Solana (SOL) Surges: Robinhood Relisting Fuels $220 Rally Hopes as Bulls Charge Back

Solana's back on Robinhood—and the bulls are roaring. After months in crypto exile, SOL's return to the retail trading platform sparks a 20% weekly pump. Traders now eye the $220 resistance like marathoners spotting a finish line.

Retail's favorite altcoin rides the momentum wave

No fancy derivatives or institutional custody needed—just good old-fashioned retail demand. The relisting triggered a liquidity surge that's got SOL flipping resistance levels like a pancake chef at brunch.

Technical breakout or dead cat bounce?

The chart paints a bullish picture: ascending triangle, rising volume, and that sweet spot above the 200-day MA. But let's not forget—this is crypto, where 'technical analysis' often means guessing which whale will dump next.

Wall Street's playing catch-up (again)

While traditional finance debates ETF approvals, SOL's already mooning. Another reminder that in crypto, the early birds don't just get the worm—they get the whole damn buffet while bankers are still reading the menu.

TLDR

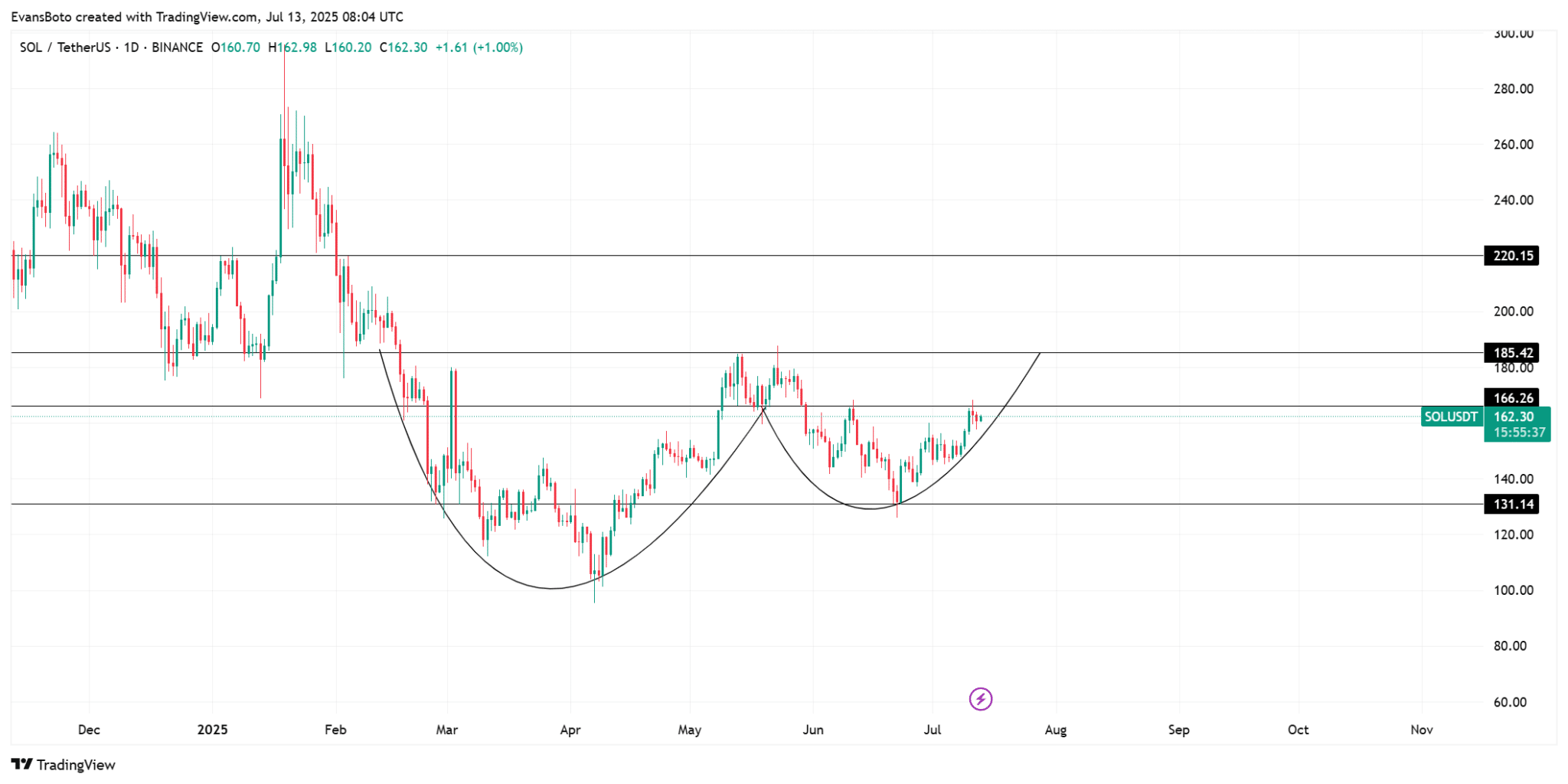

- Solana (SOL) is testing key resistance around $162-$167 after forming a cup and handle pattern with potential targets at $185 and $220

- Robinhood has relisted SOL with staking support in the U.S., signaling easing regulatory pressure and improved retail access

- Exchange outflows of $7.58 million on July 13th indicate investors are withdrawing SOL from exchanges for long-term holding

- Short liquidations totaled $555K compared to only $71K in long liquidations, suggesting bearish traders were caught off-guard

- FTX unstaked nearly 190,000 SOL worth over $31 million, raising questions about potential selling pressure

Solana is testing a critical resistance zone around $162-$167 that has capped multiple rally attempts in recent days. The cryptocurrency traded around $162.30 at the time of writing, just below this key level that could determine its next major move.

The price action comes after solana broke above an ascending trendline earlier this week. This breakout aligns with the 1.618 Fibonacci extension near $178, suggesting bulls are preparing for a potential rally toward higher targets.

Technical analysis reveals Solana has formed a textbook cup and handle pattern on the daily chart. The cup bottomed near $131 while the handle consolidated just below the $166 neckline.

This bullish continuation setup often leads to major breakouts when neckline resistance breaks. If bulls successfully flip the $166 level into support, SOL could climb toward $185 with the $220 mark as the extended upside target.

Robinhood Brings Back SOL With Staking Support

Robinhood recently brought SOL and ETH staking back to U.S. users in a development that could boost retail participation. After being dropped in 2023 when the SEC labeled it an unregistered security, SOL has returned to one of the most retail-heavy platforms in the cryptocurrency space.

This rollout signals that regulatory pressure around SOL may be easing. The ease of access Robinhood offers means more users can now stake SOL without needing to navigate DeFi tools or self-custody solutions.

From a broader perspective, this development could boost staking participation and help Solana gain ground with retail investors. The platform’s user-friendly interface makes staking more accessible to everyday users.

Exchange data shows Solana continues to see steady spot outflows, with a $7.58 million net outflow recorded on July 13th. This consistent pattern indicates that investors are withdrawing SOL from exchanges, reducing the immediate supply available for selling.

Exchange outflows typically reflect long-term holding behavior and suggest bullish sentiment among holders. This trend reinforces the broader accumulation phase and could support higher price levels if demand remains steady.

With fewer tokens circulating on trading platforms, the conditions favor continued upward price pressure. The combination of reduced exchange supply and increased staking accessibility creates a supportive environment for price appreciation.

Short Liquidations Signal Bearish Exhaustion

Solana experienced a sharp spike in short liquidations on July 13th, totaling $555K compared to just $71K in long liquidations. This imbalance implies that bearish traders were caught off-guard, likely fueling upward price movement as stop-losses and liquidations triggered forced buying.

The bulk of short liquidations came from Binance and Bybit, highlighting widespread bearish exposure across major exchanges. These liquidation events often act as catalysts for price surges, especially NEAR key resistance levels.

If bears continue to exit their positions, Solana could gain additional momentum for a breakout above the $166 neckline. The forced buying from liquidations provides natural support for upward price movements.

However, FTX-related wallets unstaked nearly 190,000 SOL worth over $31 million according to on-chain data. While this transaction isn’t necessarily bearish, it raises questions about potential sell pressure if those tokens hit the market.

The timing of this large unstake introduces a variable that could impact short-term price action. Market participants are watching closely to see whether this represents a strategic reshuffle or the start of larger moves from FTX-related wallets.

The reason why $SOL is underperforming is because it is stuck below the neckline.

Patience. pic.twitter.com/hlfdFJJvlF

— Market Watcher (@watchingmarkets) July 12, 2025

Technical analysts have identified an inverse head and shoulders pattern forming below the $162 resistance level. Higher lows are forming, and the broader chart structure suggests potential for upside movement if volume increases.

One analyst’s ABCD harmonic pattern projects a potential MOVE up to around $218 if the current bullish leg continues playing out. This projection aligns with previous resistance levels, making it a likely target if momentum stays intact.