Solana (SOL) Tests $126 Support After 5th Straight Red Day - Is This The Bottom?

Solana's price action hits a critical juncture as selling pressure stretches into a fifth consecutive session.

The Technical Breakdown

The $126 level isn't just a number—it's a psychological battleground where buyers have historically stepped in. A clean hold here could signal exhaustion of the recent downtrend, while a decisive break opens the door to lower support zones. The extended sell-off reflects broader market jitters, but also potential oversold conditions for a network that's been processing transactions at a blistering pace.

Beyond the Chart

This isn't about a single token's bad week. It's a stress test for a high-throughput blockchain that promised to fix Ethereum's woes. Network performance remains robust even as the price stumbles—a divergence that long-term builders are watching closely. Meanwhile, traditional finance pundits are probably dusting off their 'told you so' speeches, blissfully ignoring that their own bond markets have the volatility of a tranquilized sloth.

The next move hinges on whether the market sees a technical bounce or a fundamental flaw. For now, all eyes are on that $126 line in the sand.

TLDR

- Solana (SOL) dropped 5% on Monday to $126, marking its fifth consecutive day of losses and losing the gains from the previous week.

- Derivatives data shows bearish sentiment with Open Interest declining 6.17% to $7 billion and funding rates turning negative at -0.0055%.

- Long liquidations totaled $31.88 million compared to just $2.99 million in short liquidations over 24 hours, showing strong bearish control.

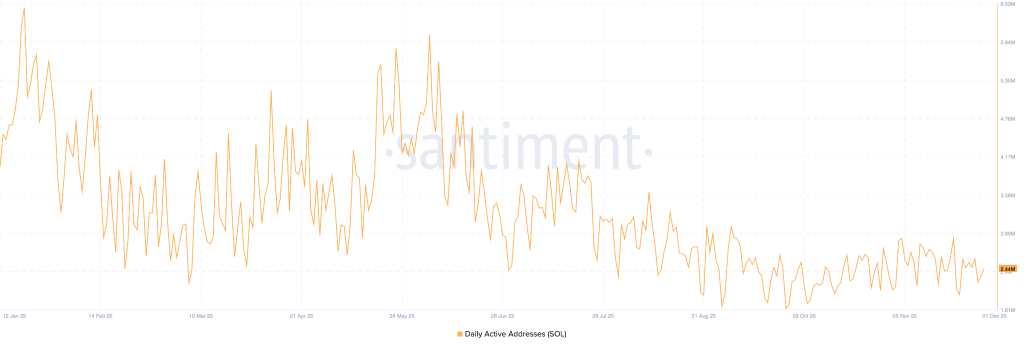

- On-chain metrics reveal weakness with daily active addresses dropping from 7-9 million to 3-4 million since early 2025, while DEX volumes and Total Value Locked (TVL) have declined consistently.

- Technical indicators show SOL defending the $121-$128 support zone for the third week, but a break below could push prices toward $100.

Solana continues its downward slide as the token trades at $126 following a 5% loss on Monday. This marks the fifth straight day of declining prices for the high-speed blockchain platform.

The broader crypto market selloff has pulled Bitcoin below $87,000. This triggered over $600 million in liquidations across the market in 24 hours.

Solana futures Open Interest dropped 6.17% to $7 billion in the last day according to CoinGlass data. Open Interest measures the total value of outstanding contracts in the derivatives market. The decline shows investors are pulling back their exposure to SOL positions.

The funding rate turned negative to -0.0055% on Monday. This metric indicates bears are paying a premium to hold short positions. When funding rates go negative, it reflects increased confidence among traders betting on price declines.

Long liquidations reached $31.88 million over 24 hours. Short liquidations only totaled $2.99 million during the same period. This gap demonstrates the strength of selling pressure that wiped out bullish positions.

On-Chain Activity Shows Weakness

Daily active addresses on solana have fallen from 7-9 million earlier in 2025 to 3-4 million by midyear. The metric has stayed around this lower range since then. Active addresses track the number of unique wallets interacting with the network.

This decline points to reduced user engagement on the platform. Transaction growth has slowed alongside the drop in active users.

DEX volumes on platforms like Jupiter and Raydium have decreased since the beginning of the fourth quarter. The drop reflects fewer speculative inflows and lower fee burns. Earlier memecoin trading drove much of Solana’s activity, but this hype-driven volume has faded.

Total Value Locked has followed a similar downward pattern. Declining TVL indicates capital leaving the ecosystem and weakening confidence in the protocol.

Technical Levels Point to Further Risk

The SOL chart shows the formation of a bearish Marubozu candle on Monday. The five-day decline has erased gains from the previous week. The price now tests the $126 support level last seen on June 22.

$SOL UPDATE

SOL has printed a small inverse head and shoulders targeting around $160 which means it should break out soon, it will happen when you least expect it tbh pic.twitter.com/WUp4HT4d19

— Don (@DonaldsTrades) November 30, 2025

A close below $126 could extend losses to $112, matching the March 11 low. The next support sits at $95 from April 7.

The Relative Strength Index sits at 33 on the daily chart. The indicator has remained below the 50 midline since early October. RSI hovering NEAR the oversold boundary at 30 suggests potential for more selling.

The Moving Average Convergence Divergence stays above its signal line for now. A cross below WOULD confirm renewed bearish momentum and trigger a sell signal.

Solana bulls are defending the $121-$128 support zone for the third consecutive week. This range has served as a strong base since early 2024 during previous periods of extended selling. Volume has drained during this defense attempt.

The weekly RSI follows a descending trend line. This pattern signals weakening rally strength. Current price action suggests further downside is possible toward $100 or slightly below in coming days.