Fed Rate Shock Sparks $200M Crypto Bloodbath—But Bitcoin’s Already Bouncing Back

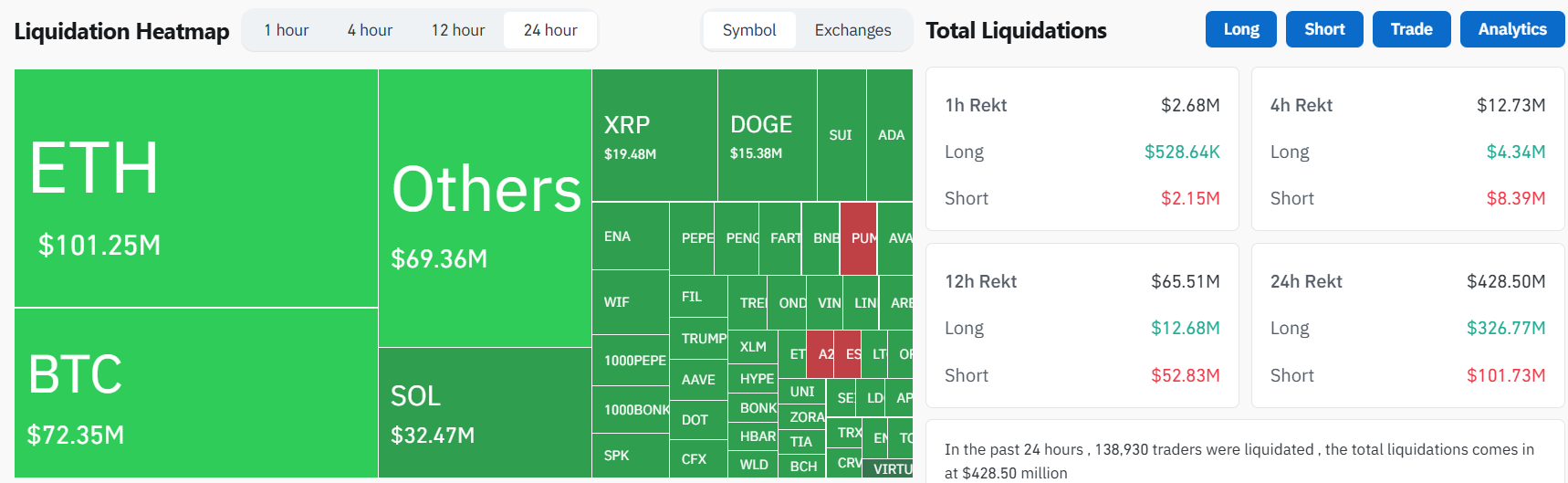

The Federal Reserve just dropped a monetary grenade—and crypto traders got shredded. Over $200 million in leveraged positions evaporated within hours as markets reacted to the latest rate decision. But here’s the twist: Bitcoin’s licking its wounds and staging a comeback.

Liquidation Carnage Meets BTC Resilience

Liquidations ripped through altcoins like a chainsaw, yet BTC’s price action tells a different story. While paper hands got rekt, the king of crypto flashed its trademark volatility-absorbing superpower. No ATHs here—just the market doing its best impression of a washing machine on spin cycle.

The Institutional Angle

Behind the scenes? Whale wallets are accumulating. Traditional finance might clutch its pearls at crypto’s ‘reckless’ swings, but smart money knows these dips are discount windows. Funny how rate hikes still move crypto markets—guess decentralization hasn’t quite killed the Fed’s influence yet.

So much for ‘decoupling.’ Bitcoin’s proving it can take a macroeconomic punch and keep trading. Meanwhile, Wall Street’s still trying to explain NFTs to their compliance departments.

TLDR

- Crypto markets saw $200M in liquidations within an hour as Fed Chair Jerome Powell’s hawkish comments triggered a selloff

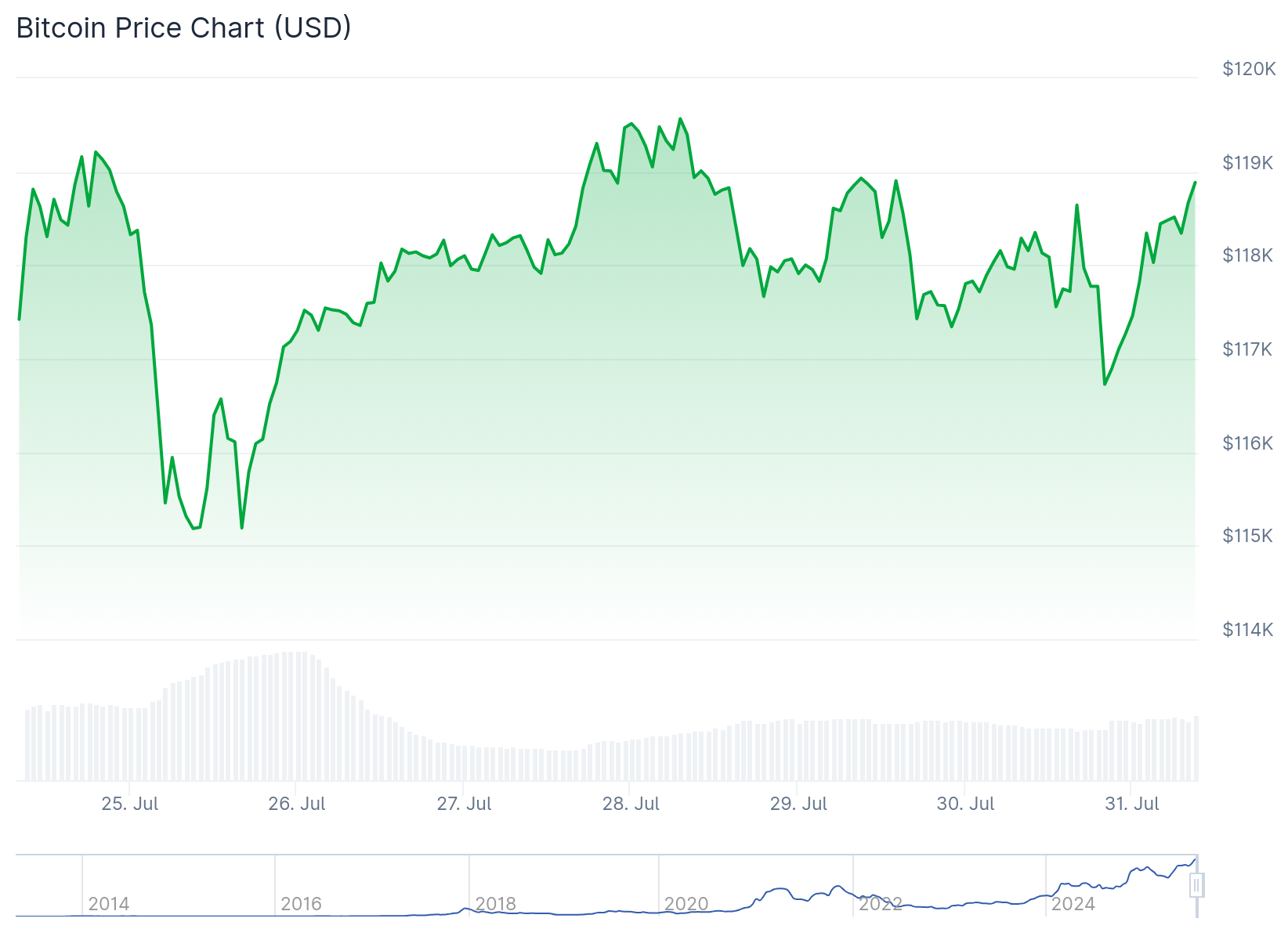

- Bitcoin dipped below $116,000 during Powell’s remarks but later recovered above $117,000, still down 0.8% for the day

- Altcoins like SOL, AVAX, and HYPE dropped 4-5% while BONK and PENGU plunged 10% before bouncing back

- The Fed left interest rates unchanged with two officials dissenting in favor of cuts

- Analysts predict potential Fed pivot to lower rates could drive BTC to $150,000 by year-end

The Federal Reserve’s latest interest rate decision sent shockwaves through cryptocurrency markets, wiping out $200 million in leveraged positions within a single hour. Chair Jerome Powell’s hawkish remarks during the announcement created immediate volatility across digital assets.

🚨 BREAKING: Jerome Powell leaves interest rates UNCHANGED again, at 4.50%

Despite the INCREDIBLE economic numbers released this morning.

This guy HAS TO GO! Unleash the U.S. economy! pic.twitter.com/Q9sY3decew

— Nick Sortor (@nicksortor) July 30, 2025

Bitcoin dropped below $116,000 during Powell’s comments but managed to recover above $117,000 by session’s end. The leading cryptocurrency remained 0.8% lower for the day, trading within its three-week range. ethereum experienced steeper losses, sliding 3% at one point before recovering to $3,750.

The Fed chose to keep interest rates unchanged despite two officials dissenting in favor of cuts. Powell emphasized concerns about inflationary pressures from potential tariffs during his remarks. This hawkish stance caught many Leveraged traders off guard.

Altcoins bore the brunt of the initial selloff. Solana, Avalanche, and Hyperliquid tokens fell 4-5% before paring losses. Meme coins faced harsher treatment with BONK and PENGU each plunging 10% before bouncing back.

The broader altcoin market lost $50 billion over 48 hours, dropping from $1.57 trillion to $1.52 trillion. Open interest across all crypto assets declined from $101 billion to $97 billion. Combined open interest in major altcoins including ETH, SOL, XRP, and DOGE shrank from $42.5 billion to $41 billion.

Market Recovery Signals

Traditional markets provided some relief with Meta and Microsoft posting strong quarterly earnings. Both stocks surged 10% and 6% respectively in after-hours trading. This positive sentiment helped crypto markets stabilize later in the session.

Traders began positioning for potential Fed policy shifts ahead of key economic data. The market assigned a 61.6% probability to a September rate cut. Odds of two cuts by year-end stood at 42.9%.

Analyst Outlook

Matt Mena from 21Shares suggested the Fed may be falling behind the curve on policy adjustments. He pointed to softening PCE inflation data and weakening consumer spending as supporting evidence. Real yields remain restrictive while unemployment edges higher.

The current setup mirrors late 2023 conditions with softening inflation and rising political volatility. A Fed constrained by lagging indicators could create opportunities for risk assets. Thursday’s PCE inflation data will provide crucial direction for future policy moves.

The upcoming White House crypto report adds another catalyst to watch. If the report offers substantial policy clarity alongside soft inflation data, Bitcoin could reclaim $120,000 territory. Some analysts project potential moves to $130,000 or even $150,000 by September if strategic Bitcoin reserve plans emerge.

Powell’s hawkish tone contrasted with market expectations for more dovish signals. The Fed maintained its cautious approach despite growing economic headwinds. Two dissenting votes for rate cuts highlighted internal debate about appropriate policy stance.

Bitcoin’s recovery above $117,000 demonstrated resilience after the initial shock. The cryptocurrency held key support levels despite heavy liquidation pressure. Ethereum’s bounce back to $3,750 showed similar strength in the face of selling pressure.