Fed’s Wednesday Decision: The Bitcoin (BTC) Price Catalyst You Can’t Ignore

All eyes on the Fed as Bitcoin braces for volatility.

The world's largest cryptocurrency is coiled like a spring ahead of Wednesday's pivotal Fed meeting—and institutional traders are placing their bets.

Will Powell pump or dump the crypto markets? Analysts are divided, but one thing's certain: when traditional finance sneezes, crypto catches a cold (or rides the wave—Wall Street's mood swings are crypto's best marketing).

Technical indicators show BTC hovering at a critical juncture. Break past resistance? New price discovery. Rejection? Another trip to 'max pain' territory.

Meanwhile, crypto degens whisper about 'buy the rumor, sell the news'—because nothing fuels speculation like central bankers playing interest rate Jenga.

TLDR

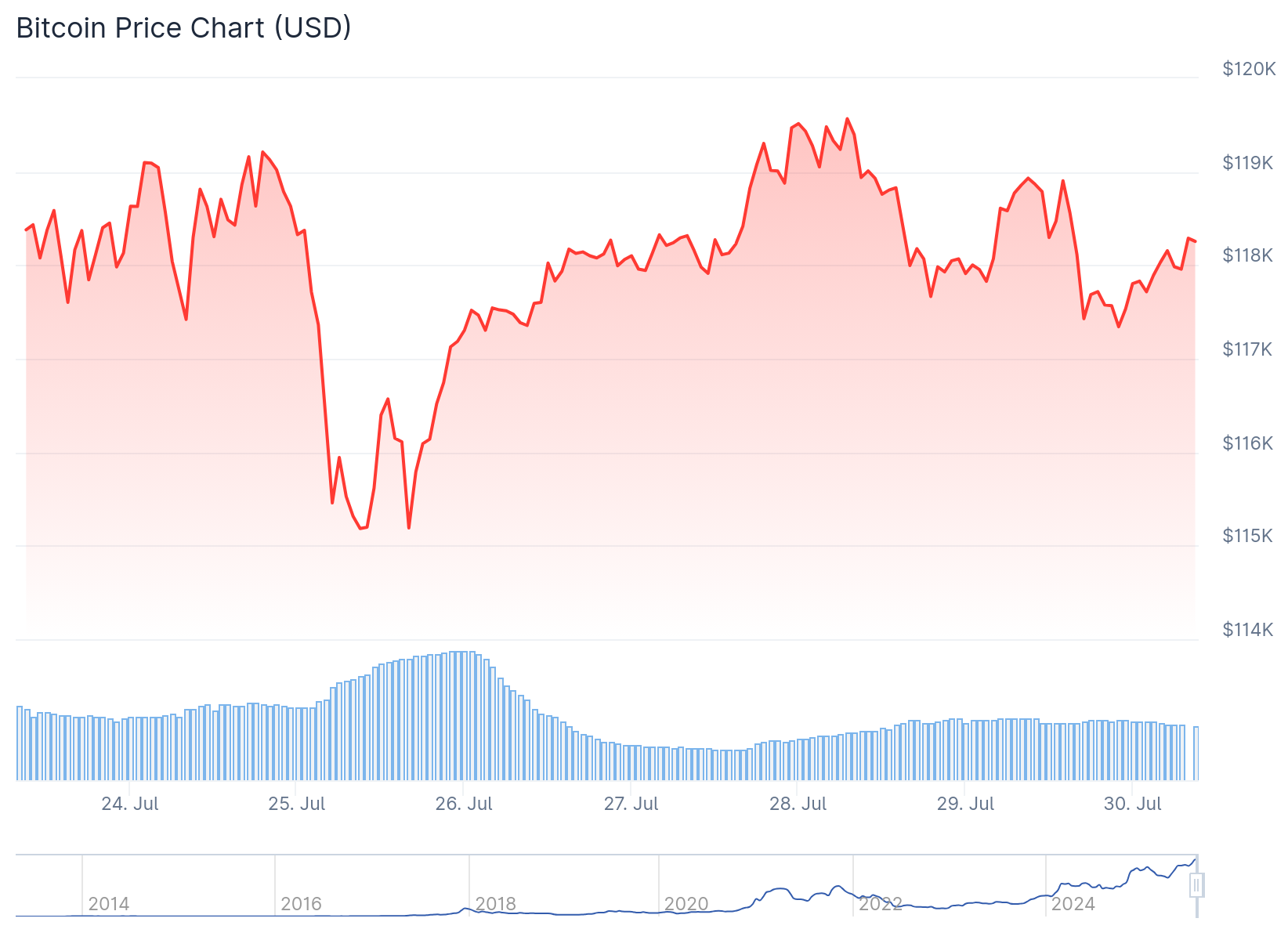

- Bitcoin is trading within the $117,000 to $120,000 range as traders reduce risk ahead of Wednesday’s Federal Reserve meeting

- Long-term holders have shifted into net selling territory near the $120K psychological resistance level

- Galaxy Digital’s reported sale of 80,000 BTC adds institutional selling pressure to the market

- Open interest has declined from $50.58 billion to $49.58 billion, with $173.8 million in long liquidations over 12 hours

- Price compression and narrowing Bollinger Bands suggest a range expansion could occur soon

Bitcoin price action has entered a consolidation phase as the cryptocurrency encounters resistance near the $120,000 mark. The digital asset continues to trade within a tight range between $117,000 and $120,000, with Tuesday’s session pointing toward a daily close below $118,000.

Market data reveals that long-term Bitcoin holders have shifted into net selling territory as prices approach the psychological $120K level. This represents the first real test for Bitcoin’s recent upward momentum, with on-chain metrics showing early-stage distribution patterns emerging.

The selling pressure isn’t limited to retail investors. Galaxy Digital’s reported sale of 80,000 BTC has added institutional weight to the sell-side, creating a different dynamic than typical retail-driven corrections. This institutional repositioning suggests profit-taking and rebalancing rather than a mass exodus from the asset.

Trading metrics support the cautious sentiment across the market. Bitcoin’s aggregate open interest has fallen to $49.58 billion from $50.58 billion at the Wall Street opening bell. Long liquidations in the futures market have accelerated the selling, with Coinglass data showing $173.8 million in margin calls over the past 12 hours.

Market Positioning Ahead of Key Events

The current price weakness appears linked to traders cutting risk positions ahead of Wednesday’s Federal Reserve meeting. The CME Group’s FedWatch metric shows a 98% probability that the central bank will maintain rates within the 4.25% to 4.5% range.

According to Polymarket, there’s a 98% chance The Fed won’t cut rates tomorrow.

The real question for FOMC tomorrow is how dovish is the language J Powell uses when discussing their decision.

The downside of no change is already baked in. pic.twitter.com/reZIsXRuLY

— K A L E O (@CryptoKaleo) July 29, 2025

Traders are also awaiting a White House report on crypto policy and a potential bitcoin strategic reserve. The report should reveal the exact number of Bitcoin currently held by the US government. Market participants hope this could provide clarity on the administration’s stance toward establishing an official strategic Bitcoin reserve.

Federal Reserve Chair Jerome Powell is scheduled to speak following the interest rate decision. The Fed appears committed to maintaining its current course despite pressure to cut rates immediately.

Technical indicators show Bitcoin’s intraday volatility has decreased by nearly 45% over the past three weeks. The daily high-to-low range has narrowed to $2,300 from $4,200 on July 14. This price compression typically precedes strong directional moves in either direction.

Technical Analysis Points to Brewing Volatility

The Bollinger Bands have compressed significantly, reinforcing the current price consolidation and suggesting an upcoming range expansion. While some analysts expect Bitcoin to retest support levels between $114,000 and $110,000, the technical setup could support movement in either direction.

Bitcoin’s 7-day Aggregated Open Interest Delta has moved into negative territory, though the decline lacks the velocity typically seen in major market exits. The mild decrease suggests partial position unwinding rather than aggressive selling.

The Relative Strength Index sits at 59, cooling from overbought levels without indicating immediate weakness. The On-Balance Volume has flattened around 1.76 million, showing stalled buying pressure but no aggressive selling patterns.

Price action remains stable despite the consolidation, with no sharp sell-off candles appearing on recent charts. Bulls appear to be defending current levels while waiting for a catalyst to drive the next major move.

Wednesday’s Federal Reserve meeting and the anticipated White House crypto policy report could provide the market direction that traders are seeking as Bitcoin holds near its recent highs.