Mill City Ventures Goes All-In on Sui: $441M Crypto Treasury Gamble Signals Bullish Bet

Wall Street meets Web3 as Mill City Ventures pivots hard into crypto—throwing $441 million at Sui’s blockchain. Because nothing says 'conviction' like a nine-figure dice roll.

The Move That Raised Eyebrows

Forget dipping toes—Mill City’s diving headfirst into Sui’s ecosystem. The investment vehicle, traditionally more cautious than a crypto trader during a bear market, just reallocated its entire treasury into the Layer 1 upstart.

Why Sui?

Rumors swirl about behind-closed-doors tech demos and whispered scalability promises. Meanwhile, skeptics note the timing—right as Sui’s token tests resistance levels. Coincidence? Probably not.

The Fine Print

No hedges. No staggered entry. Just one audacious lump-sum transfer that’ll either mint a case study or become a cautionary tweetstorm. Either way, it’s a masterclass in narrative-building—because in crypto, conviction outperforms fundamentals 60% of the time (disclaimer: fake stat).

One thing’s certain: when traditional finance finally 'gets' crypto, they don’t half-ass it—they overlever into the hype.

TLDR

-

Mill City Ventures raised $450M and will allocate 98% to buying SUI tokens.

-

The firm is transitioning its treasury strategy to focus entirely on the Sui blockchain.

-

Galaxy Asset Management will oversee the treasury; Karatage leads the funding.

-

SUI fell 11% despite the news, tracking broader altcoin weakness.

-

Analysts raise questions about whether crypto treasuries truly purchase assets from the market.

Mill City Ventures III, a Nasdaq-listed specialty finance firm, has raised $450 million in a private placement to pivot its treasury toward cryptocurrency. Nearly all of the funds—98%—will be used to purchase SUI, the native token of the sui blockchain.

$SUI just flipped the script.

$441M in from Mill City Ventures.

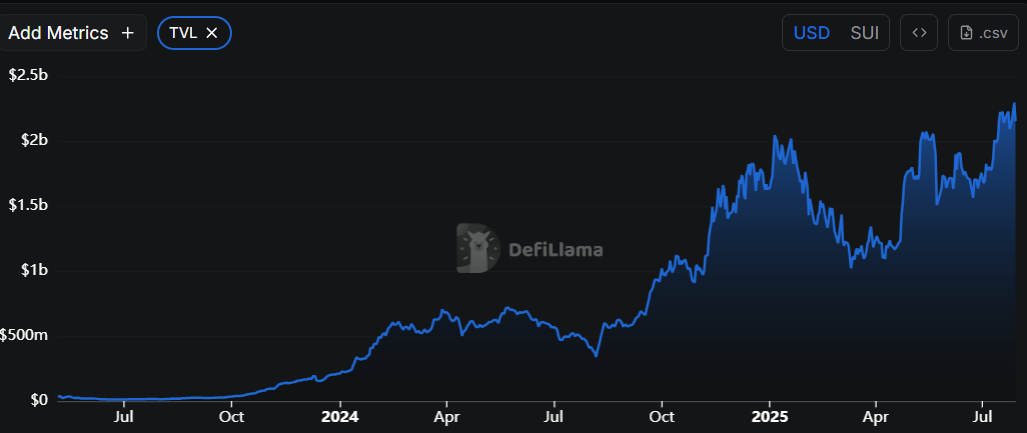

TVL over $2.2B. Open interest $2.6B.

Now trading at $3.97.

Institutional bets are in.

Retail still sleeping. pic.twitter.com/aBOWMv0P7y

— Kyle Chassé / DD🐸 (@kyle_chasse) July 29, 2025

This marks one of the largest public investments in a single blockchain asset by a U.S.-listed company. The MOVE is part of a broader transition away from traditional finance and into digital asset management.

According to the firm, SUI will now serve as Mill City’s primary treasury asset. The remaining 2% of the funds will continue to support its legacy short-term lending operations.

The announcement was made in a press release on Monday. The funding round was led by Karatage Opportunities, a hedge fund specializing in digital assets.

New Leadership and Treasury Oversight

As part of the deal, Karatage founders Marius Barnett and Stephen Mackintosh will join Mill City’s leadership. Barnett becomes board chairman, while Mackintosh takes on the role of chief investment officer.

Galaxy Asset Management has been selected to manage the new SUI-based treasury. The firm will oversee asset purchases on the open market and through direct agreements with the Sui Foundation.

Mill City said the strategy includes long-term insight into the Sui ecosystem. The approach is designed to align the company with blockchain infrastructure and the growing demand for digital assets.

Sui Blockchain Sees Rapid Ecosystem Growth

The Sui blockchain has gained attention for its ability to support high-throughput applications, including payments, gaming, and AI.

According to DefiLlama, total value locked (TVL) on the Sui network reached an all-time high of $2.22 billion over the weekend. That figure has grown nearly 400% since July 2024.

Leading Sui protocols such as Suilend, NAVI, and Haedal account for over $1.7 billion of that TVL.

Incoming CIO Stephen Mackintosh said the firm believes Sui’s architecture is well-suited for both crypto and AI workloads at scale.

Despite this, the price of SUI dropped 11% over the past 24 hours, following a broader decline in altcoins. The token is currently down 27% from its January high of $5.35.

Analyst Skepticism Grows Over Treasury Strategies

Some analysts are questioning whether crypto treasury firms are truly buying assets directly.

Critics argue that these firms often receive crypto contributions from early holders, rather than acquiring tokens on open exchanges. This allows insiders to offload assets in exchange for shares that later trade at public market premiums.

Glassnode analyst James Check and VanEck’s Matthew Sigel have both raised doubts about the sustainability of crypto-focused corporate treasuries.

The deal positions Mill City as the first U.S.-listed company to center its treasury on the Sui blockchain. The transaction is expected to close by the end of July.