Dogecoin Eyes $0.28 Target After Defying Gravity at Critical Support

Dogecoin just pulled off a Houdini act—dodging a breakdown at a major support level that had traders sweating. Now, the memecoin that started as a joke is making a serious run at $0.28.

The Floor Held

Forget the fundamentals for a second—this is pure market mechanics. A key price zone, watched by every chartist and their dog, absorbed selling pressure like a sponge. That failure to collapse has flipped the script from defense to offense.

The Path to $0.28

The roadmap is on the chart. Holding that support wasn't just about avoiding a crash; it was the launchpad. The next resistance levels are now in sight, with $0.28 standing as the near-term prize. It's a classic setup: hold the line, then rally. Simple, until it isn't.

The Meme Factor vs. Market Reality

Let's be real—this is Dogecoin. Its value proposition is a community mascot with a crypto wallet. Yet, here we are, analyzing its price trajectory with the same tools used for blue-chip stocks. The irony isn't lost on anyone, except maybe the traditional finance guys still trying to short it.

So, the stage is set. The support held. The target is $0.28. Whether it gets there on hype, hope, or just herd mentality hardly matters—the chart says it's go time. Just another day in the casino… we mean, the innovative frontier of decentralized finance.

TLDR

- Dogecoin price holds $0.13 support after liquidity sweep signals seller exhaustion

- On-chain data shows strong demand clusters at $0.074 and $0.12–$0.13

- Descending channel compression hints at a potential trend reversal

- Upside targets sit at $0.20 first, with $0.28 in focus if momentum builds

Dogecoin price is showing early signs of stabilization after a prolonged corrective phase, as technical and on-chain indicators point to easing downside pressure. Analysts highlight a defended support region NEAR $0.13 and strong historical demand at lower levels. If current bases hold, projections suggest a potential recovery toward $0.20, with scope for a broader move toward $0.28 under favorable market conditions.

Dogecoin Price Stabilizes After Liquidity Sweep

Analyst BitGuru’s Doge chart outlined a completed bullish cup formation that developed through mid-2025. After the breakout phase, the price entered a corrective pullback that respected the handle zone. A brief dip below prior lows triggered a liquidity sweep, flushing stops before reversing, a pattern often seen in volatile meme assets.

Moreover, Dogecoin price is now stabilizing around the $0.13 zone, with declining sell volume suggesting seller exhaustion. Additionally, early buying interest is emerging as volatility compresses. The analyst noted that if this base remains intact, a relief bounce could develop toward the $0.18–$0.20 resistance zone. Sustained momentum may open a path toward the previous highs near $0.28.

On-Chain Data Highlights Strong Support Clusters

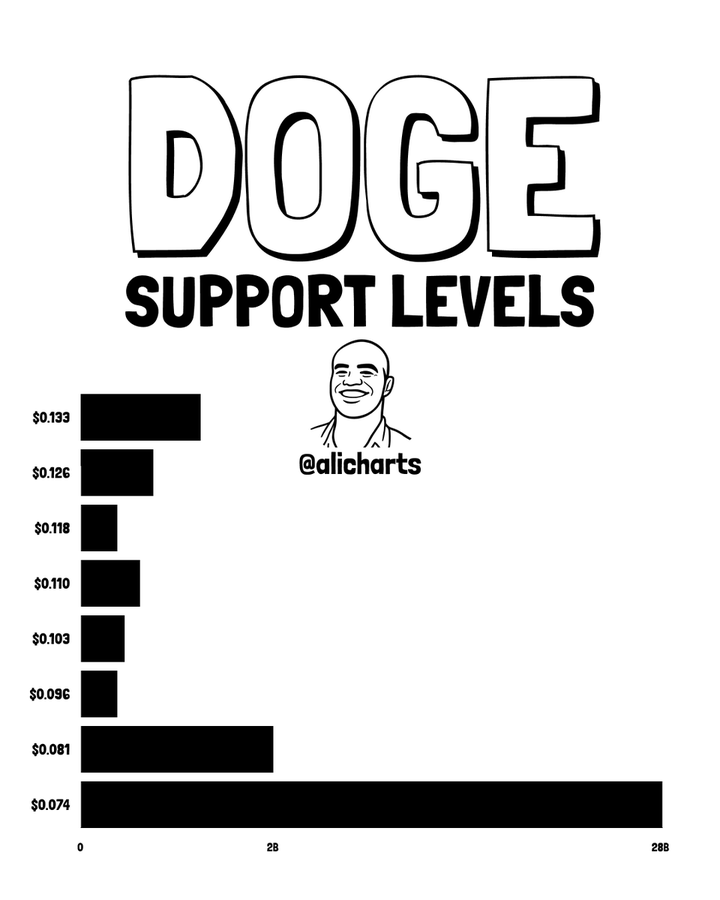

Meanwhile, analyst Ali provided an on-chain view of dogecoin price support based on historical token movement. The data highlights $0.074 as the most significant support level, where over 28 billion DOGE last changed hands. This zone represents a major cost basis for holders, increasing its importance as a defensive floor.

SOURCE: X

In addition, secondary support levels at $0.081 and the $0.126–$0.133 range show progressively lighter volume clusters. This structure implies that deeper pullbacks could attract aggressive buying near the lower levels, while recoveries may face lighter resistance until higher zones. Ali suggests that volatility could intensify if price revisits these levels, though the probability of a rebound remains elevated at major clusters.

Downtrend Compression Signals DOGE Price Reversal

Furthermore, price analysis focused on a longer-term chart shows Dogecoin in a descending channel after peaking near $0.32. The rejection zone around the highs reflects heavy distribution, while the steady decline rewarded short positions. However, the recent test near $0.13 produced an exhaustion wick, signaling weakening bearish momentum.

Additionally, volume has tapered during the descent, indicating reduced selling pressure. The current consolidation at channel support creates a potential inflection point. According to this view, a hold above current levels could invalidate the downtrend structure and trigger a short squeeze. Initial upside targets align near the channel midline around $0.20, with extension toward $0.28 if resistance breaks. Also, risk remains if the price slips below $0.10, though the risk-reward profile is shifting.

Dogecoin is approaching a technically sensitive zone where multiple indicators converge. Stabilization near key support, strong on-chain demand clusters, and compression within a descending channel all suggest that downside momentum is fading. While confirmation is still required, analysts say that a sustained hold could position DOGE for a recovery phase, especially if market conditions remain positive.