Bitcoin Posts First Negative October Close Since 2018 Cycle - Here’s What It Means

Bitcoin just broke its six-year October winning streak - and the timing couldn't be more significant.

The Historical Pattern Shift

For the first time since the last major market cycle in 2018, Bitcoin closed October in negative territory. That's six consecutive years of October gains suddenly reversed. The pattern that crypto traders have come to rely on? Gone.

Market Cycle Echoes

This development mirrors the 2018 bear market structure, back when Bitcoin was still fighting for mainstream recognition. Now, with institutional adoption at all-time highs, the parallel becomes even more intriguing. Are we seeing a classic crypto cycle replay, or is this time truly different?

Traditional finance analysts are probably nodding smugly right now - but they've been wrong about Bitcoin for over a decade. The real question isn't whether October was red, but what happens next in November.

TLDR

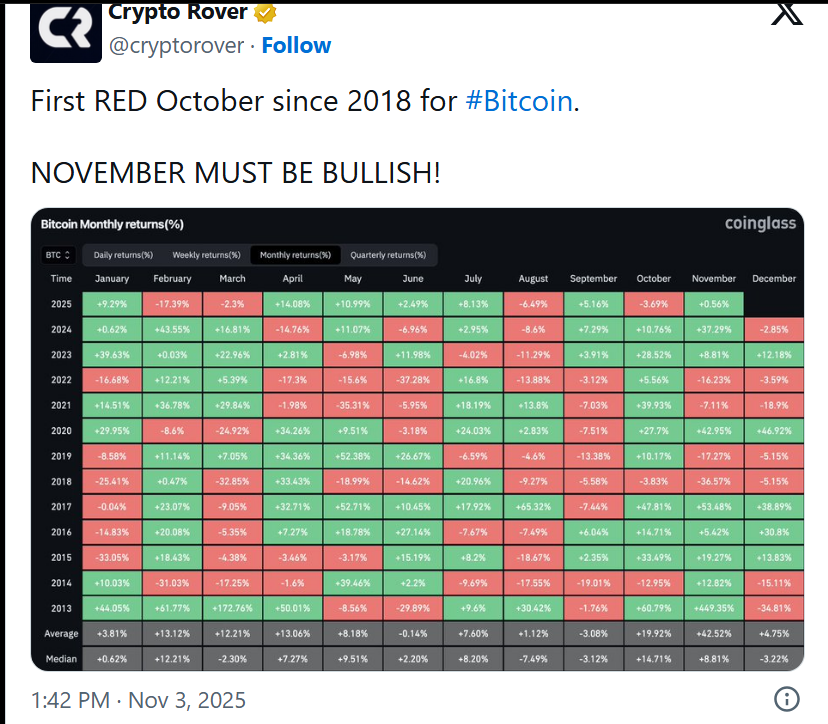

- Bitcoin fell 3.6% in October 2025, marking its first red October since 2018.

- A $20B liquidation on October 10 triggered the sharp price correction.

- Bitcoin held above $100K despite October’s drop, signaling strong demand.

- November has delivered gains in 8 of the last 12 years for Bitcoin.

Bitcoin has closed October 2025 with a -3.6% decline — its first negative October in seven years. This rare downturn broke a strong trend of October gains, with several years showing double-digit growth. While the month started strongly, a large-scale liquidation event in mid-October pressured the market. Now, traders are looking at November data, which historically points to a recovery.

October Ends in the Red After Long Bullish Streak

Bitcoin dropped 3.6% in October, based on data from CoinGlass. This marks the first time since 2018 that Bitcoin ended October in negative territory. Historically, the cryptocurrency has shown strong gains during this month. In 2020, Bitcoin rose by 27.7%, in 2021 by 39.9%, and in 2024 by 10.7%.

October has often been viewed as a bullish month. The recent decline came as a surprise to many market watchers. It was also the first monthly loss for Bitcoin in 2025, which had previously shown steady performance throughout the year.

Liquidation Event Drives Downward Pressure

The decline in October was largely triggered by a massive liquidation event. According to TradingView, over $20 billion worth of positions were wiped out on October 10. This was one of the largest liquidation events in crypto history.

The sharp drop challenged key technical levels. bitcoin fell near its 50-week moving average but managed to hold above the $100,000 mark. Analysts say this shows strong accumulation at that level. They also note the correction was likely driven by profit-taking and not a change in long-term direction.

Historical November Trends Remain Positive

Market history shows that November tends to be a strong recovery month for Bitcoin. CoinGlass data shows Bitcoin has posted gains in 8 out of the past 12 Novembers. The average gain for the month is 4.25%, while the median gain is 8.81%.

Even in weaker years, Bitcoin has managed to end November in the green. In 2023, the price ROSE by 8.8%, and in 2024, it increased slightly by 0.56%. Traders are now watching for a repeat of this pattern in 2025.

Technical and Macro Signals Suggest Upside

Technical indicators from TradingView point to a possible shift in momentum. The four-hour chart shows a bullish Change of Character (CHoCH) NEAR the $100,000 level. This is often viewed as a signal that the price may start rising again.

At the same time, global financial conditions remain supportive of risk assets. The liquidity environment remains loose due to continued monetary easing in major economies. This is giving traders confidence that the crypto market could recover sooner than during past corrections.

The Crypto Fear and Greed Index, which had moved into the fear zone during the October decline, is also starting to show signs of improvement. This suggests market sentiment may be stabilizing.

Outlook for Year-End Rally

Bitcoin is currently trading slightly above $100,000. Traders are watching closely to see if it can break above the $105,000 level. If that happens, several analysts expect the price to push toward $120,000 before the end of the year.

A possible breakout may be supported by positive economic news, exchange-traded fund (ETF) inflows, or falling inflation. These conditions have previously helped drive strong rallies in the crypto market.

Analysts note that a red October followed by a strong November has happened before. In 2018, a similar pattern was followed by a long period of price consolidation and then a large bull run.