VCs Dump $1B Into Crypto Infrastructure—Here’s Your Best Bet for 2025

Money talks—and right now, venture capitalists are screaming into the crypto void with billion-dollar checks. Infrastructure plays are back in vogue, but which tokens actually stand to win?

Layer-1s eating the world

While Wall Street hedgies chase the next meme coin, smart money’s building the plumbing. Scalability solutions, interoperability protocols, and decentralized storage networks just bagged the sector’s biggest checks since the last bull run.

The contrarian play

Forget chasing narratives. The real alpha? Tokens tied to projects that survived the bear market’s Darwinian purge—teams shipping code while everyone else was posting ‘WAGMI’ memes.

Closing thought: Nothing brings out ‘strategic investors’ like a rising bitcoin price. Funny how that works.

VC Funding Just Hit the $1 Billion Mark – Here’s What That Means

Last week’s 17-deal, $1 billion buying spree marked one of the biggest funding bursts of the year – easily cracking the top three for 2025 so far. One of the standouts was Satsuma, which raised $135 million to scale its indexing and data infrastructure.

QCEX was acquired in a $112 million buy-out, giving Polymarket a licensed derivatives exchange. And xTAO, a project that combines AI with DePIN architecture, raised nearly $23 million.

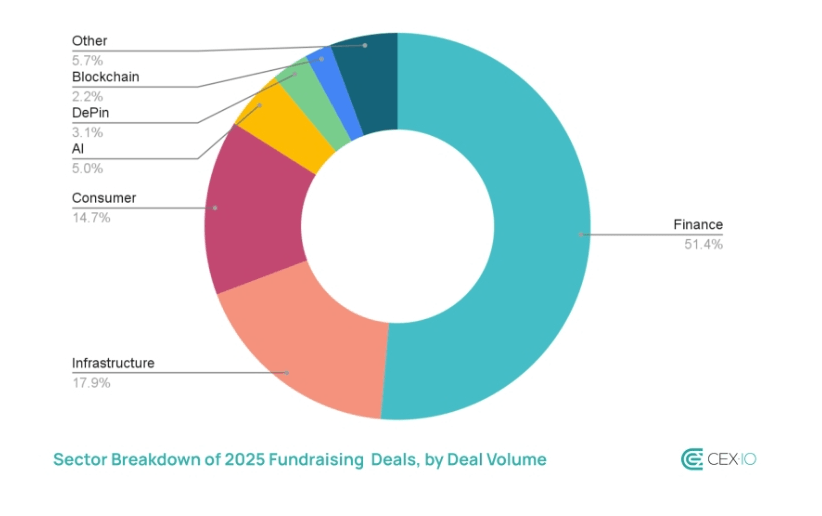

The common thread is that these aren’t HYPE tokens – they’re foundational tools powering what comes next. More than half of the funding was allocated to infrastructure and AI. This includes indexing layers, on-chain compute, and regulated infrastructure.

Zoom out, and this trend becomes even clearer. H1 2025 crypto funding has already crossed $16.5 billion, topping the entire annual total for both 2024 and 2023. Strategic acquisitions are on the rise, and if your pitch deck mentions AI or crypto infrastructure, the odds are that VCs will want to get involved.

For traders and investors, it’s a clear signal. Capital is moving toward projects with real-world use cases and sticky network effects, meaning if you’re looking for opportunity, it’s probably better to consider the Core tech than the memes.

Best Cryptos to Buy as VC Funding Ramps Up

But which coins and tokens could capitalize on this trend? Below are four of the best cryptos to buy as venture capital shifts its focus toward real utility:

1. Bitcoin Hyper (HYPER)

Bitcoin Hyper (HYPER) is aiming to be the “bridge” between Bitcoin’s blockchain and the speed of Solana. It’s a new Layer-2 scaling solution that uses the Solana VIRTUAL Machine (SVM) to port BTC into a high-throughput, low-fee environment. That means DeFi protocols, payments, and NFTs can run natively on Bitcoin.

But the project has drawn attention for more than just its tech. JRCRYPTEX and other top YouTubers have thrown their weight behind it, and the staking rewards (estimated at 189% APY) have helped fuel a presale that’s already crossed the $5.4 million mark.

This early presale success has landed HYPER a spot on CoinSniper’s list of the top upcoming crypto launches. And given that HYPER tokens are still priced at just $0.012425, investors are rushing to secure exposure while they can.

Ultimately, Bitcoin Hyper is built around a bold idea – BTC meets speed. So if you’re looking for the best crypto to buy with big upside potential, this one’s worth watching closely. Visit Bitcoin Hyper Presale.

2. Altlayer (ALT)

Altlayer (ALT) is becoming a key player in the rollup infrastructure race. Its platform lets developers create custom, app-specific rollups in minutes and “restack” them back to ethereum when demand dips – no in-house protocol team needed.

Also, with native support across Arbitrum, Base, Optimism, and even Solana, it has reach that most infrastructure tokens lack. Everything is powered by the native ALT token, which has rallied 12% in the past day to reach $0.039.

Spot trading volumes for ALT have increased by 840% – suggesting that traders see real potential here. As VC dollars FLOW back into core tech, Altlayer could be in a great spot to benefit.

3. Optimism (OP)

Optimism (OP) isn’t the fanciest project out there, but it’s got the fundamentals nailed down. Its “Superchain” vision is now live and growing, with Coinbase’s Base and Worldcoin’s World Chain both running the OP Stack.

Fault proofs were launched earlier this year, and Bedrock 2.0 – which is coming soon – aims to slash gas fees by another 30%. Plus, airdrop programs keep participation in the Optimism ecosystem high.

The OP token is priced at $0.81 with a market cap of $1.4 billion, meaning it’s more established than most other scaling plays. If you want the best crypto to buy for reliable infrastructure exposure, this one should be on your watchlist.

4. SUBBD (SUBBD)

SUBBD (SUBBD) is attempting to overhaul how creators generate income online using Web3, AI, and token incentives. Think subscriptions, tips, and merch – all settled on-chain using crypto payments.

On the SUBBD platform, AI handles the backend tasks: clipping videos, moderating chat, and even allowing fans to generate remix content that earns shared revenue with the original creator. That’s led to over 2,000 creators with a combined 250 million followers trialing the SUBBD beta.

A Coinsult audit came back clean, SUBBD token staking offers 20% APY until TGE, and the token’s fully diluted value is just $56 million. That’s tiny next to Web2 platforms like Patreon, meaning there’s enormous room for growth here.

If SUBBD can deliver, it taps into two of the biggest narratives that VCs are currently investing in: creator monetization and AI. For anyone interested in projects with a unique use case and low-cap upside, it’s a clever bet. Visit SUBBD Presale.