UnitedHealth Group ($UNH) Feels the Squeeze: Soaring Costs Crush Profits—2026 Bounceback in Sight?

UnitedHealth's balance sheet bleeds as medical costs outpace premiums. Wall Street shrugs—because what's another two years of pain in the grand scheme of healthcare oligopoly profits?

The squeeze is real—and it's ugly

Q2 earnings exposed the brutal math: UNH's golden goose is laying smaller eggs. No fancy accounting can disguise the margin compression when every IV bag and hip replacement costs 20% more than pre-pandemic levels.

2026: The magic recovery year?

Management's crystal ball sees profitability returning to glory... in eighteen months. Because obviously, America's healthcare cost crisis will politely resolve itself by then. Meanwhile, the stock buyback program works overtime to distract from the fundamentals.

Analysts whisper about 'temporary headwinds' while quietly downgrading price targets. The street still bets on UNH's pricing power—after all, where else are employers gonna go? The beauty of operating in an industry where 'competition' means choosing which corporate giant overcharges you slightly less.

TLDR

- UnitedHealth Q2 revenue rose to $111.6B but EPS missed at $4.08 vs. $4.59 expected

- Net income fell to $3.4B due to elevated healthcare costs

- Updated 2025 guidance includes EPS of at least $16 and revenue up to $448B

- Medicare Advantage and Medicaid costs pressured profit margins

- Management expects earnings growth to resume in 2026

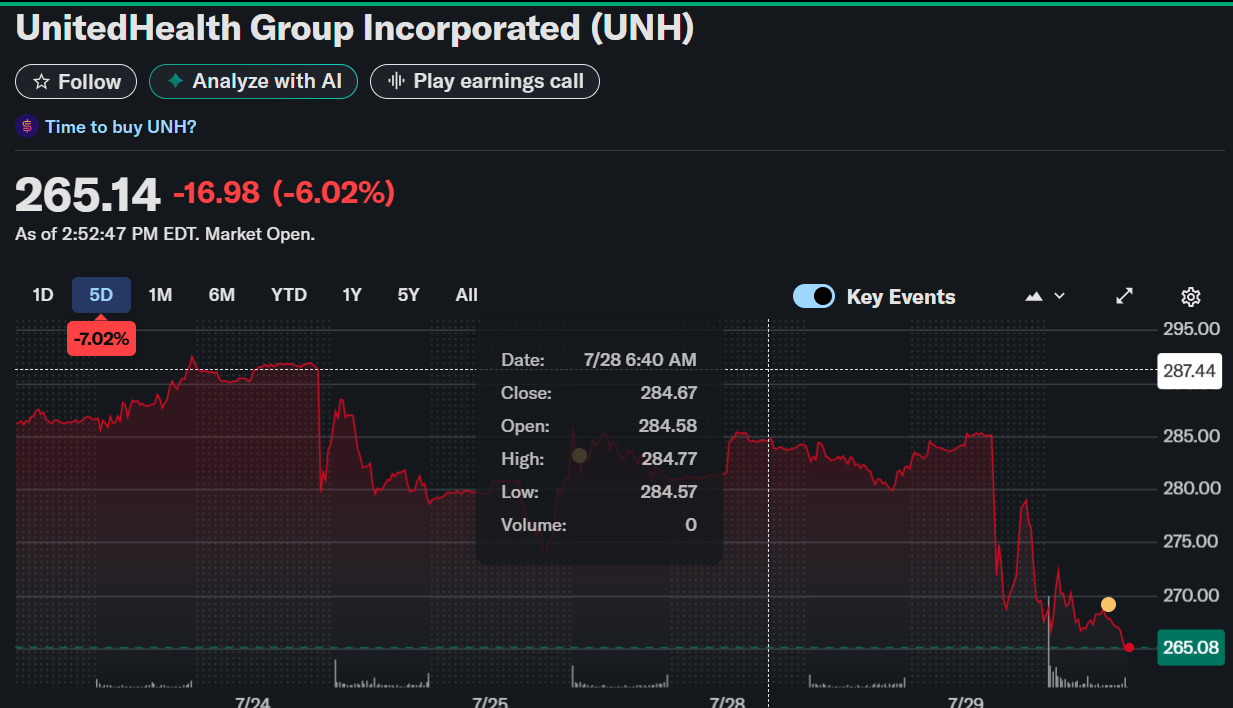

UnitedHealth Group (NYSE: UNH) reported second-quarter 2025 earnings on Tuesday, with its stock trading at $267.11, down 5.32% in intraday trading.

UnitedHealth Group Incorporated (UNH)

While the company beat top-line expectations with revenue of $111.6 billion, adjusted earnings per share came in at $4.08, missing Wall Street’s $4.59 estimate. Compared to Q2 2024, revenues grew by nearly $13 billion, yet profit margins shrank from 4.3% to 3.1%.

UnitedHealth $UNH Reported Earnings:

Revenue: $111.61B v $111.59B ✅

(Up 13% Y-Y)

EPS: $4.08 v $4.45 ❌

(Down 40% Y-Y)

Shares are down 5% in pre market! pic.twitter.com/prEFSn45f3

— Dividend Talks on YouTube (@DividendTalks) July 29, 2025

Cost Pressures From Government Plans

The company’s bottom line was weighed down by rising healthcare costs, particularly within its Medicare Advantage, Medicaid, and Affordable Care Act (ACA) offerings. Executives across the industry have cited a surge in demand for postponed care from the pandemic era. UnitedHealthcare’s medical care ratio climbed to 89.4%, up 430 basis points from last year, driven by higher unit costs and service intensity. This ratio reflects the percentage of premiums spent on medical care and is now significantly above the preferred mid-80s range.

Outlook for 2025 and 2026

UnitedHealth has reinstated its full-year 2025 guidance after suspending it in Q2. It now projects revenues between $445.5 billion and $448 billion, and adjusted EPS of at least $16. Net income is expected to reach at least $14.65 per share. CEO Stephen Hemsley emphasized the company’s renewed focus on operational discipline and predicted a return to earnings growth in 2026.

Leadership Changes and Industry Challenges

In response to ongoing struggles, UnitedHealth replaced former CEO Andrew Witty with Stephen Hemsley. Tim Noel, CEO of UnitedHealthcare, expressed confidence in overcoming current headwinds while continuing to offer quality care. The company faces cost-related challenges across all three government-backed insurance segments.

Other major players like Centene, Elevance Health, Molina Healthcare, and CVS Health have also revised or lowered their 2025 guidance due to similar financial strain from government-subsidized plans. CVS even announced it will exit the ACA individual market in 2026.

Optum Health Disappoints

Optum Health, UnitedHealth’s care delivery arm, underperformed as well. Full-year 2025 revenue is expected to be between $101.1 billion and $101.6 billion, representing a 4% decline from 2024. CEO Dr. Patrick Conway noted the business had fallen short of expectations and outlined renewed efforts for improvement.

UnitedHealth’s short-term margin challenges are steep, but the company’s strategic leadership changes and long-term earnings forecast suggest a possible rebound by 2026.