Altcoin Season Heats Up: Why Bullish Predictions Defy Bear Market Signals in 2025

Altcoins defy gravity as traders ignore red flags.

Bear market? What bear market? Despite indicators screaming caution, altcoin season predictions are surging—because when has crypto ever followed logic?

The Contrarian Rally

While Bitcoin dominance wobbles, ETH, SOL, and memecoins are mooning. Traders pile into 'next cycle plays' like it's 2021 again—ignoring the fact most will get rekt.

Institutional Whispers

Hedge funds quietly accumulate while retail FOMO kicks in. 'This time it's different' narratives spread faster than a Telegram scam.

The Punchline

When even the 'smart money' starts chasing 100x shitcoins, you know we're either at peak genius or peak delusion. Place your bets—just don't mortgage your house this time.

TLDR

- Crypto analysts predict a “massive liquidity shift” later this year could trigger a parabolic pump for altcoins

- Most altcoins remain lackluster despite Bitcoin surging 680% from its November 2022 bear market low

- Altseason index indicators from multiple sources currently sit at bear market lows, ranging from 24 to 35 out of 100

- Over 150 altcoin ETFs are waiting for SEC approval, which could serve as a catalyst for altcoin growth

- Only a few altcoins like BNB and Hyperliquid have reached recent all-time highs while most trade at multi-year lows

Crypto analysts are predicting the arrival of altcoin season despite current market indicators showing the opposite. Analyst Ash crypto forecasts a “massive liquidity shift” later this year that will lead to a “parabolic pump” for altcoins.

Why no Altseason in 2025 yet ?

Bitcoin has pumped 8.5x to $126,000 from the bottom of $15,400 in November 2022.

US stocks are at an all-time high.

Gold added $15 trillion to its market cap.

With massive liquidity, all these big assets are absolutely exploding. While ETH is…

— Ash Crypto (@Ashcryptoreal) October 24, 2025

The majority of altcoins have underperformed this year. Bitcoin has surged 680% from its November 2022 bear market low while major assets like tech stocks and gold have hit all-time highs.

Investors are currently focusing on safe-haven assets due to trade tariff concerns and geopolitical tensions. Ash Crypto explained that liquidity is only in low-risk assets right now. He noted this pattern matches how bull markets played out in 2017 and 2021.

The analyst expects several Federal Reserve rate cuts and an easing of monetary policy. He predicts liquidity will flow back to risk assets. This shift would send bitcoin and Ether to new peaks with altcoins following.

Another analyst, Crypto GEMs, shared a chart showing the last time the US central bank injected liquidity. That injection kicked off the previous altseason.

More than 150 altcoin exchange-traded funds are waiting for SEC approval. This could provide another catalyst for altcoin growth.

Current Market Indicators Paint Different Picture

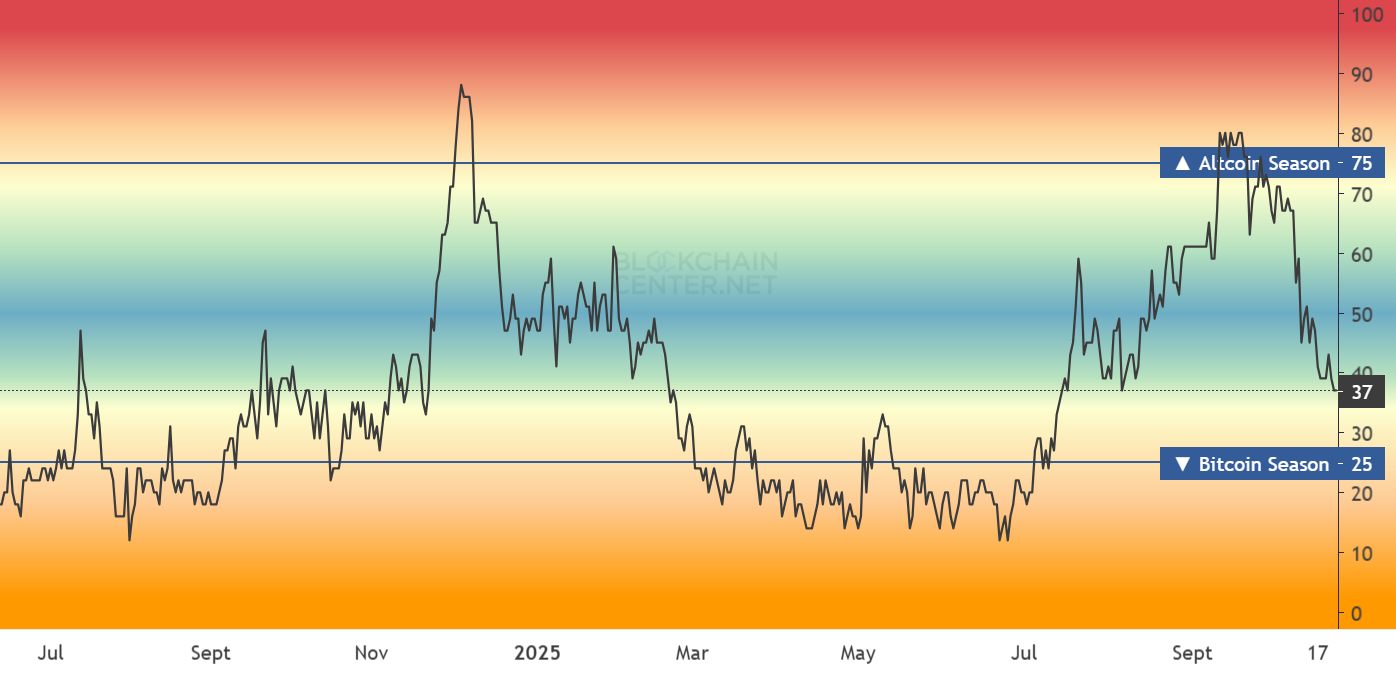

Altcoin season index indicators tell a different story from analyst predictions. Most indexes currently sit at bear market lows.

The Blockchain Center’s Altseason Index stands at 37 out of 100. This represents the lowest level since July.

CoinMarketCap’s altseason gauge sits even lower at 24. The platform reports it is still “Bitcoin season.” CryptoRank shows a similar reading of 24 while Bitget’s altcoin season index stands at 30.

Limited Altcoin Performance

Few altcoins have shown strong performance recently. BNB and Hyperliquid have made recent all-time highs. Most other altcoins are trading at multi-year lows.

Some altcoins started moving higher today. BNB, Solana, HYPE, Zcash and World Liberty Finance all outperformed the broader market according to CoinGecko.