Cardano (ADA) Price: Will the Midnight Sidechain Launch Finally Push ADA Higher?

Cardano's long-awaited Midnight sidechain is finally here—and the market's watching to see if it's the catalyst ADA needs to break its consolidation pattern.

The privacy-focused protocol promises to bring smart contract confidentiality to the Cardano ecosystem, a feature that could attract institutional interest and new developer activity. It's a technical leap that addresses one of blockchain's oldest trade-offs: transparency versus commercial secrecy.

Can Midnight Deliver a Price Surge?

Sidechain launches are often buy-the-rumor, sell-the-news events. The real test for ADA won't be the mainnet launch itself, but the user adoption and total value locked (TVL) that follows in the subsequent quarters. A shiny new sidechain without meaningful traffic is just another road to nowhere—a common pitfall in crypto where building it doesn't guarantee they'll come.

Market mechanics are simple: increased utility should drive demand. If Midnight successfully onboards enterprises or developers needing data privacy, that could translate into sustained ADA buying pressure. If it languishes, it becomes another bullet point on a roadmap that investors have learned to view with a healthy dose of skepticism.

The Verdict: A Necessary, But Not Sufficient, Condition

Midnight is a serious piece of engineering for a serious problem. It makes Cardano more competitive. But in a market that rewards narrative as much as utility, ADA's price needs more than a successful launch—it needs a wave of real-world use that proves the hype right. Otherwise, it's just another feature waiting for a problem, funded by hopeful speculators betting on a future that may never arrive.

TLDR

- Cardano (ADA) is trading around $0.41 to $0.42, down over 85% from its 2021 all-time high of around $3.10

- The Midnight sidechain and NIGHT token are scheduled to launch on December 8, which could boost ADA adoption and price

- The SEC may soon approve the first spot Cardano ETF, potentially driving institutional investment

- Derivatives data shows open interest near $735M with futures volume at $670M, indicating heavy leverage trading activity

- ADA is trading at the same price level it reached in late 2017, showing limited progress over eight years despite multiple market cycles

Cardano is trading around $0.41 as November ends and December begins. The price represents a drop of more than 85% from the token’s 2021 peak.

The cryptocurrency closed at $0.42 on November 25. Recent 24-hour trading shows the token moving between $0.413 and $0.422 with a slight gain of about 1%.

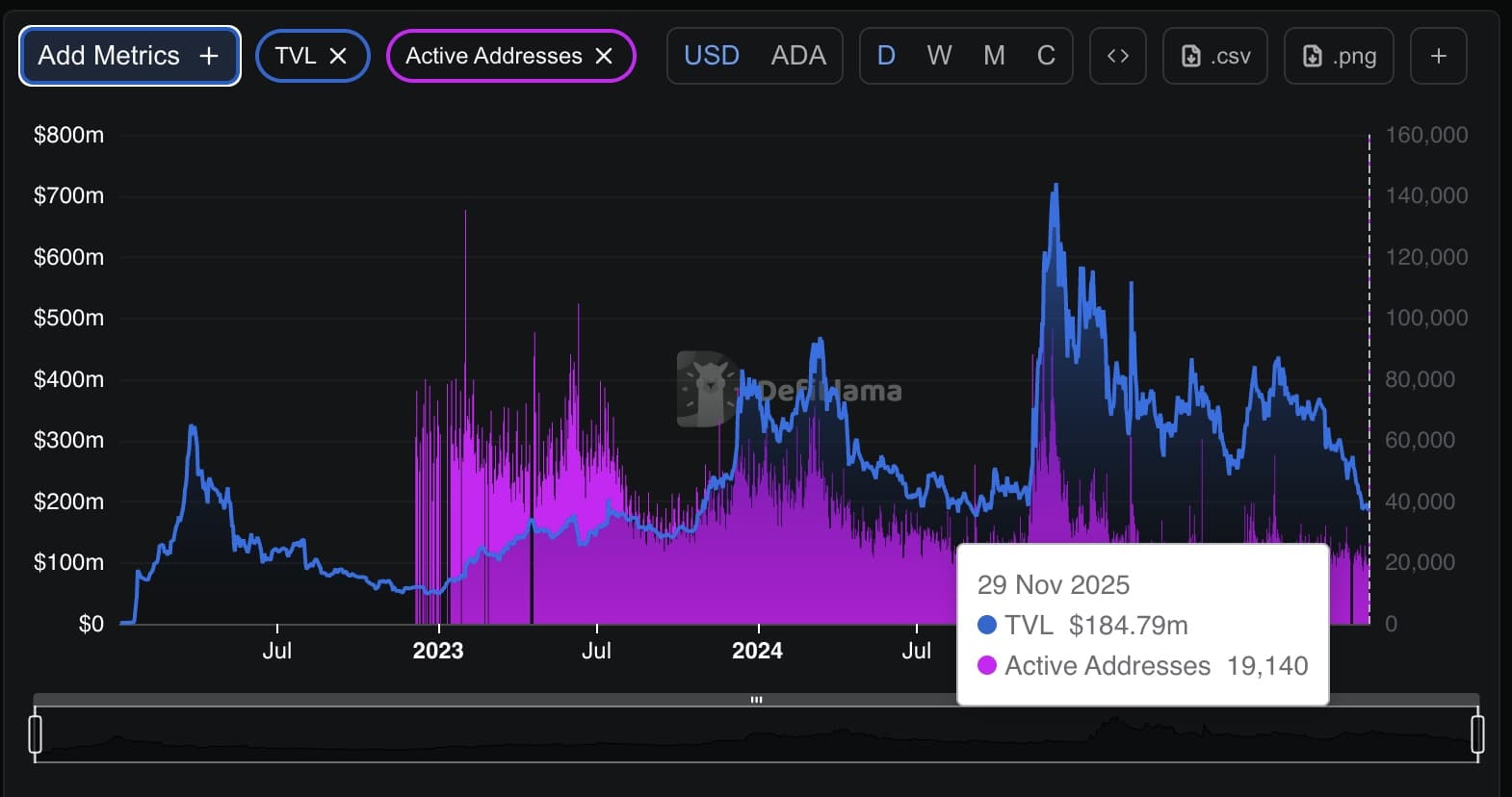

Spot trading volume sits above $540 million. On-chain data from DeFiLlama shows roughly $185 million locked in Cardano’s DeFi services. DEX trading volume stands at approximately $1.8 million.

About 19,000 active addresses were recorded in the past 24 hours. The numbers point to a stable user base without major growth in new demand.

Derivatives Activity Shows Leverage Risk

The derivatives market tells a different story than spot trading. Futures volume reached about $670 million in 24 hours according to Coinglass data.

That compares to spot volume NEAR $76 million. Open interest sits close to $735 million.

The gap suggests most trading activity comes from short-term positions using leverage. Long-term buyers do not appear to be building positions at current levels.

Price predictions for December put ADA in a range between $0.38 and $0.48. A MOVE above $0.45 could push the token toward $0.50 to $0.55. Breaking support at $0.40 might send the price into the mid-$0.30s.

$ADA is at the same level it was 8 years ago. pic.twitter.com/sktS4PbpI5

— Milk Road (@MilkRoad) November 29, 2025

Cardano faces challenges in gaining market share. The blockchain has not captured space in the growing stablecoin sector or real-world asset tokenization market. Some analysts project the stablecoin industry could reach $4 trillion by 2030.

Internal disputes between the Cardano Foundation and founder Charles Hoskinson have created organizational issues. These conflicts sometimes overshadow technical achievements.

Midnight Launch Could Impact Price

The Midnight sidechain represents a potential catalyst for Cardano. Midnight combines Cardano’s reliability with privacy features needed by businesses and individuals.

The NIGHT token is scheduled to launch on December 8. Charles Hoskinson believes Midnight will drive increased adoption of cardano and add value to its DeFi applications.

The blockchain continues work on RealFi projects. These initiatives aim to bring decentralized finance tools to people in developing countries.

A chart shared by analysts shows ADA trading near the same level it reached in late 2017. The token sat around $0.41 to $0.42 during its first major breakout cycle eight years ago.

Between 2017 and now, Cardano reached a peak in 2021 before dropping through 2022. The past year brought mostly sideways price movement.

The SEC may approve the first spot Cardano ETF soon. This could bring institutional investment to the token. Stablecoin supply on Cardano currently sits close to $40 million.

Technical analysis suggests Cardano remains in a wide trading range. Volume is thin and resistance near 2024 highs has not been retested. The Midnight launch on December 8 represents the next major event that could influence price direction.