GameSquare (GAME) Stock Rockets 6% on Bold Crypto Play: 2,717 ETH Purchase and $5M Buyback Blitz

GameSquare just lit a rocket under its stock price—and Wall Street didn’t see this combo coming. The gaming conglomerate’s shares surged 6% after dropping two bombshells: a major Ethereum acquisition and a aggressive buyback plan. Here’s why traders are scrambling.

The Crypto Gambit: 2,717 ETH Goes on the Books

No slow drip-feed here. GameSquare went all-in, snapping up 2,717 ETH—a move that screams confidence in crypto’s role in gaming’s future. Forget dipping toes in; this is a cannonball into the deep end.

$5M Buyback: Putting Money Where the Mouth Is

While most companies whisper about ‘shareholder value,’ GameSquare’s throwing $5 million at its own stock. Either they know something the market doesn’t, or they’re betting big on hype outpacing fundamentals (hey, it’s 2025—both could be true).

The Aftermath: Speculation or Strategy?

One thing’s clear: GameSquare’s playing chess while others play checkers. Whether this is visionary or just another ‘look-at-me’ crypto stunt? Time will tell. But for now, the market’s voting with buy orders—and the suits are left playing catch-up.

TLDR

- GameSquare Buys $10M in ETH, Launches 8–14% Yield Strategy & Stock Buyback

- GameSquare Taps DeFi: ETH Yields to Fund $5M Stock Repurchase Plan

- GameSquare Adds 2,717 ETH, Ties Buybacks to DeFi Yields for Share Growth

- GameSquare Turns Crypto into Cash Flow with ETH Yield & Buyback Model

- Blockchain Boost: GameSquare Leverages ETH for Stock Buybacks & Income

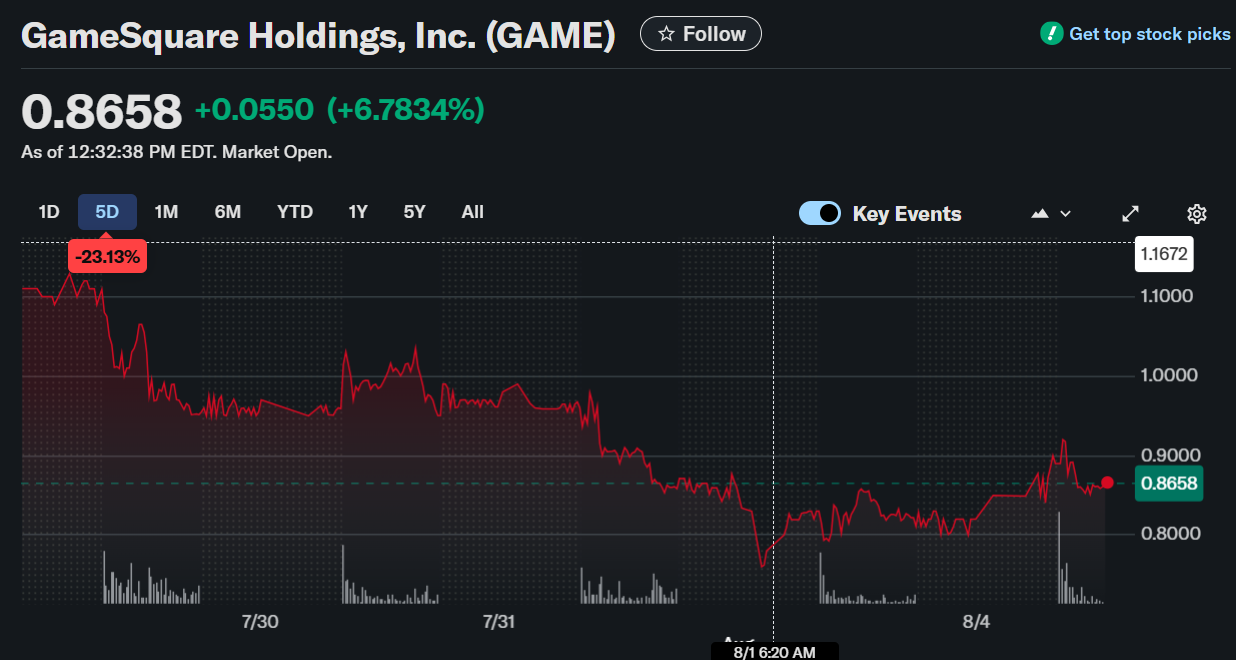

GameSquare Holdings, Inc. (GAME) shares rose 6.78% to $0.8658 following a $10 million ethereum purchase and new buyback plan.

GameSquare Holdings (GAME)

The company boosted its ETH holdings to 15,630.07 and launched a yield strategy targeting 8% to 14% annually. A $5 million stock repurchase program will be funded directly from ETH yield proceeds under strict trading thresholds.

Ethereum Purchase Expands Treasury Holdings and Launches Onchain Yield Strategy

GameSquare purchased 2,717 ETH for $10 million, expanding its blockchain treasury position to 15,630.07 ETH. This MOVE reflects the company’s commitment to blockchain-based capital management and on-chain yield strategies. The acquisition follows prior approvals to deploy up to $250 million in ETH over time.

GameSquare has purchased an additional 2,717 of Ethereum for $10 million, increasing treasury holdings to 15,630.07 ETH.

The board also authorized a stock buyback program, funded through net proceeds generated by the onchain yield platform. Onchain yield strategy with… pic.twitter.com/dU4O8eZAKz

— GameSquare Holdings Inc. (@GSQHoldings) August 4, 2025

The company activated its ETH yield program on August 1, 2025, through a partnership with Dialectic. The strategy seeks annual returns of 8% to 14% from decentralized finance (DeFi) protocols. This positions GameSquare among the public firms using ETH to drive productive income generation.

Management views Ethereum as a long-term asset and an engine for recurring capital inflows. GameSquare intends to convert idle crypto reserves into active, yield-generating components of its corporate finance structure. The program is subject to quarterly reviews and strategic rebalancing as needed.

Stock Buyback Plan Tied to Ethereum Yield Earnings

GameSquare’s Board authorized a $5 million stock buyback plan, funded entirely by ETH yield income. The program targets open-market purchases only when GAME shares trade below $1.50. This structure links blockchain-based earnings directly to equity value strategies.

The company emphasized this mechanism as a way to return capital without tapping into operating reserves. This reflects a dual-pronged approach to capital efficiency and shareholder return. Management considers this integration of DeFi income with traditional equity repurchases a Core pillar of its financial model.

The repurchase plan includes flexible execution via open market, private transactions, or Rule 10b5-1 trading plans. GameSquare maintains full discretion over the scale and timing of purchases under the authorized ceiling. All activity will align with compliance guidelines and current market conditions.

A Pioneering Move in Blockchain-Aligned Treasury Management

GameSquare’s ETH-based strategy signals a shift in how public firms can use digital assets for yield and equity support. With over $60 million deployed in ETH and NFTs, the company remains focused on leveraging DeFi for ongoing capital growth. The structure introduces a new method of balancing treasury assets and share performance.

Traditional firms typically rely on cash equivalents, but GameSquare’s strategy brings a higher-risk, higher-reward approach. However, it mitigates volatility with institutional-grade custody and diversified exposure across protocols. It also aligns its strategy with periodic reviews for risk control.

GameSquare continues to establish itself as a leading example of integrating Web3 technologies into capital markets. Its model blends decentralized finance and corporate finance in a structured, yield-focused system. The company plans to provide protocol-specific performance and allocation updates in future investor materials.