guaranteed. Whether DOGE sustains momentum or crashes back to earth depends on whether the crowd stays greedy. One thing’s certain: it’ll be entertaining.

TLDR

- Dogecoin fell 30% from July peak to test crucial $0.19 support level

- Technical indicators show momentum cooling but long-term uptrend intact via golden cross

- Traders remain bullish with 3:1 long/short ratio on major exchanges

- Macro headwinds from new tariffs and Fed policy pressure risk assets

- Analyst sees “great risk-reward” opportunity with falling wedge breakout pattern

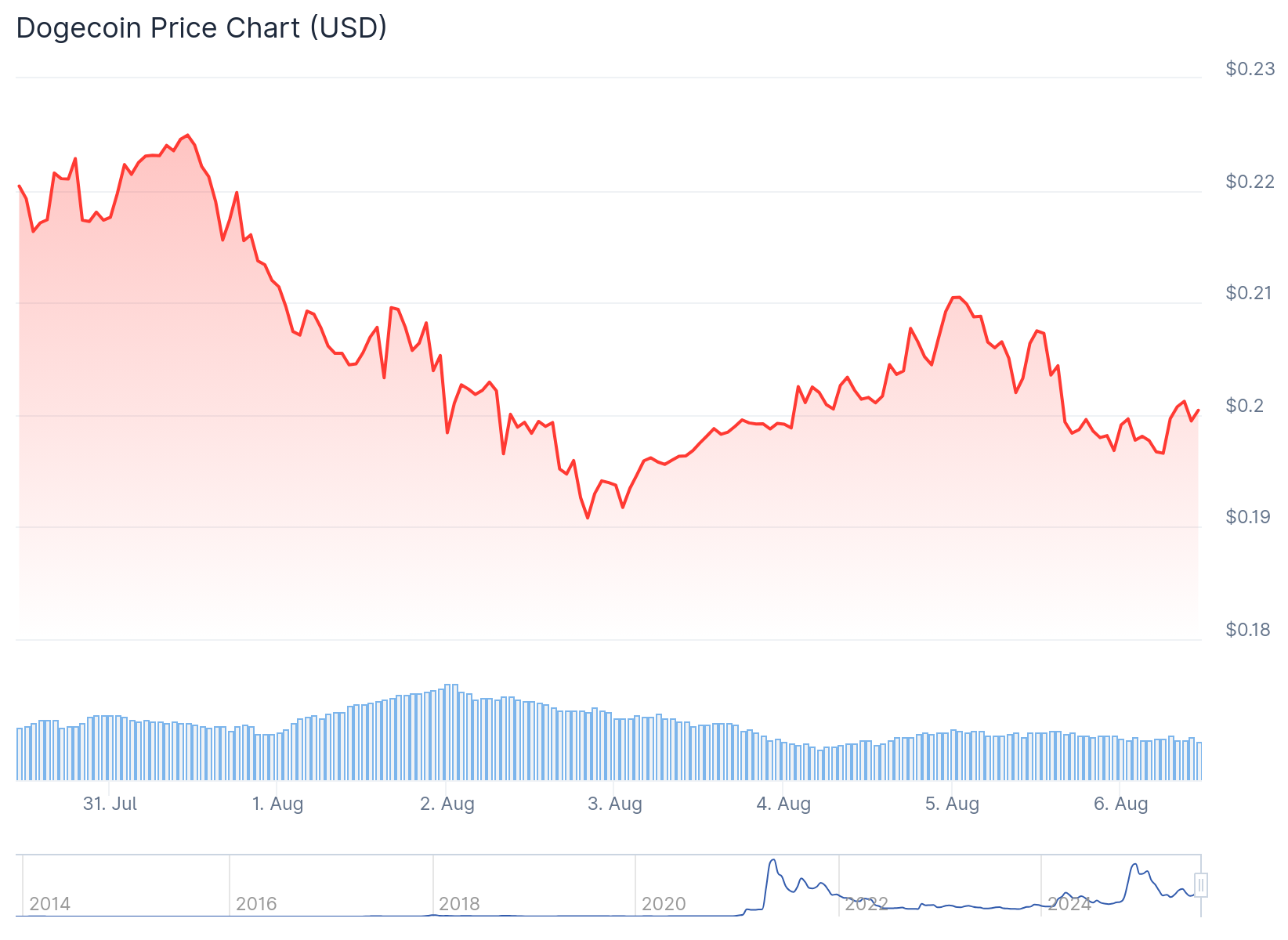

Dogecoin price has declined sharply over the past two weeks after reaching a five-month high NEAR $0.28 on July 21. The meme coin dropped almost 30% to test the critical $0.19 support level.

The selloff comes as macro headwinds pressure risk assets across markets. President TRUMP introduced new import taxes ranging from 10% to 41% on goods from Canada, India, Brazil, Taiwan and other nations. This ended the grace period many investors hoped would continue.

The Federal Reserve also maintained steady policy rates at its latest meeting. This stance is expected to persist, causing investors to shift toward safer assets and away from cryptocurrencies like DOGE.

🔥LATEST: There is now an 87% chance of a rate cut in September.#FederalReserve #InterestRates #StockMarket #Inflation pic.twitter.com/cD142WQDmS

— Trader Edge (@Pro_Trader_Edge) August 4, 2025

Despite the pressure, Doge bulls managed to defend the $0.19 support area. This level sits below both the 50-day and 200-day exponential moving averages at $0.206 and $0.207 respectively.

Technical Indicators Show Mixed Signals

From a long-term perspective, Dogecoin maintains a bullish structure thanks to a golden cross between the 20-day and 200-day moving averages that occurred in late July. This pattern typically indicates long-term bulls remain in control.

However, momentum indicators are cooling. The daily Relative Strength Index dropped from overheated readings above 80 to below 50, entering bearish territory. The moving average convergence divergence also flipped bearish, confirming the recent rally lost steam.

Popular analyst Cantonese Cat sees opportunity in the current setup. The analyst noted DOGE broke above a “bear market trendline” and is now retesting “bull market” support levels. This forms part of a broader falling wedge pattern that could signal continuation higher.

The RSI has recovered above the neutral 52 level after briefly dipping. The MACD line maintains its lead over the signal line despite recent weakness, suggesting short-term uptrend momentum may be taking hold.

Trader Sentiment Remains Bullish

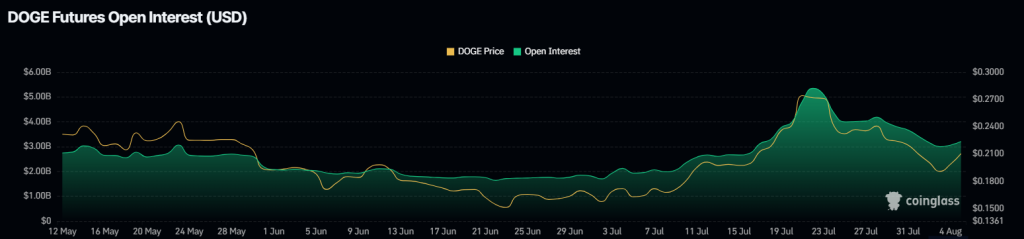

Despite the price decline, trader positioning suggests underlying confidence. Aggregate futures volume decreased 37% to $4 billion over 24 hours, but open interest held steady near $3 billion. This indicates traders are maintaining positions rather than exiting.

Exchange data shows bullish positioning across major platforms. On Binance, long accounts outnumber shorts by a 3:1 ratio. OKX displays an even stronger 3.6 reading, confirming bullish sentiment among traders.

Coinglass data shows open interest increased 2.43% today to $3.15 billion as speculative demand picks up again. About 75% of traders on Binance are positioning for upside moves.

If DOGE holds the $0.19 support level, a rebound toward the 20-day moving average around $0.22 becomes possible. A break above $0.24 resistance could open the path toward the psychological $0.30 level.

However, a decisive break below $0.19 on high volume WOULD target the next support levels at $0.17 and $0.15. These represent potential declines of 12% to 24% from current levels.

Pattern Suggests Upside Potential

The falling wedge breakout noted by analysts targets previous resistance at $0.25 for a potential 25% gain from current levels. If this level converts to support, the rally may extend toward the mid-July high at $0.2875, representing a 38% gain.

Recent weekend trading saw DOGE bounce 8%, which some analysts view as the potential start of a new uptrend. The breakout from the bear market trendline and successful backtest as support marks a higher low structure.

Momentum indicators are beginning to flash green signals. The RSI recovery above neutral levels and MACD maintaining its bullish crossover suggest buyers may be regaining control after the recent correction.

The technical setup presents what analysts call “great risk-reward” opportunity if the support level holds. However, this will likely require improvement in macro conditions and fresh positive catalysts for the broader cryptocurrency market.

Current price action shows DOGE testing the lower boundary of its recent trading range while maintaining key technical support levels that could serve as a foundation for the next MOVE higher.