Cardano (ADA) Smashes Records: $1.7B Open Interest Fuels Bull Run Toward $1

Cardano's ADA isn't just knocking on the door—it's kicking it down. With open interest hitting a staggering $1.7 billion, traders are piling in like it's a Black Friday sale on blockchain assets.

The $1 target? Closer than Wall Street's next flip-flop on crypto regulation.

Why the frenzy? Smart money's betting ADA's proof-of-stake efficiency and academic rigor finally pay off—or maybe everyone's just tired of Ethereum's gas fee roulette.

One thing's clear: When derivatives markets throw this much fuel on the fire, you'll smell the FOMO from here to Charles Hoskinson's next TED talk.

TLDR

- Cardano (ADA) has gained nearly 62% in 30 days, approaching the key $1 resistance level

- Open interest in ADA futures reached a record $1.7 billion, surpassing 2021 peaks by $200 million

- Technical indicators show bullish crossovers with 9-day and 21-day EMAs crossing above 200-day EMA

- Trading volume jumped 20% in 24 hours, now representing 8% of ADA’s total market cap

- Apple Pay integration rumors for Cardano dApps via CardanoKit have circulated but remain unconfirmed

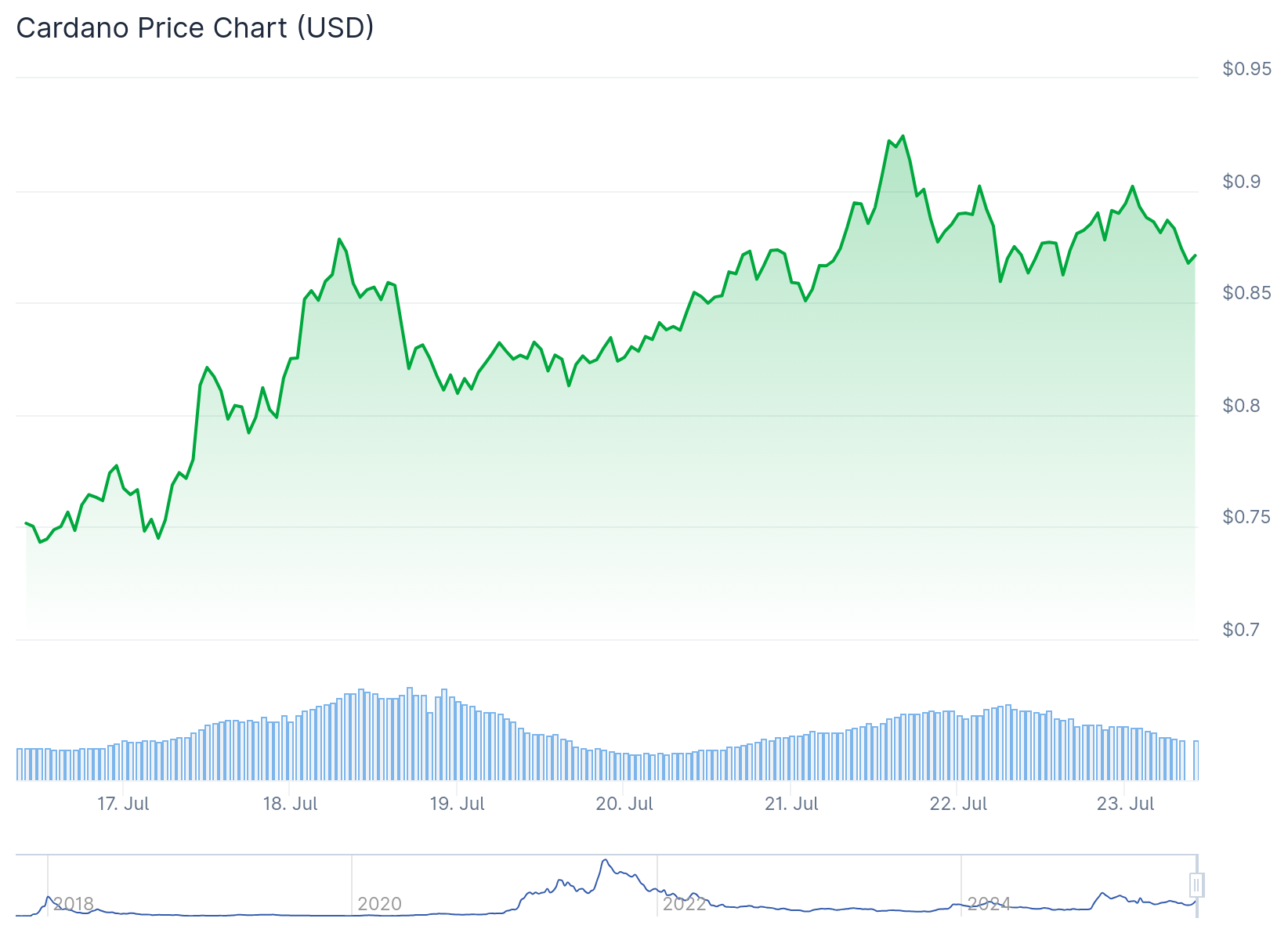

Cardano (ADA) has emerged as one of the top performers among major cryptocurrencies, posting impressive gains that have pushed the token close to the psychologically important $1 level. The price surge has been accompanied by increased trading activity and growing institutional interest.

Over the past 30 days, ADA has climbed nearly 62%, making it one of the strongest performers in the top 10 cryptocurrencies by market cap. This rally has brought the token within striking distance of $1, a level it has not crossed since February 2025.

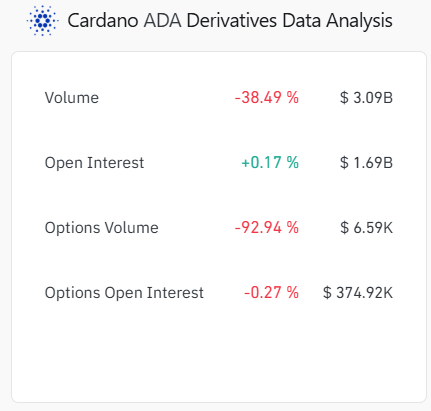

Trading volume for Cardano has increased by 20% in the past 24 hours. The current volume now accounts for 8% of ADA’s total market capitalization, indicating strong participation from both retail and institutional investors.

Market sentiment has shifted decisively bullish, with the Fear and Greed Index climbing to 67. This reading places the market firmly in “greed” territory, reflecting increased Optimism among traders and investors.

Record Open Interest Signals Growing Institutional Involvement

Open interest in ADA futures contracts has reached unprecedented levels, hitting $1.7 billion according to CoinGlass data. This figure surpasses the previous record set in September 2021 by nearly $200 million, suggesting renewed institutional interest in the cryptocurrency.

The surge in futures activity may be connected to recent regulatory developments in the United States. The passing of the Genius and Clarity Acts has improved the regulatory outlook for digital assets, potentially attracting more institutional capital to the space.

Unconfirmed reports have also circulated about cardano incorporating Apple Pay support for its decentralized applications through CardanoKit. While these claims have not been verified by official channels, they have generated discussion within the crypto community over the past few hours.

Technical Analysis Points to Continued Strength

From a technical perspective, ADA is displaying multiple bullish signals that align with broader market trends. The token has successfully broken above a key resistance level at $0.85, which had previously acted as a ceiling for price action.

The exponential moving averages are showing bullish alignment, with both the 9-day and 21-day EMAs crossing above the 200-day EMA. This configuration is considered a classic bullish crossover pattern and often precedes upward price movements.

This breakout followed a golden cross between the shorter-term 9-day and 21-day EMAs, marking a clear trend reversal from previous bearish conditions. The momentum indicators suggest the upward movement may continue in the NEAR term.

Analysts have identified the next key resistance level at $1.18, which represents potential upside of approximately 34% from current price levels. This target is based on liquidity zones and historical price action patterns.

The weekly chart analysis reveals that ADA has been trading within a descending parallel channel since November 2024 but appears ready to break out. The token has formed six consecutive bullish weekly candles, indicating sustained buying pressure.

A triple bottom pattern formed around the $0.60 support level earlier this year, providing a foundation for the current rally. Technical indicators including the Relative Strength Index and Moving Average Convergence Divergence have generated bullish signals similar to patterns that preceded previous major rallies.

Historical data shows that when these indicators align in similar fashion, ADA has experienced gains ranging from 176% to 316%. If these patterns repeat, price targets could extend to $2.60 or potentially higher levels.

Wave count analysis suggests Cardano may be in the early stages of a five-wave upward movement, with the current phase representing wave three. This type of pattern typically produces parabolic price increases as momentum builds.

The combination of technical breakouts, increased institutional interest, and improving regulatory clarity has created conditions that favor continued price appreciation for Cardano in the coming months.