Bitcoin (BTC) Price Outlook: Exchange Outflows Surge 59% as Buying Pressure Intensifies

Bitcoin's moving off exchanges—fast. A 59% spike in outflows signals investors are pulling coins into cold storage, betting on higher prices ahead. That's classic accumulation behavior, and it's tightening supply just as demand appears to be heating up.

The Great Bitcoin Migration

When coins flee centralized platforms, they're not going on vacation. They're heading to private wallets—the digital equivalent of stuffing cash in a mattress, but with better encryption and no risk of moths. This mass withdrawal reduces the immediate sell-side pressure on exchanges, creating a potential powder keg for price moves.

Buying Pressure Meets Shrinking Supply

The math is simple: fewer coins available for sale plus increasing buy orders equals upward pressure. It's basic economics, though in crypto, 'basic' often gets dressed up in complex narratives about macroeconomic hedges and digital gold. Sometimes, it's just people buying more than others are selling.

The Institutional Whisper

While retail investors chase memecoins, this outflow pattern often hints at smarter money positioning. Institutions don't typically day-trade on retail exchanges—they secure assets in custody solutions. That 59% jump suggests someone's building a position, not flipping for quick gains.

The Cynical Take

Watch traditional finance analysts scramble to explain this 'irrational' behavior—the same experts who dismissed Bitcoin at $100 and now commission reports on 'digital asset exposure' while their clients miss another rally. The market doesn't wait for permission slips from Wall Street.

Bottom line: When Bitcoin leaves exchanges, it usually doesn't come back until prices are significantly higher. The vaults are locking, and the countdown to the next supply squeeze has begun—whether traditional portfolios are ready or not.

TLDR

- Bitcoin traded around $89,000 on Monday after dropping 2% last week, stuck in tight ranges due to low trading volume

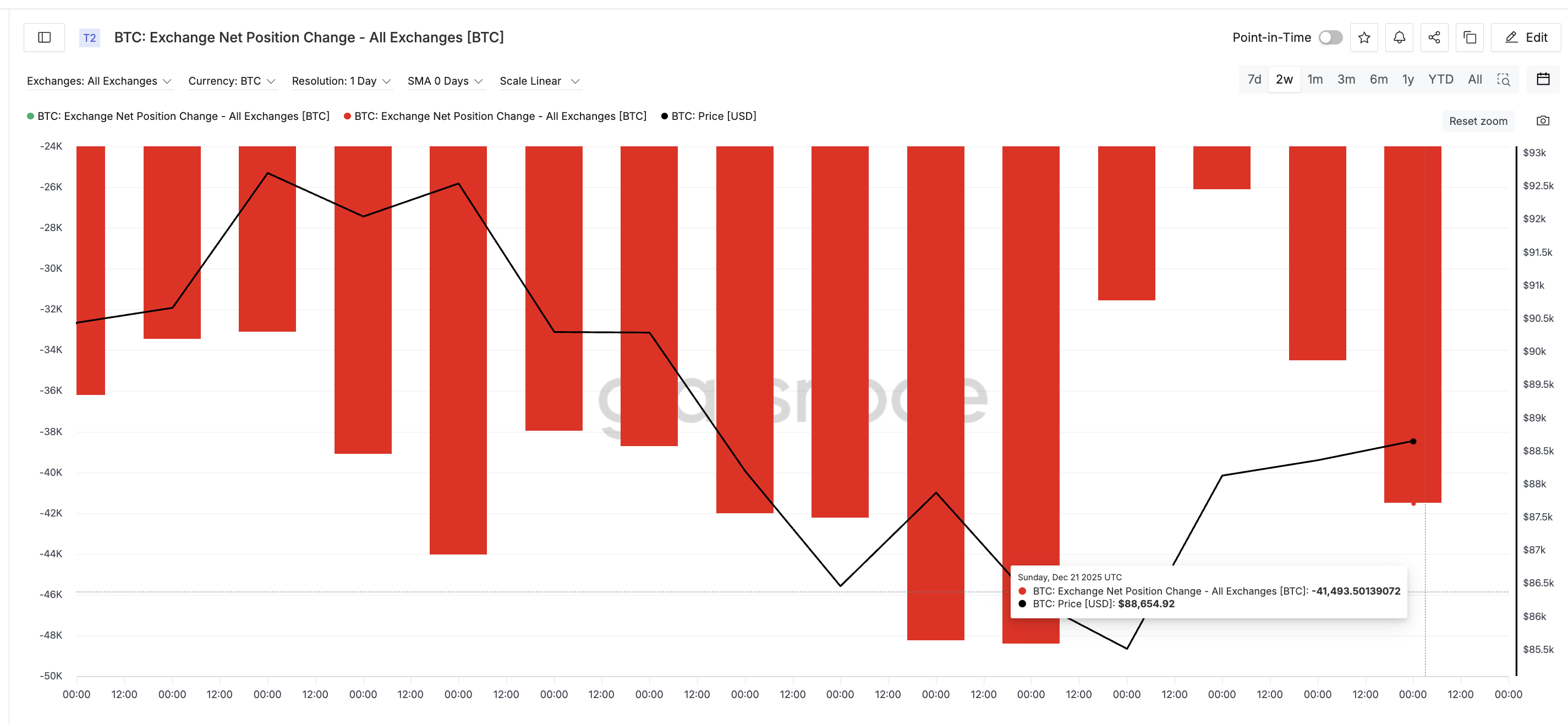

- Exchange outflows jumped 59% from December 19 to 21, moving from 26,098 BTC to 41,493 BTC, showing increased spot buying

- The number of wallets holding at least 1,000 BTC started rising again after dropping on December 17

- Hong Kong’s insurance regulator proposed new rules allowing insurers to invest in crypto assets with a 100% risk charge

- Bitcoin faces key resistance at $89,250 and support at $87,590, with potential targets at $96,700 if resistance breaks

Bitcoin traded at $89,089.92 on Monday morning, holding near recent levels after posting a 2% decline last week. The world’s largest cryptocurrency remains stuck in tight trading ranges as the year-end holiday period approaches.

The digital asset has struggled to break above the $90,000 level throughout December. Traders point to reduced demand from institutional investment vehicles and cautious positioning ahead of the holidays as reasons for the sluggish price action.

Bitcoin is up roughly 5% over the past 30 days. However, the past week showed mostly flat movement with little clear direction from either buyers or sellers.

Market conditions elsewhere improved on Monday. Gold reached fresh all-time highs driven by expectations that the Federal Reserve will cut interest rates in 2026 following softer inflation data. Stock markets also advanced, with Asian equities and U.S. futures opening higher.

The crypto market faces thin liquidity conditions typical of the late December period. Analysts cite slowing inflows to exchange-traded funds and mixed sentiment around digital assets as factors keeping prices range-bound.

Exchange Data Shows Rising Buying Activity

On-chain data reveals a sharp increase in coins leaving centralized exchanges. Exchange outflows measure how many bitcoins MOVE off trading platforms, often indicating buyersare moving assets into self-custody.

On December 19, bitcoin exchange outflows totaled roughly 26,098 BTC. By December 21, that figure had jumped to 41,493 BTC. This represents a 59% increase in net outflows over just two days.

The surge in exchange outflows suggests retail and mid-sized buyers are stepping into the market. This acceleration in spot buying activity comes alongside more gradual accumulation by larger holders.

Data tracking wallets holding at least 1,000 BTC shows the number of these entities started rising again after a drop on December 17. This metric tracks large holders often called whales. The count has been climbing gradually since December 20, though it remains slightly below recent six-month peaks.

Hong Kong Proposes Crypto Investment Rules for Insurers

Hong Kong’s Insurance Authority is proposing rules that WOULD allow insurance companies to invest in cryptocurrencies and other alternative assets. The proposal, reported by Bloomberg News, comes as regulators seek to direct capital toward government priority sectors.

According to Bloomberg, the Hong Kong Insurance Authority is proposing a set of new rules to channel insurance capital into assets including cryptocurrencies and infrastructure. Under a presentation document, the regulator would apply a 100% risk capital charge to crypto assets,…

— Wu Blockchain (@WuBlockchain) December 22, 2025

Under the plan, insurers would face a 100% risk charge on crypto asset holdings. This means they would need to hold capital equal to the full value of their crypto investments as a buffer against potential losses.

The proposal also covers stablecoin investments. These would face risk charges based on the fiat currency backing the stablecoin rather than a flat 100% charge.

The rules appeared in a December 4 presentation reviewed by Bloomberg. The regulatory change would represent a step toward mainstream institutional adoption of digital assets in one of Asia’s major financial centers.

$BTC could see something diabolical like this happening in the next few weeks. This would be the bottom imo pic.twitter.com/MbB7rxWhye

— Altcoin Sherpa (@AltcoinSherpa) December 21, 2025

Bitcoin currently faces resistance at the $89,250 level. This price point has capped upward moves since mid-December through multiple failed attempts to push higher. Support sits at $87,590, with further downside levels at $83,550 and $80,530 if selling pressure increases.