SharpLink Gaming Just Dropped $48M on Ethereum—Now They’re the #2 Corporate Whale

Game on—SharpLink just went all-in on crypto. The gaming firm's massive $48 million Ethereum buy rockets them to second place among corporate ETH holders, trailing only the usual suspects (looking at you, MicroStrategy).

Why this matters: When traditional companies start hoarding crypto like dragons, it's either a genius hedge—or peak 'money printer go brrr' energy.

The move signals growing institutional confidence in Ethereum's long-term value, despite the SEC still playing regulatory whack-a-mole. Meanwhile, Wall Street analysts remain divided: 'Visionary asset allocation' vs. 'YOLO-ing shareholder funds into internet magic beans.'

One thing's certain—the line between gaming companies and crypto investment vehicles just got blurrier than a Play-to-Earn tokenomics whitepaper.

TLDR

- SharpLink Gaming purchased 16,374 ETH worth $48.85 million on Sunday, bringing their total holdings to over 270,000 ETH

- The company has become the second-largest corporate Ethereum holder behind the Ethereum Foundation after starting their treasury strategy two months ago

- SharpLink’s ETH investments have generated $45 million in unrealized profits since beginning their accumulation strategy

- The gaming company is staking all their ETH through the Hoppers DApp to earn rewards and contribute to network security

- Ethereum co-founder Joseph Lubin serves as SharpLink’s chairman and describes the purchases as long-term commitment rather than trading

SharpLink Gaming acquired another 16,374 ETH worth approximately $48.85 million on Sunday, according to blockchain data from Arkham Intelligence. The transaction was processed through Galaxy Digital’s over-the-counter trading desk and transferred to SharpLink’s wallet.

🚨BREAKING:

SharpLink Gaming just acquired 16,373 $ETH worth $49M directly from Galaxy! 🧠

Big players are doubling down on ethereum — conviction is real! pic.twitter.com/KMnGOdlUZs

— islam Abdelnaser (@islam_naserr) July 14, 2025

The Minneapolis-based gaming company has now accumulated over 270,000 ETH total. This makes SharpLink the second-largest corporate holder of Ethereum behind only the Ethereum Foundation itself.

The latest purchase follows a busy week for SharpLink’s Ethereum accumulation strategy. On Friday, the company bought 21,487 ETH for $63.7 million across two separate transactions.

Earlier in the week on July 11, SharpLink purchased 10,000 ETH directly from the Ethereum Foundation for $25.7 million. The Foundation faced criticism from the crypto community for selling ETH, with some interpreting it as declining confidence in Ethereum’s future.

Strategic Treasury Shift

SharpLink began its aggressive Ethereum treasury strategy just two months ago following a $425 million private placement led by Consensys. This funding round brought Ethereum co-founder and Consensys CEO Joseph Lubin on board as chairman of SharpLink.

Under Lubin’s direction, the company has repositioned itself from a sports betting affiliate marketing firm to what it calls a strategic Ethereum reserve. Lubin described the purchases as a long-term commitment rather than trading activity.

“This isn’t a trade—it is a commitment to our long-term vision,” Lubin said in a statement. “SharpLink is acquiring, staking, and restaking Ethereum as responsible industry stewards, removing supply from circulation and reinforcing the health of the Ethereum ecosystem.”

The company’s approach goes beyond simple accumulation. SharpLink has staked all of its ETH holdings through the Hoppers DApp to earn staking rewards and contribute to network security.

Financial Performance

SharpLink’s Ethereum strategy has generated strong returns in the short term. The company’s existing ETH investments have appreciated five times their original value, bringing $45 million in unrealized profits according to Arkham Intelligence.

Market Impact

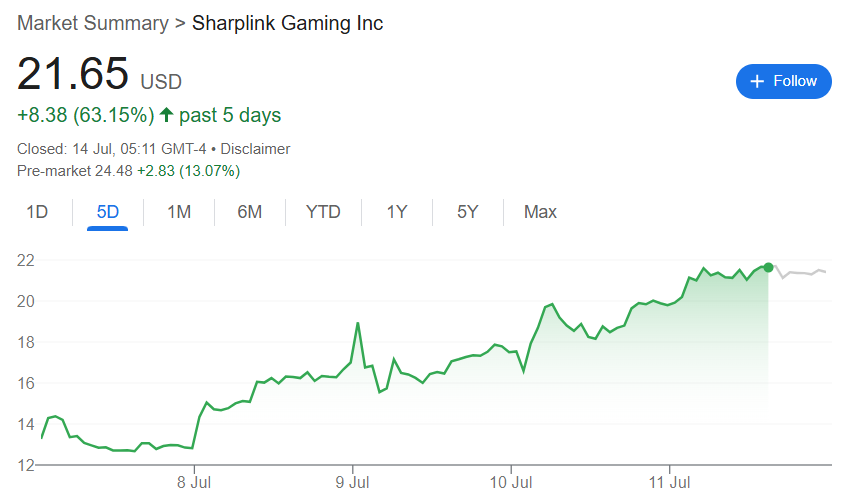

The company’s stock has rallied on the back of these purchases. SharpLink shares closed Friday at $21.65, up 17.5% on the day and 71% over the past week. Sunday trading showed shares moving higher again, up 7.16% at $23.20.

Ethereum itself has benefited from the institutional buying pressure. The asset reclaimed the $3,000 mark last week, reaching its highest level in five months. ETH is trading at $3,052, up 3% over the past 24 hours.

The buying activity coincided with the largest single day for U.S. Ethereum exchange-traded fund inflows at $383.1 million. As Ethereum’s price jumped, $258.6 million worth of Ethereum shorts were liquidated over the past 24 hours.

Foundation contributor Binji Pande defended the Ethereum Foundation’s sale to SharpLink, calling the company “the MicroStrategy of Ethereum.” He emphasized that the ETH WOULD be effectively locked out of circulation through staking and active network participation.

The Foundation stated that sales proceeds will fund protocol research and development, ecosystem maintenance, and community grants. All of these activities are considered critical to Ethereum’s continued development.