Dogecoin (DOGE) Surges 12% From Support—Why Traders Are Still Betting Big on the Meme Coin

Dogecoin bulls aren't backing down. After a 12% rebound from key support levels, DOGE traders are doubling down—proving once again that crypto markets thrive on chaos and memes.

Breaking Down the Bounce

The Shiba Inu-themed coin clawed back double-digits this week, dodging what skeptics called an 'inevitable dump.' Technicals suggest the rally wasn't just blind luck: strong buy orders stacked up at the support zone like degenerate gamblers at a roulette table.

What’s Next for DOGE?

With leverage ratios creeping up and open interest swelling, this could either be the start of a parabolic move or another trap for overeager retail traders. Either way, Wall Street analysts are still scratching their heads at how a joke currency keeps outliving their 'serious' price predictions.

TLDR

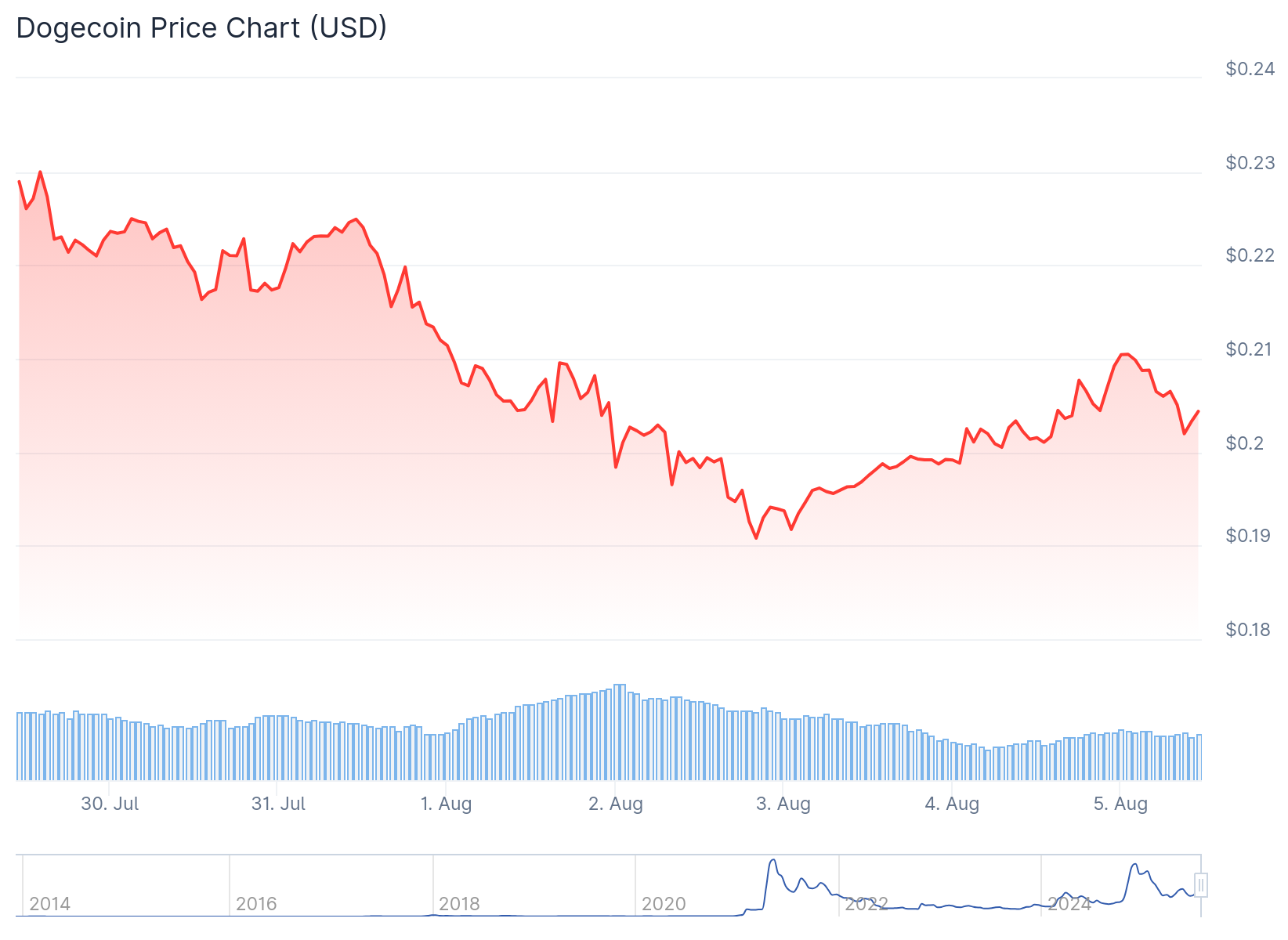

- Dogecoin (DOGE) has dropped 30% from its July peak of $0.28 to test crucial $0.19 support level

- Technical indicators show cooling momentum with RSI falling below 50 and bearish MACD crossover

- 4-hour RSI approaching oversold level below 30 that previously triggered 70% rally in June

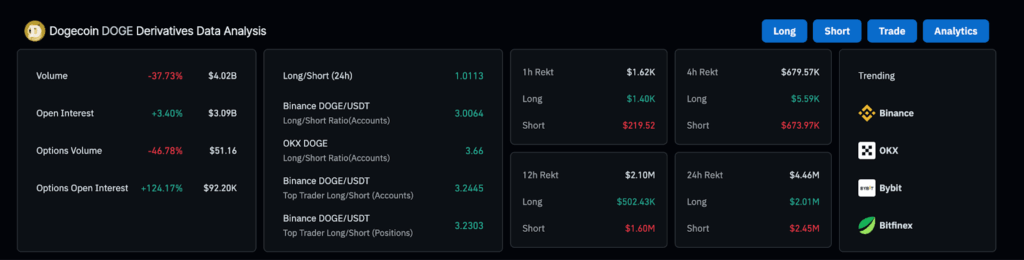

- Futures data shows traders remain bullish with 3:1 long/short ratio on major exchanges

- Golden cross pattern from late July still supports broader uptrend despite current weakness

Dogecoin price has retreated from its recent highs as the cryptocurrency tests a critical support level. The meme coin reached nearly $0.28 on July 21, marking a five-month peak before declining approximately 30% to current levels around $0.19.

The selloff has pushed DOGE below both the 50-day and 200-day exponential moving averages. The coin now trades NEAR $0.206 and $0.207 respectively, key technical levels that traders are watching closely.

Macroeconomic factors have contributed to the recent weakness. President TRUMP introduced new import taxes ranging from 10% to 41% on goods from Canada, India, Brazil, Taiwan and other nations. The Federal Reserve also maintained steady policy rates at its latest meeting.

These developments have pushed investors toward safer assets, pressuring risk assets including cryptocurrencies. The policy uncertainty has ended what many investors hoped WOULD be an extended grace period.

Despite the price decline, Doge maintains structural bullish characteristics from a longer-term perspective. A golden cross formation occurred in late July when the 20-day moving average crossed above the 200-day average.

This technical pattern typically indicates longer-term bullish momentum remains intact. The primary uptrend for the leading meme coin has not been invalidated as long as price stays above the slower-moving average.

Momentum Indicators Show Mixed Signals

Technical momentum indicators present a mixed picture for Dogecoin’s near-term direction. The daily Relative Strength Index has fallen from overbought readings above 80 to below 50, entering bearish territory.

This decline signals that market momentum has cooled substantially. The moving average convergence divergence indicator recently flipped bearish, confirming the recent rally has lost steam.

However, analysts point to potential bullish developments on shorter timeframes. The 4-hour RSI is approaching oversold levels below 30, a condition that previously triggered strong recoveries.

The last time the 4-hour RSI fell below 30 was in June, when DOGE was trading around $0.14. What followed was a rally exceeding 70% over the following month.

Current price levels around $0.20 represent a higher low compared to June’s action. The formation of higher lows often leads to higher highs in technical analysis.

If DOGE repeats its June performance with a 70% gain from current levels, the price could reach approximately $0.34. This would still leave the cryptocurrency more than 50% below its all-time high of $0.74 from 2021.

Trader Sentiment Remains Constructive

Futures market data suggests traders maintain optimistic positioning despite recent weakness. Aggregate Dogecoin futures volume decreased 37% to $4 billion over 24 hours, but open interest held steady around $3 billion.

The stable open interest indicates traders are maintaining their positions rather than closing them. This suggests confidence in potential price recovery among larger market participants.

Exchange data shows bullish positioning across major platforms. Binance reports long accounts outnumbering shorts by a 3:1 ratio, while OKX shows an even stronger 3.6:1 long/short ratio.

These metrics reflect underlying bullish sentiment among active traders. The positioning suggests accumulated buying power could drive prices higher if technical support levels hold.

Key support levels to watch include the current $0.19 area, followed by $0.17 and $0.15 if the decline continues. A break below $0.19 on high volume could target these lower levels, representing 12% to 24% downside from current prices.

Conversely, a successful defense of $0.19 support could enable a rebound toward the 20-day moving average around $0.22. Further strength above $0.24 resistance might open the path toward the psychological $0.30 level.

August historically represents a challenging month for Dogecoin, with average declines of 10%. The cryptocurrency has already declined 5.31% this month according to CryptoRank data, following July’s 27.1% gain.

The 4-hour RSI currently sits near levels that previously marked important bottoms for the cryptocurrency.