Why Is Crypto Crashing Today? July 2025’s Market Bloodbath Explained

Crypto markets are bleeding—again. Here's what's hammering digital assets this week.

Macro Mayhem: Fed rate fears and a stronger dollar are choking risk appetite. Traders are fleeing to 'safe' assets like gold (how quaint).

Whale Dumps: On-chain data shows three massive BTC wallets moved 12,000 coins to exchanges overnight. Nothing says 'confidence' like billionaires bailing.

Regulatory Roulette: The SEC's latest enforcement action against a DeFi protocol sparked panic selling. Because nothing boosts innovation like lawsuits.

Technical Breakdown: Bitcoin sliced through its 200-day MA like a hot knife through butter. Next support level? Probably somewhere near 'ouch.'

Remember: This is crypto. By the time you read this, the market might've already pumped 20%. Or crashed another 30%. Such is life in the casino.

TLDR

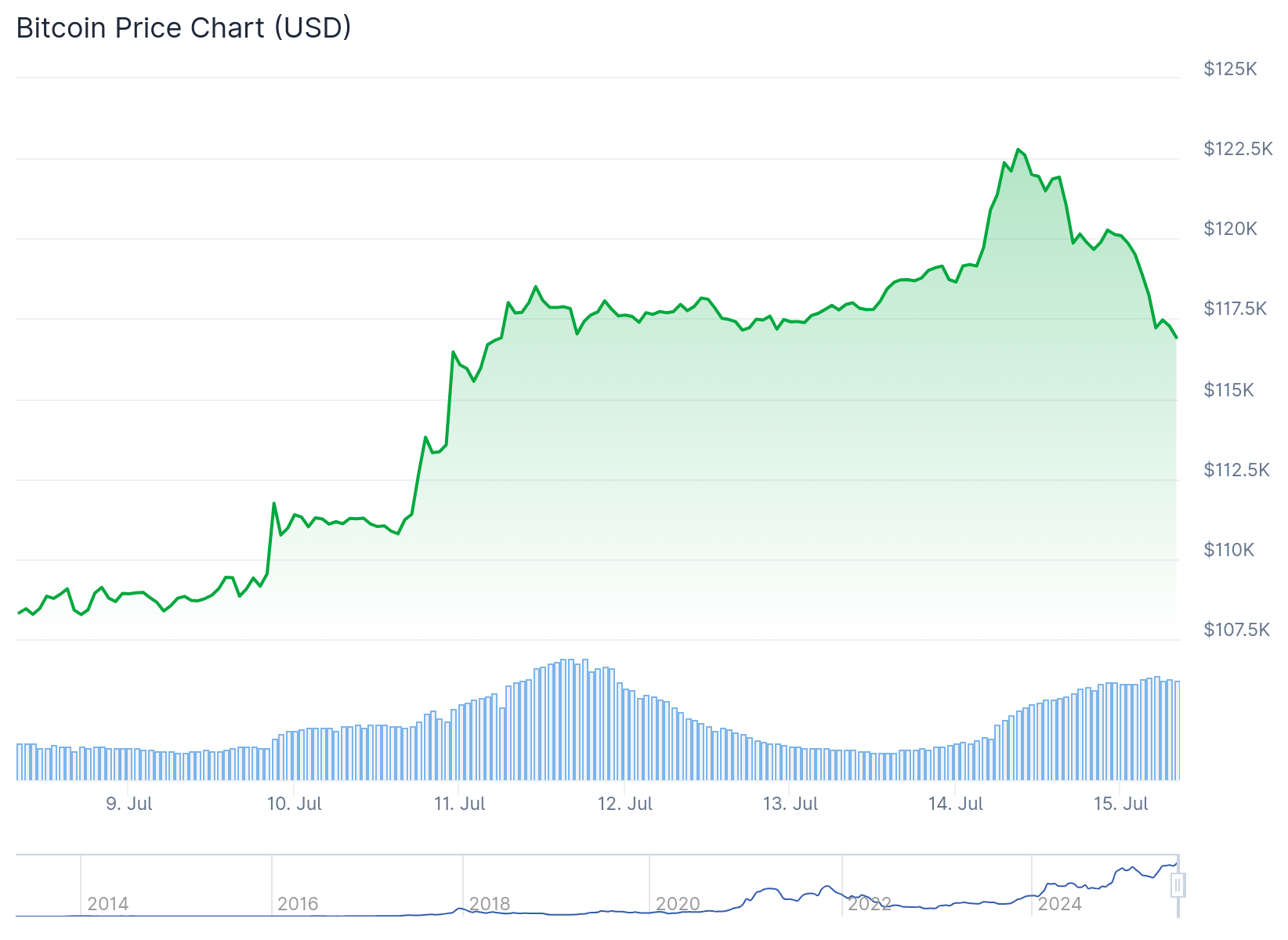

- Bitcoin fell below $117,000 today, down nearly 2% after hitting record high of $123,100 yesterday

- Massive transfers of 9,000 BTC ($1.06 billion) to Galaxy Digital and 7,843 BTC ($923 million) to major exchanges triggered sell pressure

- $406 million in long positions were liquidated in four hours after key support levels broke

- MemeCore and other meme coins dropped sharply as traders rotated to larger cryptocurrencies

- Total crypto market cap fell 3.5% to $3.68 trillion with analysts viewing this as healthy correction in ongoing bull trend

Bitcoin dropped below $117,000 today after reaching an all-time high of $123,100 yesterday. The leading cryptocurrency fell nearly 2% in the past 24 hours as traders began taking profits from recent gains.

The selloff intensified after large transfers from dormant wallets hit the market. On July 14, approximately 9,000 BTC worth about $1.06 billion was sent to Galaxy Digital.

Another 7,843 BTC valued at $923 million was moved to major exchanges including Binance and Bybit. These movements from older Satoshi-era wallets increased the available supply for sale.

Liquidations Drive Market Lower

The selling pressure broke important support levels around $118,000 for Bitcoin. This breach triggered a wave of forced liquidations across the market.

Around $406 million in long positions were liquidated within four hours. The forced selling from these liquidations pushed prices further down as traders were forced to exit positions.

High leverage positions amplified the downward move. Even small price drops forced many traders to close their positions, creating additional sell pressure.

Meme Coin Rotation Continues

MemeCore and other meme coins saw sharp corrections during today’s selloff. MemeCore plunged 35% as traders moved capital away from riskier assets.

The rotation favored more established cryptocurrencies like Bitcoin and Ethereum. This shift often signals changing sentiment toward safer holdings during volatile periods.

Trading volumes remained high despite the correction. Market participants stayed engaged, suggesting continued interest in the crypto market.

The total cryptocurrency market cap fell about 3.5% to $3.68 trillion. This represents the impact of widespread selling across the sector.

Technical Analysis Points to Correction

Technical analysts view today’s drop as a natural correction after Bitcoin’s recent rally. The broader trend for Bitcoin and the overall crypto market remains bullish according to market watchers.

The pullback could provide an entry point for new buyers. Key support zones around $110,000-$115,000 for bitcoin will be watched closely.

Market activity continues at robust levels despite the correction. This suggests that while prices have pulled back, overall market interest has not faded.

The drop comes as US legislators prepare for key votes on cryptocurrency policy this week. While the overall policy environment remains supportive, regulatory uncertainty often adds to short-term volatility.

Trading activity and volumes remain high across major exchanges. Market participants are awaiting the next directional MOVE as prices consolidate.