Bitmine Immersion (BMNR) Skyrockets as Ethereum Treasury Hits $2.9B – Now the Largest ETH War Chest on Earth

Move over, nation-states—Bitmine Immersion just flexed its $2.9B Ethereum stash and stole the treasury crown.

The ultimate HODL play?

BMNR’s stock went vertical after revealing its ETH trove now dwarfs corporate and institutional holdings. Forget balance sheets—this is a pure crypto power move.

Wall Street analysts scrambling to slap ‘buy’ ratings (better late than never). Meanwhile, ETH maximalists are popping champagne—while quietly sweating the lack of a corporate exit strategy.

One thing’s certain: when your treasury outpaces small countries, you’re either a visionary or a future case study in ‘aggressive asset allocation.’

TLDR

- Bitmine Becomes Largest ETH Holder, Eyes 5% Global Share & Staking Push

- Bitmine Soars After Amassing $2.9B in ETH, Plans $1B Stock Buyback

- BMNR Stock Climbs on $2.9B ETH Haul, Staking & Crypto Treasury Plans

- Bitmine Builds $2.9B ETH War Chest, Climbs to Top 3 in Crypto Holdings

- Bitmine’s $2.9B ETH Play Sparks Stock Surge & Institutional Backing

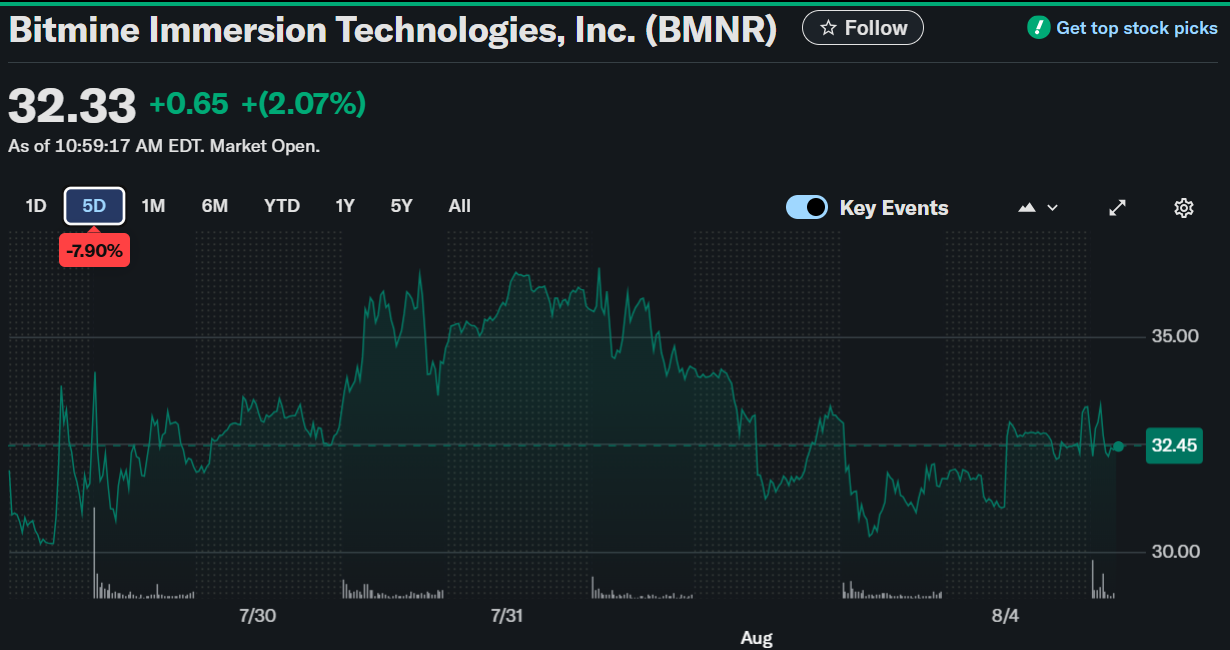

Bitmine Immersion Technologies, Inc. (NYSE American: BMNR) recorded sharp stock movement early Monday, with shares opening at $31.68 and rising to $33.71. As of 10:59 AM EDT, BMNR traded at $32.33, reflecting a 2.07% gain from the previous close. The strong price action followed the company’s announcement of over $2.9 billion in ethereum (ETH) holdings.

Bitmine Immersion (BMNR)

The company’s ETH portfolio has reached 833,137 units, positioning Bitmine as the world’s largest corporate holder of Ethereum. It launched this ETH accumulation strategy on June 30 and closed the initial phase by July 8. Over the past 35 days, Bitmine built its ETH treasury from zero to the current total, signaling rapid growth.

This strategic move places Bitmine third among global crypto treasuries by total digital asset value. Only MicroStrategy and MARA Blockchain currently hold more in terms of overall crypto value. Bitmine also revealed it now holds 192 BTC, further diversifying its crypto assets.

Ethereum Holdings: Strategy, Execution, and Impact

Bitmine’s aggressive Ethereum acquisition strategy targets 5% of the global ETH supply, which the company labels the “alchemy of 5%”. As ETH traded at $3,491.86 on August 3 at 6:30 PM ET, the value of Bitmine’s Ethereum exceeded $2.9 billion. The company cites Bloomberg pricing for valuation, reinforcing credibility.

The Board of Directors approved a $1 billion stock repurchase plan to support this ETH-focused growth strategy. This buyback initiative aims to enhance shareholder value while advancing Bitmine’s position in the crypto infrastructure space. The ETH accumulation is expected to continue as the company scales operations.

Bitmine plans to launch Ethereum staking soon, which could generate substantial recurring income. Staking WOULD enable the company to earn yield on idle ETH assets while increasing profitability. This next step aligns with Bitmine’s broader mission to build a digital asset powerhouse.

Bitcoin Holdings and Market Position

Bitmine disclosed ownership of 192 Bitcoin, marking another significant crypto holding. While modest compared to its ETH portfolio, the BTC assets reinforce the company’s balanced treasury approach. Together, these holdings elevate Bitmine into the top five corporate crypto holders globally.

The company has gained market traction, ranking as the 42nd most actively traded U.S. stock with a $1.6 billion average daily trading volume. BMNR now ranks just behind Uber Technologies in trading activity among over 5,700 U.S.-listed stocks. This liquidity adds to the company’s appeal for market participants.

Institutional backing continues to strengthen Bitmine’s credibility and financial profile. Notable stakeholders include Bill Miller III, ARK’s Cathie Wood, and firms like Pantera, Founders Fund, and Galaxy Digital. These strategic supporters view Bitmine as a strong digital infrastructure company with long-term potential.