CZ’s $2 Million Aster Purchase Ignites Market Frenzy: Extreme Volatility Hits Crypto

When Binance founder Changpeng Zhao drops $2 million on a single altcoin, markets listen—then convulse.

The CZ Effect in Action

Aster's price chart went from calm waters to tsunami warnings within hours of the purchase confirmation. Trading volumes exploded 400% as both retail and institutional players scrambled to position themselves around the whale movement.

Liquidity Pools Tested

Decentralized exchanges saw spreads widen dramatically while centralized platforms struggled with order book imbalances. The $2 million injection created ripple effects across correlated assets in the mid-cap altcoin space.

Market Psychology at Play

When a figure like CZ makes a public move of this magnitude, it triggers the ultimate FOMO cocktail—part genuine conviction, part speculative frenzy, and pure gambling masquerading as investment strategy.

Volatility isn't a bug in crypto—it's the main attraction for traders and the perfect excuse for traditional finance executives to justify their 2-and-20 fees while doing absolutely nothing.

TLDR

- Binance founder Changpeng Zhao invested over $2 million of his personal funds into Aster, a decentralized perpetuals exchange

- Aster’s price jumped from $0.91 to above $1.20 within an hour following CZ’s announcement, but has since dropped 14% to around $0.90

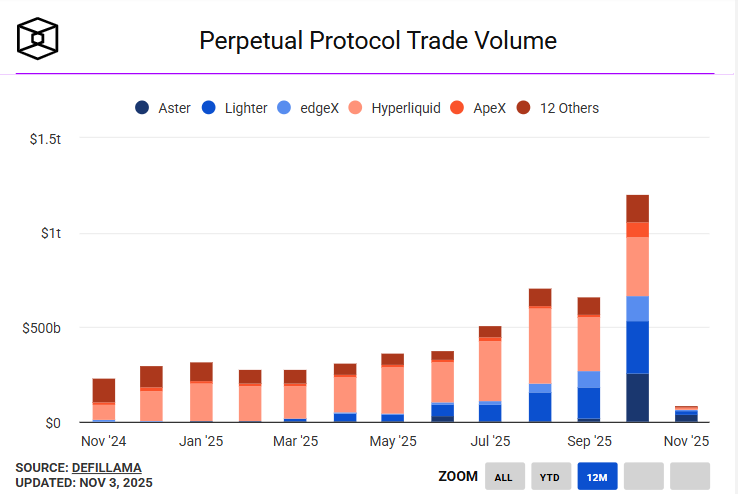

- Aster surpassed Hyperliquid with over $70 billion in weekly trading volume, making it a leading decentralized perpetuals platform

- CZ received a presidential pardon on October 23 after serving four months in prison for banking law violations

- Despite the initial price surge, CZ warned traders about timing risk, noting his history of buying before market drops

Changpeng Zhao announced a personal investment of over $2 million in Aster on social media platform X. The former Binance CEO stated he purchased the token with his own funds and planned to hold it long term.

Aster is a decentralized perpetuals exchange that allows traders to buy and sell crypto contracts. The platform operates without a central authority.

Following Zhao’s announcement, Aster’s price jumped from around $0.91 to over $1.20 within an hour. Trading volume increased sharply as other investors followed the purchase.

The price surge was short-lived. Over the following week, Aster dropped 14% to trade around $0.90 to $0.93.

Zhao has connections to Aster through YZi Labs, his family office. This relationship drew investor attention to the project.

Trading Volume Reaches New Heights

Aster recently surpassed Hyperliquid in reported trading volumes. The platform logged more than $70 billion in transactions over a seven-day period.

Earlier this year, questions arose about Aster’s data accuracy. DefiLlama founder 0xngmi temporarily removed the platform’s metrics over verification concerns.

The data was later restored after Aster deployed new monitoring systems. These tools help track decentralized exchange volumes more accurately.

Aster has a market capitalization of $1.88 billion. Its fully diluted valuation stands at $7.47 billion, showing that roughly 25% of tokens are currently in circulation.

The platform’s volume-to-market cap ratio sits at 79.69%. This indicates high trading activity relative to its size.

Presidential Pardon Changes Landscape

Zhao received a presidential pardon from Donald TRUMP on October 23. The pardon came after Zhao served four months in U.S. prison for banking law violations.

He had resigned as Binance CEO before his sentence. WHITE House Press Secretary Karoline Leavitt called the pardon an end to the previous administration’s approach to cryptocurrency.

$ASTER is Getting Ready for massive Bullish Rally so don't miss the RIDE..📈#Crypto #ASTER #AsterDex pic.twitter.com/dReYICc0ov

— Captain Faibik 🐺 (@CryptoFaibik) November 5, 2025

Both Aster and Binance’s BNB token responded to the pardon news. Aster climbed to $1.07 while BNB gained more than 5% to reach $1,123.

Zhao later cautioned traders about market timing. He referenced his history of buying before price drops, mentioning Bitcoin’s fall from $600 to $200 in 2014 and BNB’s 2017 pullback.

The current support level for Aster sits at $0.90. A break below could push the price to $0.85.

Resistance levels appear at $1.00 and $1.10. A move above these points WOULD signal renewed buying strength.

The MACD indicator shows early signs of a potential upward cross. The RSI reading of 43.4 suggests selling pressure has eased but strength is not yet confirmed.