Ethereum (ETH) Surges Toward $4K: ETF Demand Soars as Supply Crunch Looms

Ethereum bulls charge as institutional money floods in—just as the network tightens its supply screws. Could this be the perfect storm for a $4K breakout?

The ETF Effect: Wall Street's New Crypto Toy

Spot ETH ETF inflows hit record highs this week, with BlackRock and Fidelity gobbling up tokens faster than a VC at a free sushi bar. Meanwhile, the SEC quietly weeps into its 20-year-old copy of Howey.

Deflationary Pressure Cooker

Active addresses spike while ETH burns—the network's EIP-1559 mechanism now torches $12M daily. Circulating supply drops for the 18th straight month, turning ETH into digital uranium (but with better PR).

The $4K Psychological Battlefield

Technical charts show ETH cleared its 2024 resistance like a bull in a China shop. Traders now eye the $4K level—where crypto Twitter hype meets institutional profit-taking.

*Funny how 'decentralized' money moves when pension funds start buying...*

TLDR

-

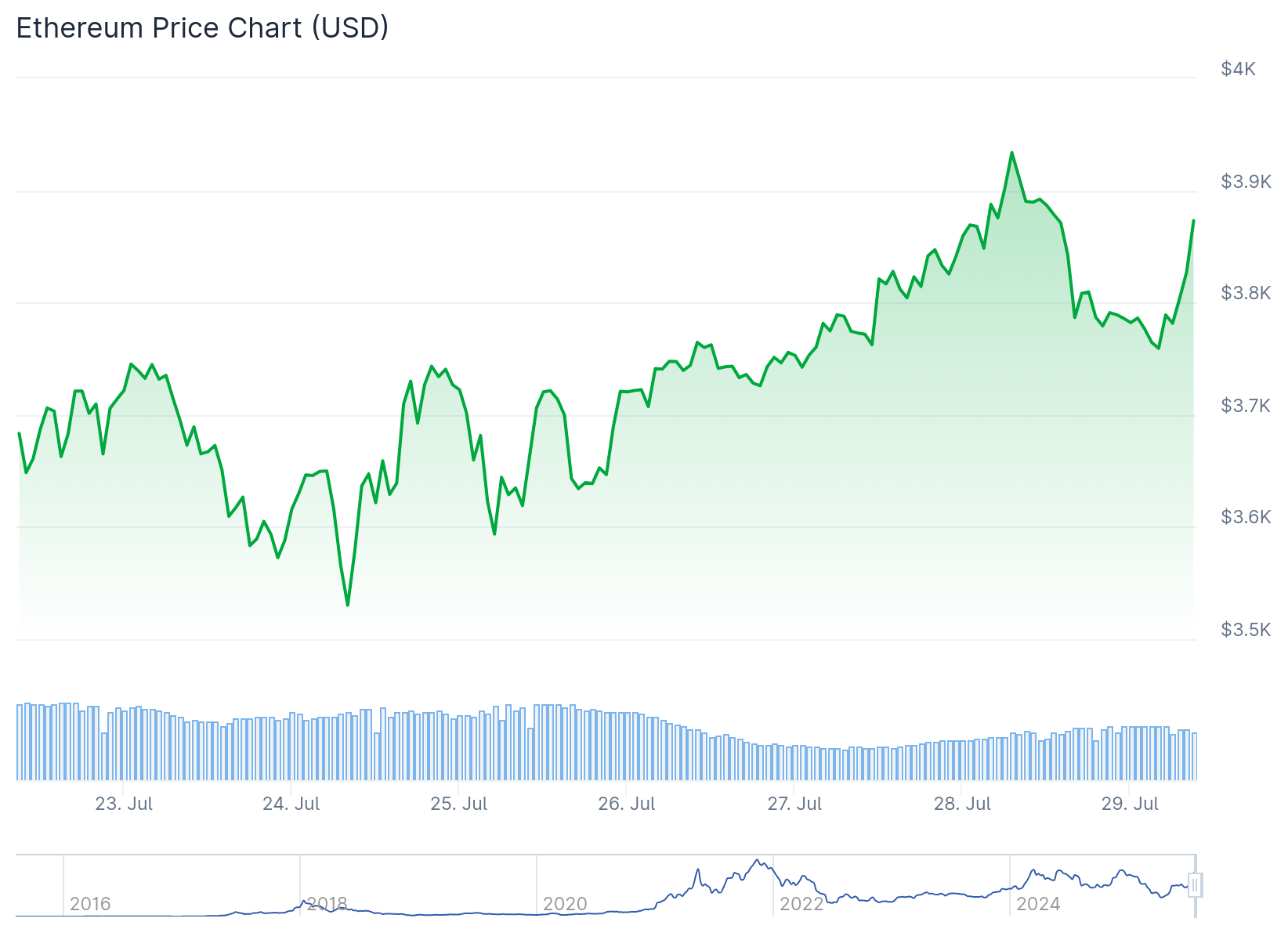

Ethereum is trading around $3,792, down 2.42% in 24 hours, but weekly gains show +1.78% resilience.

-

Trading volume is up 16.04%, signaling strong market participation despite the pullback.

-

$4,000 remains a key resistance, while support lies near $3,510–$3,000.

-

ETF inflows hit $5.12 billion in July, showing strong institutional conviction.

-

A break above $3,919 could trigger a push toward $4,173–$4,874, or risk correction if rejected.

Ethereum (ETH) is trading at $3,792 after a 2.42% daily decline. Weekly performance shows a gain of 1.78%, keeping the uptrend intact.

Trading volume ROSE 16.04% to $36.84 billion. This signals active investor interest despite the recent dip.

Key support sits at $3,510, with deeper support at $3,000 and $2,760. Resistance remains at $4,000 and the crucial Fib level at $3,919.

If ETH breaks $3,919, it could open the path toward $4,173 and higher Fibonacci levels. These include $4,378, $4,583, and $4,874 as potential upside targets.

ETF Inflows and Exchange Supply

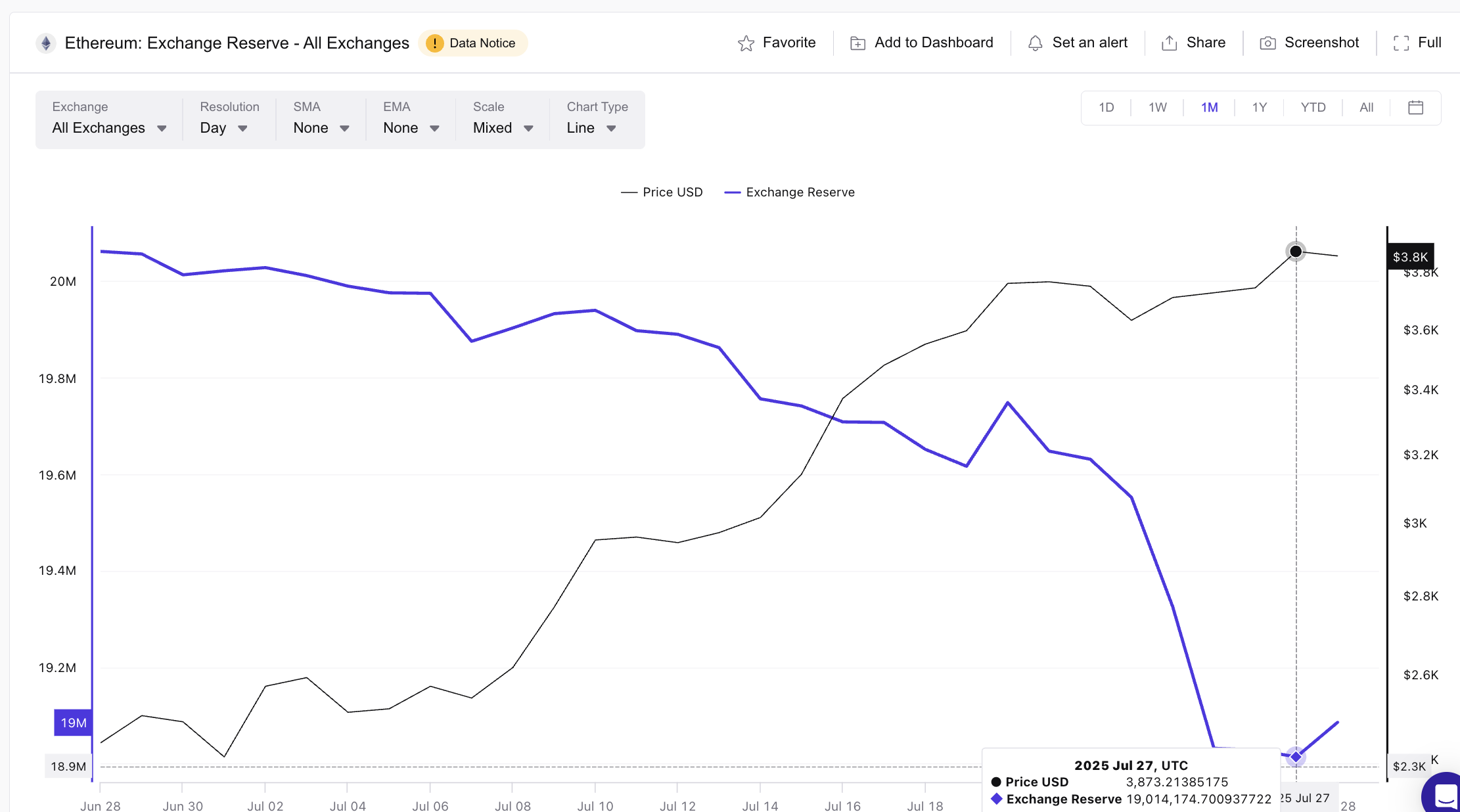

Institutional interest is rising sharply. ETH Spot ETFs brought in $5.12 billion in July—the strongest inflows in a year.

At the same time, exchange reserves are at their second-lowest point in over 12 months. This drop suggests lower sell pressure and steady demand from both retail and institutional buyers.

Even with wallet selling, exchange supply hasn’t risen. This implies absorption, where buyers are soaking up sales quickly.

Such conditions often support bullish price action. Combined with ETF demand, this could help ETH push through resistance.

Leverage Pressure and RSI Readings

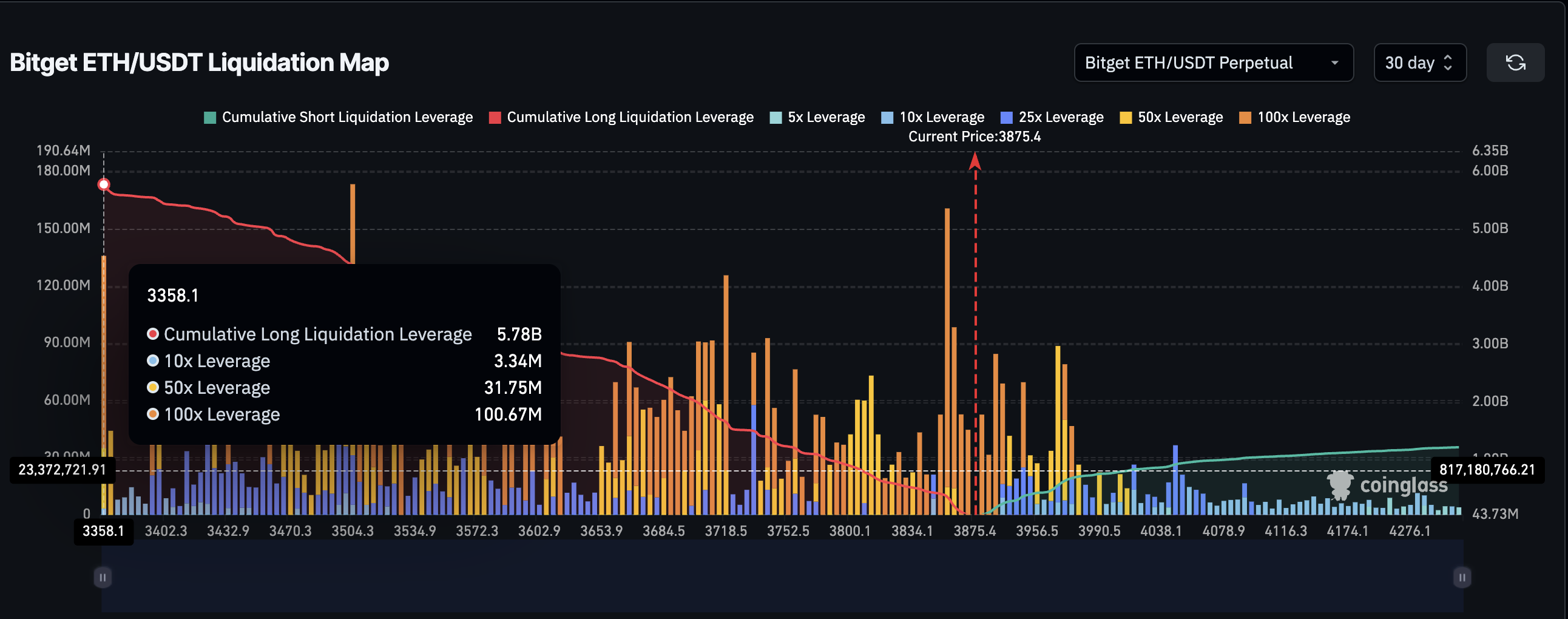

Ethereum is trading NEAR a heavy leverage cluster between $3,358 and $3,875. This range holds over $5.78 billion in long positions, which increases risk if ETH loses momentum.

The Relative Strength Index (RSI) sits at 80, approaching overbought territory. This suggests ETH may need a brief cooldown before any next move.

Ethereum price has already climbed above its 200-day Simple Moving Average (SMA). Analysts suggest that a retracement to around $3,500 could offer a fresh entry for another push.

$ETH

Overbought at Resistance — $4K in Sight, But Momentum Slowing

▪️ Broke above 200 SMA, $3,000 & $3,450 ➜ Targeting $4,000

▪️ Pattern: Overbought at Resistance

▪️ RSI > 80 ➜ Very Overbought ⚠️

▪️ MACD Histogram declining ➜ Momentum fading

▪️ Resistance: $4,000

▪️ Support:… pic.twitter.com/CjJNxVGDbX

— CoinCodeCap Trading (@c3_trading) July 28, 2025

Funding rates remain modest at 0.0081%, showing traders are cautious. Open interest has dipped slightly by 1.43% to $57.65 billion.

The ETH/BTC ratio has surged to 0.032. A golden crossover between moving averages is nearly complete, which could confirm a bullish structure for altcoins.

If that final crossover hits, it may reinforce Ethereum’s momentum. ETH/USD has historically followed ETH/BTC gains.

As of now, ethereum price is challenging the 0.236 Fibonacci level at $3,919. A breakout here could trigger short liquidations and rapid upside movement.

If the price fails to hold above this mark, a pullback to $3,510 may follow. This level becomes key for bulls to defend the current structure.

Final Thoughts

Ethereum price is at a key point near $3,800. Strong ETF inflows, falling exchange reserves, and technical setups suggest bullish potential, but $3,919 must break for further gains.