Bitcoin (BTC) at a Crossroads: Will August Deliver a $105K Plunge or a $118K Surge?

Bitcoin's August drama unfolds as bulls and bulls battle for control—will the king of crypto nosedive to $105K or skyrocket to $118K?

The tension is palpable. Traders cling to charts like life rafts, while institutional whales place bets with other people's money—as usual.

Technical breakdown: The $105K support level holds the key. A breach could trigger panic selling, while holding firm might fuel the rocket to $118K.

Market sentiment swings like a pendulum. Retail FOMO meets institutional hedging in a classic crypto standoff.

One thing's certain: volatility never takes vacation in crypto land. Whether you're stacking sats or shorting the top, August promises white-knuckle action.

Remember: in crypto, the only guarantee is that someone's always getting rekt—make sure it's not you this time.

TLDR

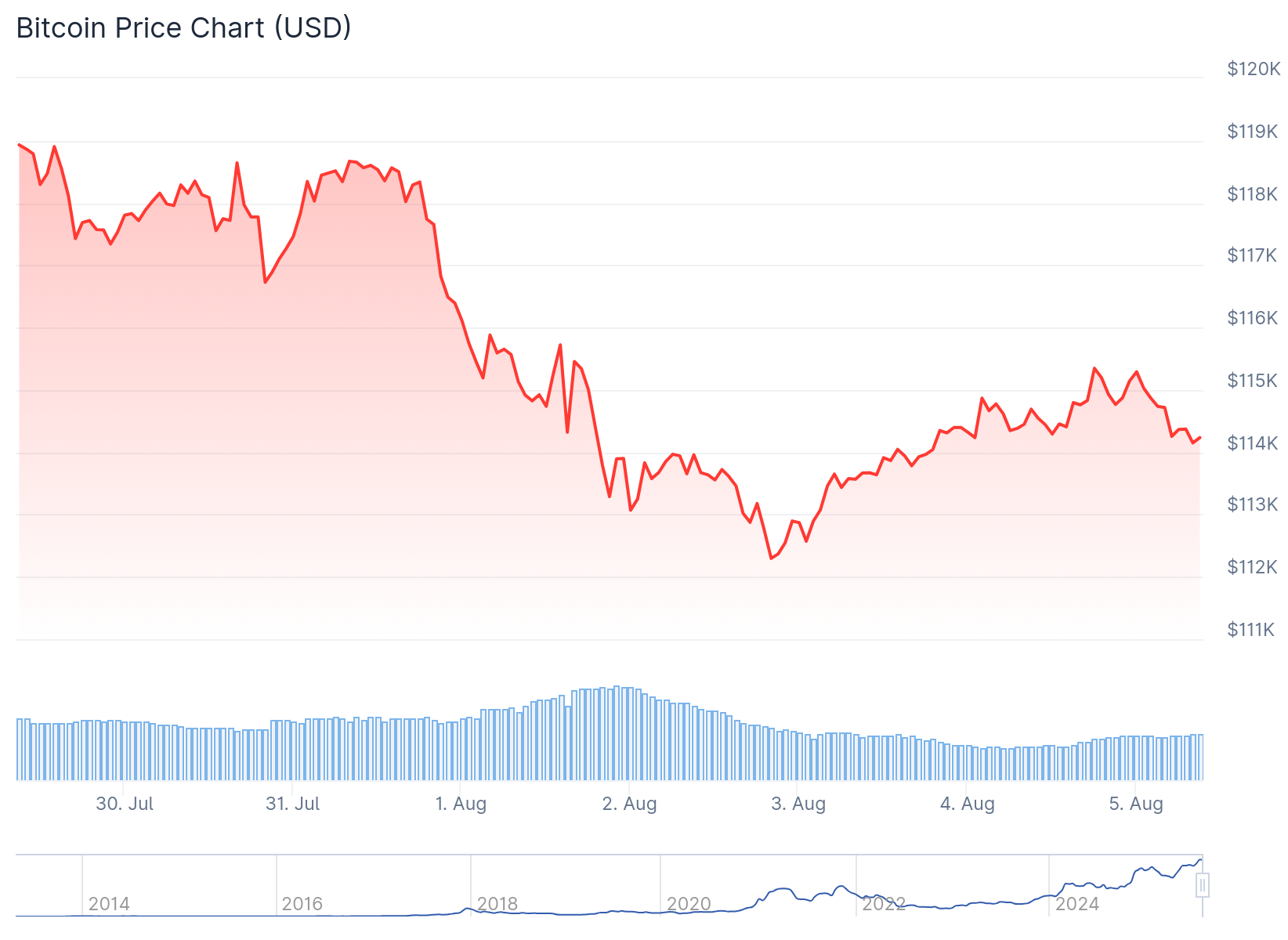

- Bitcoin price is currently trading above $114,000 after recovering from weekend lows around $112,000

- August historically shows bearish patterns with an average 11.4% decline over the past 7 years

- Technical analysis suggests potential dip to $105,000 before rallying to $118,000-$125,000 range

- Japan-based firm Metaplanet acquired 463 additional Bitcoin worth $53.7 million at $115,895 average price

- Analyst Mike Alfred predicts Bitcoin could reach $312,000 before crashing 76% to $75,000 in 2026

Bitcoin price is trading above $114,000 after recovering from weekend lows around $112,000. The cryptocurrency faces seasonal headwinds as August historically delivers negative returns for the digital asset.

Data shows Bitcoin recorded negative monthly returns in 5 of the last 7 Augusts since 2017. The average loss during those declining months reached 11.4%, creating downside pressure toward the $105,000 level.

This $105,000 target aligns with the bottom trendline of an ascending triangle pattern on daily charts. A break below this technical structure could threaten the bullish outlook and trigger a larger correction.

Bitcoin has reclaimed its bull flag pattern structure despite the August headwinds. The cryptocurrency broke back inside the flag formation, with the current spot price at $114,500 trading above the lower trendline.

The consolidation above $112,000 support may set the stage for a breakout toward $118,000. Technical indicators are supporting this bullish case, with the TD Sequential flashing a buy signal on 12-hour charts.

Institutional Buying Continues Despite Market Volatility

Metaplanet deepened its bitcoin commitment on August 4 by acquiring 463 additional coins worth $53.7 million. The Japan-based investment firm paid an average price of $115,895 per Bitcoin, slightly above current spot levels.

Metaplanet has acquired 463 BTC for ~$53.7 million at ~$115,895 per bitcoin and has achieved BTC Yield of 459.2% YTD 2025. As of 8/4/2025, we hold 17,595 $BTC acquired for ~$1.78 billion at ~$101,422 per bitcoin. $MTPLF pic.twitter.com/9EyuDIMsqq

— Simon Gerovich (@gerovich) August 4, 2025

This purchase raised Metaplanet’s total holdings to 17,595 Bitcoin. At current prices NEAR $114,500, the portfolio is valued at over $2 billion, placing the firm among the top seven publicly listed Bitcoin treasuries globally.

The institutional buying occurred despite strong technical resistance levels. Market participants continue accumulating Bitcoin even as seasonal patterns suggest potential weakness ahead.

Resistance at $115,000 remains critical for the short-term outlook. Analysts note Bitcoin needs to close confidently above this level to target $118,000 and then $125,000.

The recent pullback retested the breakout zone at $112,000, which held firm during weekend selling pressure. This level represents the rising support trendline from April lows.

Charts show Bitcoin trading above this ascending support line, currently positioned around $114,700. The narrow channel formation suggests continued bullish accumulation above the trendline.

Long-Term Price Projections Point to Extreme Volatility

Market expert Mike Alfred shared projections based on previous cycle performances and subsequent bear market corrections. Historical data shows Bitcoin crashed 80% from $1,000 to $200 in 2014.

In 2014, Bitcoin crashed from $1,000 back to $200

In 2018, Bitcoin crashed from $20,000 back to $3200

In 2022, Bitcoin crashed from $69,420 back to $16,000

Given this pattern, I am deeply concerned that Bitcoin will crash from $315,000 back to $75,000 in 2026

I’m scared.

— Mike Alfred (@mikealfred) August 2, 2025

The 2018 cycle saw an 84% decline from $20,000 to $3,200. Following the 2021 peak above $69,000, Bitcoin fell approximately 80% to around $16,000 in 2022.

Using these patterns, Alfred expects Bitcoin to reach a cycle top above $300,000. His specific target sits at $312,000 before the next major market correction begins.

The projection calls for a subsequent crash to $75,000, representing a 76% decline from the predicted peak. This correction is expected to occur in 2026 rather than 2025.

Alfred addressed criticism about realized volatility constraints by noting that volatility metrics are not static. Historical periods show volatility can exceed previous ranges during major market moves.

The short-term outlook remains bullish provided support at $112,000 holds. Analysts project potential rallies to $124,000 based on compression zone breakout targets.

Current technical conditions support continued upward momentum above key support levels. The ascending triangle pattern and bull flag structure provide bullish frameworks for price action.

Bitcoin’s institutional adoption continues with Metaplanet’s recent $53.7 million purchase at an average price of $115,895 per coin.