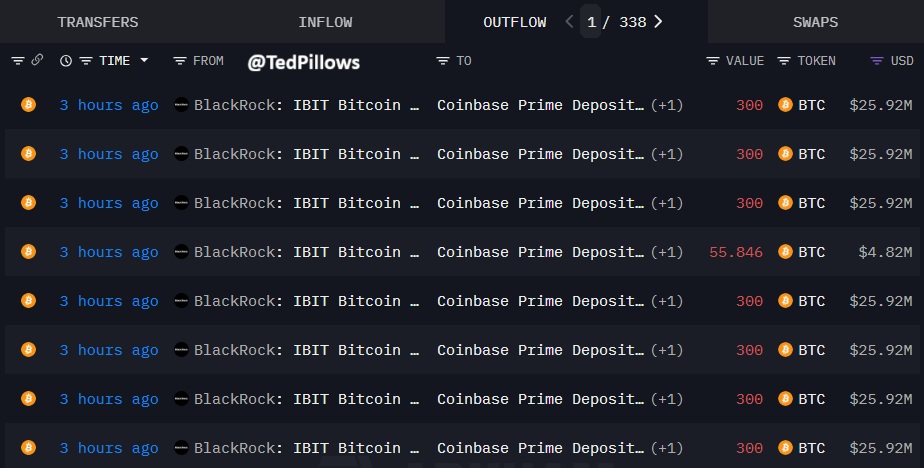

BlackRock Shifts 2,156 BTC to Coinbase Prime in Major Fund Rebalancing Move

BlackRock just made a multi-million dollar crypto shuffle.

Institutional Moves

The world's largest asset manager transferred a hefty 2,156 Bitcoin to Coinbase Prime, a platform built for major players. This isn't a casual trade—it's a calculated step in a broader fund rebalancing strategy. The move signals how traditional finance giants are actively managing their digital asset exposure, treating Bitcoin not as a speculative toy but as a core portfolio component.

Why It Matters

When BlackRock moves, markets watch. Transfers of this scale to a prime brokerage suggest preparation for liquidity events, client allocations, or internal repositioning. It underscores the maturation of crypto infrastructure, where billion-dollar funds can execute major operations with the same ease as moving traditional securities. Forget the wild west—this is Wall Street protocol with a blockchain ledger.

Big Picture

This rebalancing act is a masterclass in institutional crypto management. It's a reminder that for the giants, volatility is just another parameter to optimize against. While retail traders chase headlines, the real money is quietly executing a long-term plan, one blockchain transaction at a time. After all, what's a few thousand Bitcoin between friends when you're playing with pension fund money?

TLDR

- BlackRock-linked wallet sent 2,156 BTC to Coinbase Prime worth $186M

-

Analysts tie the transfer to ETF liquidity and treasury operations

-

No signs of selling as coins remain in institutional cold storage

-

ETF saw $137M in outflows last week amid broader institutional moves

A wallet associated with BlackRock moved 2,156 Bitcoin, valued at approximately $186 million, to Coinbase Prime, according to on-chain data. Blockchain analysts monitoring institutional flows reported the movement as routine for ETF-related activity, not market-driven selling.

The transfer occurred amid continued ETF rebalancing by major institutions. Coinbase Prime is designed for institutional custody and bulk settlement rather than retail trading. Analysts noted that transfers to this platform are common during ETF share creation or redemption periods.

ETF Rebalancing Drives Institutional Bitcoin Movements

The Bitcoin movement was interpreted by analysts as part of BlackRock’s operational procedures tied to its spot Bitcoin ETF. ETF managers often transfer large volumes of crypto to support share issuance, redemptions, or to rebalance custodial allocations.

Such flows are not unusual, with Coinbase Prime used for secure transactions outside of open order books. “These activities typically support ETF liquidity, OTC settlement, and internal treasury balancing,” said a blockchain analytics firm that tracks institutional wallets.

BlackRock operates several cold wallets and often moves bitcoin for rebalancing between custodians or preparing for large redemptions. These operations align with typical ETF activity and do not indicate selling unless coins are fragmented or moved to hot wallets.

Recent Outflows Add Attention to Institutional Activity

The MOVE follows a recent $137 million net outflow from BlackRock’s Bitcoin ETF. Market participants have closely followed such large transfers due to recent price declines. Bitcoin fell below $84,000 in the same period, triggering speculation about potential coordinated selling.

According to online reports, other large entities also moved Bitcoin recently. A viral post claimed that Wintermute sold 8,714 BTC, Grayscale 8,193 BTC, BlackRock 6,812 BTC, and several others, including Coinbase, Binance, and Bybit, also transferred or sold high volumes of BTC.

However, analysts have advised caution when interpreting these figures. Transfers to platforms like Coinbase Prime often represent over-the-counter deals or ETF settlements rather than immediate market selling. The transactions remain within institutional custody channels.

BlackRock ETF Products Remain Among Most Active Globally

Despite fluctuations in ETF flows, BlackRock’s spot Bitcoin ETF remains one of the most successful among over 1,400 ETFs globally. “When we launched, we were optimistic, but we didn’t expect this scale,” said a senior BlackRock executive, as quoted by ETF analyst Nate Geraci.

Defined processes, including daily rebalancing and custody updates, drive institutional Bitcoin transactions. BlackRock’s use of Coinbase Prime supports efficient and secure movement of large volumes, avoiding slippage that WOULD occur on retail exchanges.

Analysts stated they will continue to monitor Coinbase Prime wallets for additional movement of these coins. If the BTC remains untouched or is sent to another cold address, it will likely confirm that the transfer was operational rather than speculative.

Monitoring Future Wallet Activity for Clarity

Observers noted that there is no indication of selling unless the transferred Bitcoin enters hot wallets or is broken into smaller outputs. Until such signs appear, most industry analysts consider this a standard ETF liquidity and custody adjustment.

“Unless there’s a transfer into exchange hot wallets, we don’t assume it’s selling,” said one on-chain analyst. “The structure of ETF custodianship involves these kinds of rebalancing transfers.”

Large institutional investors now dominate Bitcoin flows, with most transfers handled through OTC desks and professional platforms like Coinbase Prime. These flows FORM part of a larger trend where institutions are managing assets with infrastructure designed for scale and security.