Cardano (ADA) Eyes $1 Surge as Golden Cross Breakout Ignites Bullish Momentum

Cardano's ADA isn’t just flirting with a breakout—it’s screaming bullish signals after smashing through a golden cross. Traders are now laser-focused on that psychological $1 target, a level that could trigger a fresh wave of FOMO.

Golden Cross or Golden Trap?

The 50-day MA just sliced through the 200-day like a hot knife through butter—a classic bullish indicator. But let’s not pop champagne yet. Remember when the ‘death cross’ became the ‘just kidding cross’ last quarter? Crypto moves fast, and today’s golden cross could be tomorrow’s faded memory.

Why $1 Matters More Than Your Average Resistance Level

Breaking $1 isn’t just technical—it’s psychological. Retail investors treat round numbers like holy grails (while hedge funds quietly accumulate at $0.97). A clean breakout here could see ADA ride the momentum wave straight into the mid-$1s.

The Cynic’s Corner

Meanwhile, traditional finance analysts are still trying to explain how a ‘golden cross’ works while their bond portfolios yield less than a Celsius savings account. ADA’s move comes as Wall Street finally admits crypto isn’t just ‘magic internet money’—it’s magic internet money that outperforms their precious S&P 500.

TLDR

-

Cardano price is holding above $0.83 with a confirmed golden cross on daily charts.

-

ADA gained over 50% in July, breaking out of a two-month downtrend.

-

Support lies at $0.75–$0.80, with major resistance around $0.90–$1.10.

-

Open interest is rising while top traders favor long positions.

-

ADA is forming a symmetrical triangle, with breakout potential into $1.00–$1.10.

Cardano (ADA) has surged more than 50% in July, recovering from the $0.53 level and climbing above key resistance points. The MOVE helped confirm a golden cross pattern on the daily chart—a bullish signal where short-term moving averages cross above the long-term 200-day EMA.

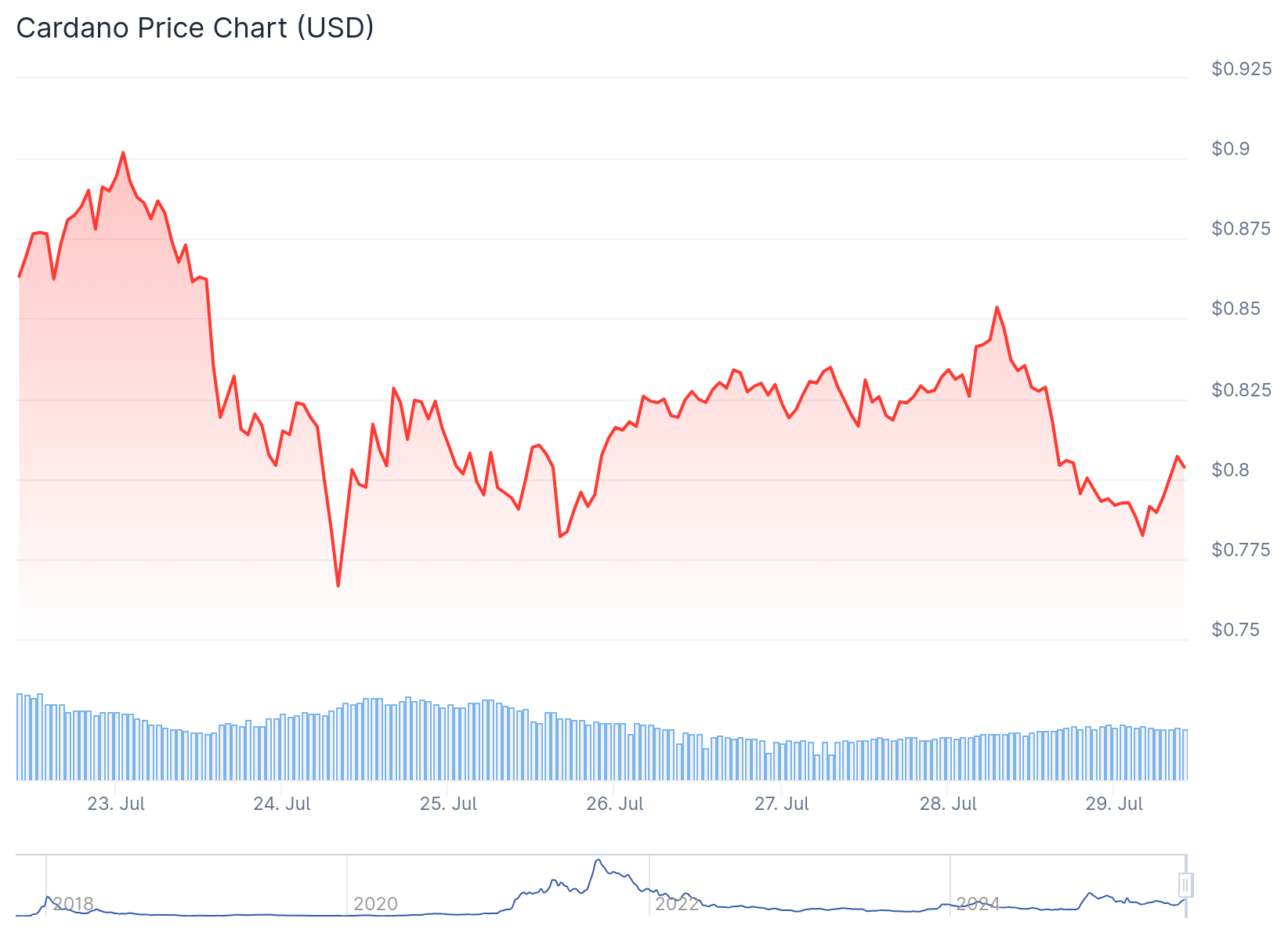

ADA’s price reached as high as $0.94 on July 21 before cooling off. It now trades around $0.83, consolidating just below the $0.90 resistance level.

The golden cross comes after ADA broke out of a descending channel. This ended a two-month downtrend and created a clear higher low structure.

Support and Resistance Levels Define the Next Move

Cardano price is now holding support above $0.78, which previously acted as resistance. This level aligns with a broader mid-range between $0.64 and $0.90.

The next upside target sits between $1.00 and $1.10. That area corresponds to a key supply zone from past cycles.

If the $0.75–$0.80 region holds, analysts expect bulls to make another push toward $1. A move below $0.77 could invalidate the trend and open room for a drop toward $0.70.

On the 4-hour chart, ADA is respecting an ascending trendline from July 24. Price is coiling within a symmetrical triangle, with a breakout apex expected by the end of the month.

Volume has declined slightly during consolidation. However, that’s typical before major breakout attempts.

Traders Favor Longs as Indicators Reset

The 14-day RSI has dropped from overbought levels above 80 to 63. This reset allows room for another leg higher without overextending momentum.

MACD remains in positive territory, though histogram bars are narrowing. A bearish cross between MACD and the signal line could indicate a short-term slowdown rather than a trend reversal.

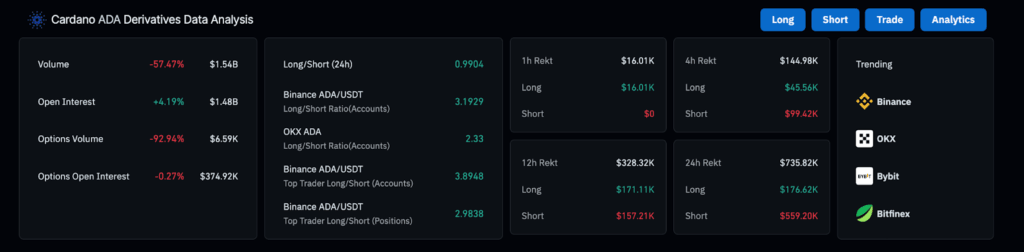

Futures data from Coinglass shows volume has decreased by 57% in the past 24 hours to $1.54 billion. However, open interest has risen by 4.2% to $1.48 billion—suggesting traders are holding positions.

Long/short ratios show that Binance and OKX users are leaning heavily long. On Binance, top traders are 3.8x more long than short.

This positioning suggests that smart money sees current price action as consolidation before a continuation move.

Cardano’s ecosystem also continues to grow, now supporting over 2,000 projects. Upcoming upgrades like Hydra are building confidence in long-term network scalability.

Final Thoughts

Cardano price is consolidating above key support after forming a golden cross and climbing 50% in July. With long positioning rising and bullish chart patterns intact, ADA may soon retest the $1 mark if buyers push through $0.90 resistance.