Cardano (ADA) Soars 23% as Institutional Money Floods In—Is This the Start of a Mega Rally?

Wall Street's crypto FOMO just hit Cardano. Institutional investors are piling into ADA—fueling a blistering 23% price surge that's leaving retail traders scrambling.

The smart money's betting big

Hedge funds and crypto VCs aren't chasing memecoins this time. They're loading up on Cardano's proof-of-stake infrastructure as Ethereum competitors heat up. No 'wen lambo' tweets here—just nine-figure buy orders moving the needle.

Retail's playing catch-up... again

While pension funds quietly accumulate ADA at scale, your cousin's 'altcoin guru' Telegram group is still arguing about 2017-level technicals. The irony? This rally started precisely when SEC chair Gary Gensler took a vacation—coincidence or market manipulation? You decide.

Cardano's proving it's more than just an 'academic project'—it's becoming institutional-grade crypto real estate. Whether that's good for decentralization? Well... ask your friendly neighborhood BlackRock portfolio manager.

TLDR

- Cardano has gained 23.3% over the past week, making it the second-best performer in the top 10 cryptocurrencies

- ADA broke out of a long-standing downtrend channel with above-average trading volumes

- The token crossed above its 200-day exponential moving average and formed a golden cross pattern

- New partnerships include XRP ecosystem integration and institutional-grade upgrades from Apex Fusion

- Technical analysis suggests potential targets of $0.87 in the near term and $1.40 longer term

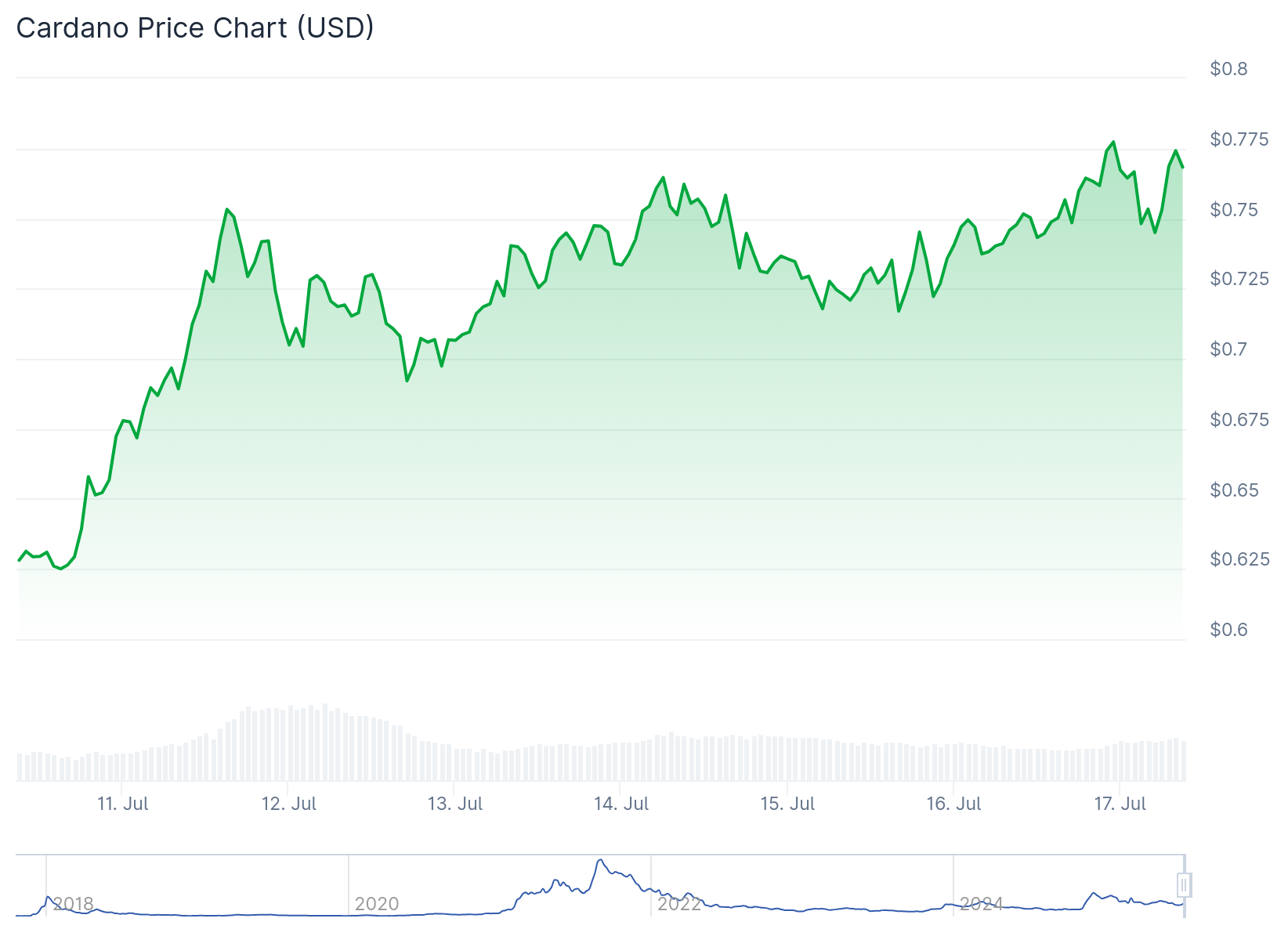

Cardano has emerged as one of the week’s top performers, surging 23.3% to become the second-best-performing cryptocurrency in the top 10. The rally has pushed ADA to $0.77, marking a strong recovery from April lows.

The price surge comes after ADA broke out of a multi-month falling channel pattern on the weekly chart. This breakout occurred with strong trading volumes, suggesting genuine buying interest rather than a temporary spike.

Weekly Cardano $ADA chart update 📊

Price action is starting to shift in a meaningful way.

We’re seeing early signs of a potential trend reversal. ADA has broken out of the descending channel it’s been stuck in for months, and short-term momentum is turning bullish.

The weekly… https://t.co/Ao0ltdvp3D pic.twitter.com/fVBawVhTRy

— The DApp ₳nalyst (@TheDAppAnalyst) July 14, 2025

Technical indicators are showing bullish momentum across multiple timeframes. The Stochastic RSI has exited oversold territory, which traders view as an early buy signal with potential for further upside.

On the daily chart, ADA has climbed above its 200-day exponential moving average, a key technical milestone that often precedes sustained rallies. The 9-day EMA recently crossed above the 200-day EMA, creating what traders call a “golden cross” formation.

This golden cross pattern is considered a powerful buy signal that typically precedes explosive price moves. The Relative Strength Index has entered overbought levels, indicating strong upward momentum.

Partnership Developments Drive Adoption

Recent partnership announcements have contributed to the bullish sentiment surrounding Cardano. The Tokeo Wallet plans to integrate with the XRP Ledger, enhancing cross-chain functionality between the two ecosystems.

🚨 A #Cardano – #XRP bridge is brewing! 🔗 Tokeo Wallet confirms plans to integrate with the XRP Ledger, hinting at cross-chain #DeFi and Midnight-based privacy features. “It’s definitely coming,” they say. 👀🔥

$XRP $ADA pic.twitter.com/KU2LCuxSep

— ChainAffairs ⚡ (@ChainAffairs) July 16, 2025

This integration could expand DeFi opportunities for both platforms, with Cardano’s Midnight sidechain expected to play a key role. The partnership represents a step toward greater interoperability in the blockchain space.

Apex Fusion and Well-Typed have also partnered with cardano to introduce formal verification expertise. This collaboration aims to improve scalability, throughput, and DeFi capabilities for institutional use cases.

Grayscale’s Smart Contract Fund currently holds 18.57% in ADA, reflecting institutional interest in the token. The Cardano Foundation maintains $660 million in assets, providing financial backing for continued development.

Scalability Solutions Show Progress

Cardano’s Hydra scalability solution has achieved throughput of over 100,000 transactions per second in testing. This represents a major milestone for the network’s ability to handle high transaction volumes.

The Cardinal smart contract bridge now enables Bitcoin asset transfers, expanding Cardano’s ecosystem beyond its native blockchain. This development opens new possibilities for cross-chain DeFi applications.

Partnerships with African governments and EU digital identity frameworks highlight Cardano’s growing utility in real-world applications. These partnerships demonstrate the platform’s potential beyond speculative trading.

Technical Analysis and Price Targets

The first technical target for ADA sits at $0.87, representing a 17% upside potential from current levels. This target is based on relevant liquidity zones identified through technical analysis.

If the current momentum continues, some analysts project a target of $1.40, which WOULD represent 87% upside potential from current prices. This target assumes the move aims toward the nearest area of external liquidity.

The $1 psychological level remains a key milestone for ADA. Breaking above this level would likely attract additional buying interest from both retail and institutional investors.

Current resistance stands at $0.78, while support has formed at $0.54. The RSI reading of 75.34 indicates overbought conditions, suggesting a potential pullback in the NEAR term.

In case of a pullback, the price could retreat to the 200-day EMA to gather liquidity before resuming its upward trajectory. The MACD indicator shows bullish divergence, supporting the continuation of the upward trend.

ADA is currently trading at $0.77, representing a 4.22% gain in the past 24 hours and maintaining its position as one of the week’s top performers in the cryptocurrency market.