SOLANA EXPLOSION: Fidelity’s 4.3 Million Investor Floodgate Opens for SOL Price Surge

Wall Street's sleeping giant just woke up—and it's holding Solana keys.

The Institutional Tsunami Hits

Fidelity's move unleashes 4.3 million accredited investors directly into Solana's ecosystem. No more complicated workarounds, no sketchy exchanges—just pure institutional-grade access to one of crypto's fastest-growing networks.

Liquidity Meets Lightning

Solana's already blistering 65,000 TPS capacity now faces its biggest stress test yet. Traditional finance finally discovers what crypto natives knew: speed matters when money's moving.

The Compliance Gambit

Fidelity's stamp of approval cuts through regulatory fog like a laser. Suddenly, every wealth manager who dismissed crypto as 'too risky' needs a SOL position—or risks explaining to clients why they missed the boat.

Price pressure builds as institutional allocation meets retail FOMO. Because nothing makes traditional finance embrace innovation faster than seeing competitors profit from it.

Solana (SOL) Price

Solana (SOL) Price

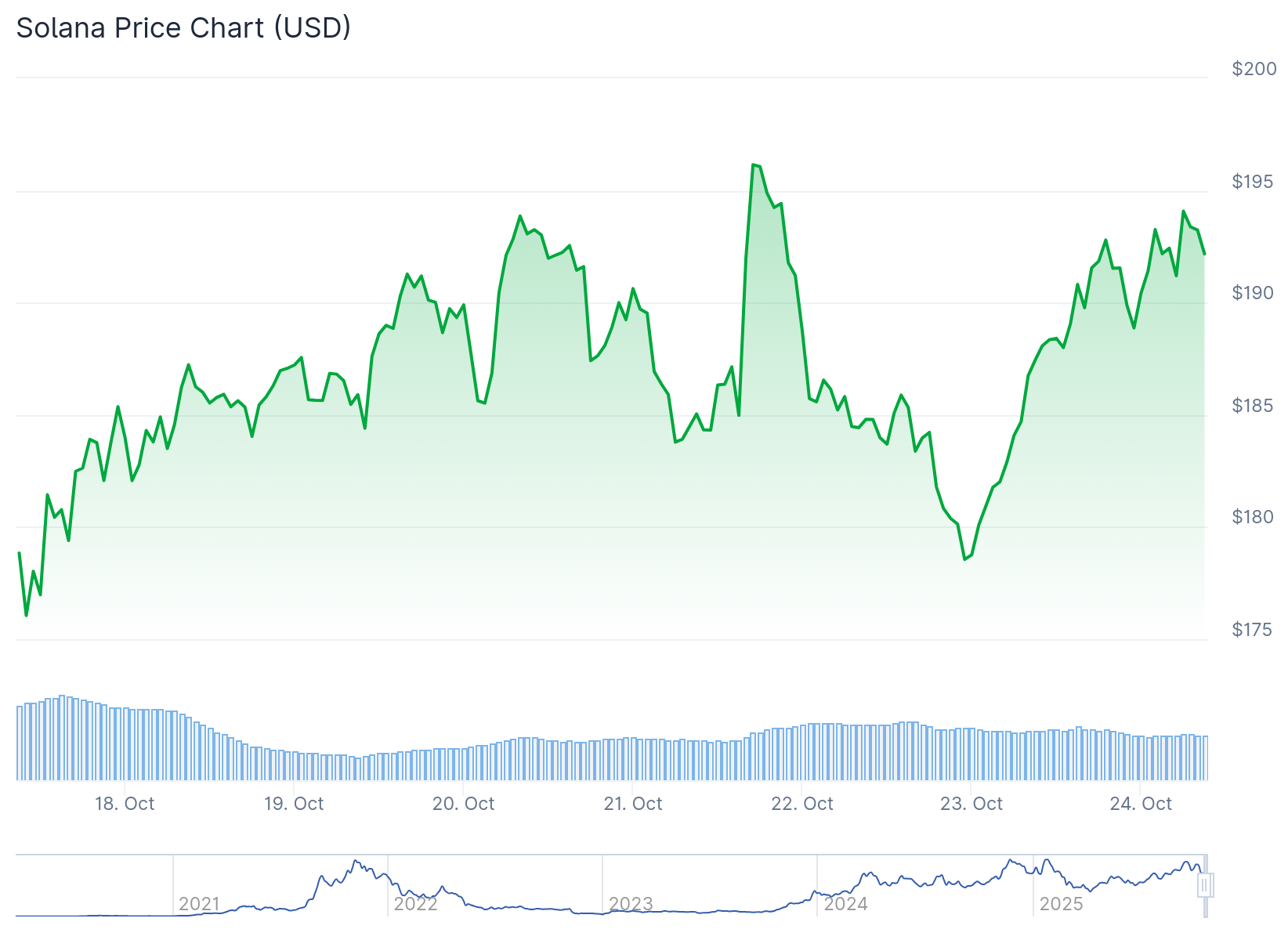

SOL gained 5% in the 24 hours following the announcement. The token recovered above $190 after bouncing off a key support level at $175.

The price movement came with trading volumes of $7 billion. This figure falls below the 14-day moving average of $10 billion but still shows market interest.

Solana currently has a market capitalization of over $104 billion. The token ranks as the sixth-largest cryptocurrency by market cap.

Institutional Adoption Continues to Grow

Nine companies currently hold Solana treasuries worth $2.6 billion combined. This represents 2.5% of the token’s circulating market cap.

The REX-Osprey Solana + Staking ETF holds nearly $400 million in assets under management. This makes it the largest exchange-traded fund linked to an altcoin besides Ethereum.

Technical indicators suggest the token could push toward $200 if it maintains current support levels. The Relative Strength Index climbed above its 14-day moving average.

Network Aims for Traditional Finance Integration

The Solana community wants the network to become the home of internet capital markets. Developers are working to attract tokenized real-world assets to the platform.

These assets include stocks, money market funds, stablecoins, and collectibles. The goal is to democratize access to finance and unlock liquidity in traditionally illiquid asset classes.

Tether launched crosschain interoperable versions of USDt and Tether Gold on Solana in October. This positions the network as a potential cross-chain stablecoin liquidity hub.

U.S. regulators signaled intent in September to MOVE toward 24/7 trading schedules. The Securities and Exchange Commission and Commodity Futures Trading Commission released a joint statement supporting expanded trading hours.

Fidelity’s integration comes as institutional interest in Solana grows. The financial services company now offers customers direct access to the token through regulated platforms.