Crypto Roars Back as Fed Rate Cut Probability Hits 90% Following Jobs Data Revision

Markets flip bullish as macro tides turn—digital assets surge on dovish Fed expectations.

Fed Put Goes Crypto: How Traders Are Front-Running The Central Bank

With the CME's FedWatch tool now pricing in a 90% chance of rate cuts by September, Bitcoin and altcoins are painting the tape green. Never mind that last month's 'hot' jobs report just got revised colder—Wall Street's algos only read the headline, not the footnote.

Ethereum leads the charge with 8% gains as DeFi tokens follow suit. Even the SEC's latest enforcement threats can't dampen the mood—apparently nothing trumps cheap money fantasies, not even regulators.

As one trader put it: 'When the Fed blinks, we drink... Lambos all around until the next CPI print.' Because nothing says sustainable rally like betting against the most data-dependent Fed in history.

TLDR

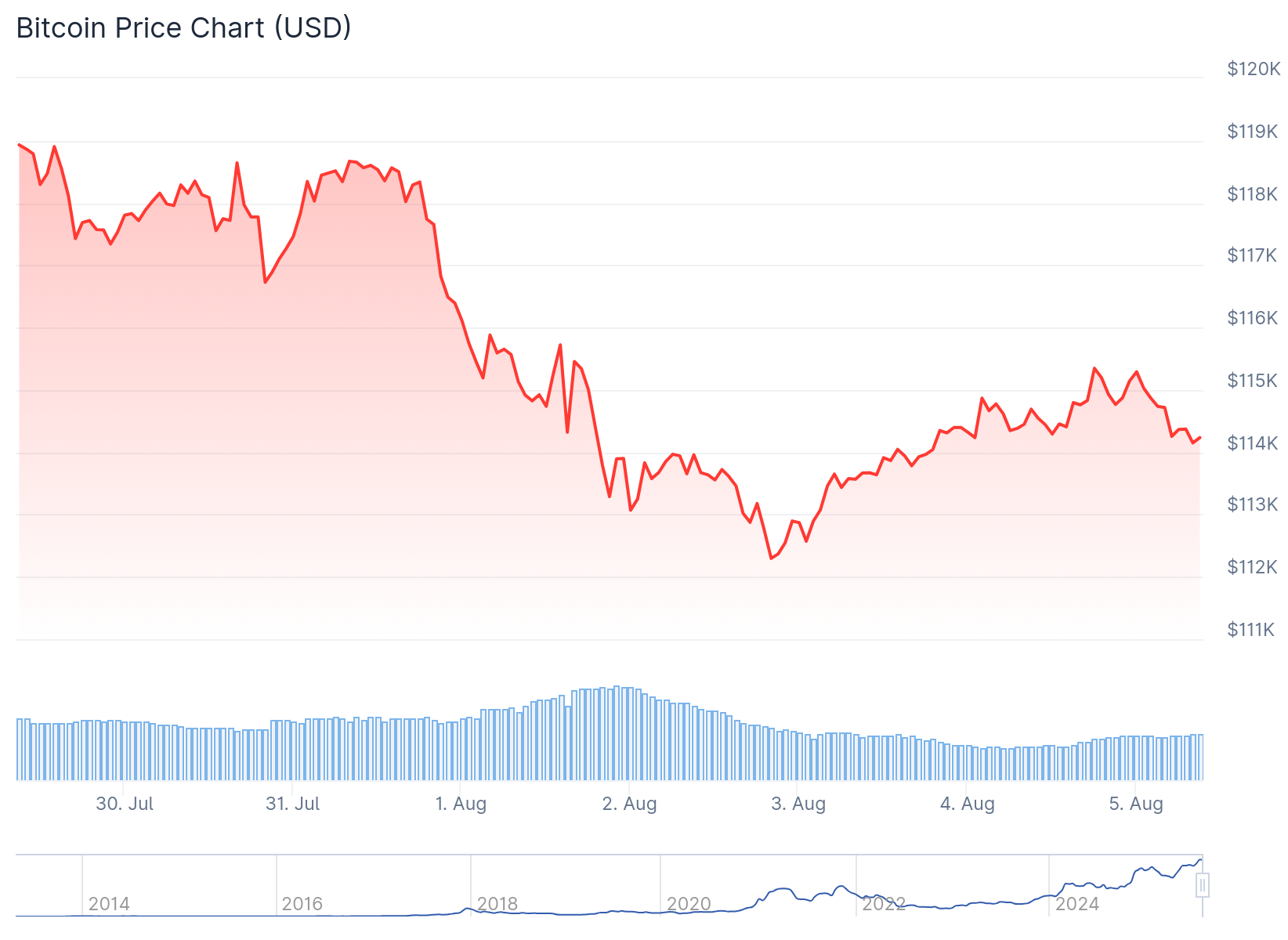

- U.S. stocks and crypto rebounded Monday with Nasdaq up 1.84% and Bitcoin rising 0.74% following revised jobs data

- Federal Reserve rate cut probability for September jumped to over 90% from 63.1% after 258,000 downward revision to May-June jobs

- Analyst Alex Krüger believes crypto market has bottomed, comparing current selloff to August 2024 crash that recovered on Monday

- Options traders showing caution with Bitcoin put demand in $105,000-$110,000 range despite market rebound

- Trump’s dismissal of Labor Statistics Commissioner adds to macroeconomic uncertainty amid tariff tensions

U.S. stocks and cryptocurrencies posted gains Monday following a sharp revision to employment data that boosted expectations for Federal Reserve interest rate cuts. The tech-heavy Nasdaq jumped 1.84% while the Russell 2000 gained 2.35%.

Bitcoin saw a more modest increase of 0.74% according to CoinGecko data. The cryptocurrency tracked broader risk assets higher but lagged behind equity market gains.

The market rally came after the Bureau of Labor Statistics revised May and June jobs data downward by a combined 258,000 positions. This revision fueled speculation that the Federal Reserve will cut interest rates at its September meeting.

Rate cut probability for September has surged to over 90% from 63.1% a week earlier, according to the CME’s FedWatch Tool. The sharp shift in expectations drove buying across risk assets including stocks and crypto.

Jake Ostrovskis, an OTC trader at Wintermute, described Monday’s bounce as “fairly machine-driven.” He warned of “plenty of signs of froth” and “high levels of risk taking” in both traditional finance and crypto markets.

Market Uncertainty Persists

President Donald Trump’s dismissal of Bureau of Labor Statistics Commissioner Erika McEntarfer has added to investor uncertainty. The MOVE is seen by some as political interference in economic data reporting.

Ongoing tariff tensions and policy unpredictability continue to weigh on market sentiment. These U.S.-focused issues behind last week’s selloff remain unresolved according to analysts.

Options activity in Bitcoin reflects continued caution among traders. Put demand is concentrated in the $105,000 to $110,000 range, suggesting investors are seeking downside protection rather than betting on further gains.

Analyst Sees Market Bottom

Macro analyst Alex Krüger believes the crypto market has likely found a tradable bottom. He compared the recent selloff to the August 2024 crash that bottomed on a Monday.

So I've lost the habit of posting here, as I've been traveling for an extended period of time and busy with personal matters. Plan to resume posting regularly soon. In the meantime let me share some quick market views given the dramatic moves we've just experienced.

I see the…

— Alex Krüger (@krugermacro) August 2, 2025

Krüger noted similarities between current market conditions and last year’s sequence of events. Both periods featured Federal Reserve policy uncertainty followed by weak employment data that triggered risk asset selling.

The analyst pointed to several factors that contributed to recent market stress. These included mixed Big Tech earnings, higher-than-expected inflation data, and poor jobs numbers that sent markets lower.

Regulatory Developments

The SEC launched “Project Crypto” to modernize securities rules and move more market infrastructure on-chain. SEC leadership framed tokenization and blockchain-based market systems as regulatory priorities under “American Leadership in the Digital Finance Revolution.”

Krüger called this development “extremely bullish” and expects it to drive investment flows later in the year. The policy push represents a shift toward more crypto-friendly regulation.

Fed Governor Adriana Kugler’s resignation creates an earlier-than-expected Board vacancy for the WHITE House to fill. Former Fed Governor Kevin Warsh has called for limits on central bank independence to help government finances.

Markets are pricing 85% odds for a September rate cut following the payrolls miss and jobs data revision.