Ethereum Whales Gobble $480M as Fear Craters to 40 — Analysts Bet Big on LINK and AVAX Next Moves

Whales are feeding while retail panics—classic crypto reversal signals flashing bright green.

The Big Money Moves

Ethereum's deep-pocket investors just deployed $480 million into positions as market fear levels collapsed to 40. That kind of institutional conviction typically precedes major price breakouts—and this time appears no different.

Analysts Circle Next Winners

Chainlink's oracle dominance and Avalanche's subnet explosion have traders positioning for the next leg up. LINK's institutional adoption metrics scream accumulation phase while AVAX's ecosystem growth outpaces most Layer 1 competitors.

Smart money knows retail always sells the bottom and buys the top—meanwhile, the whales just placed their biggest bet in months.

Ethereum Whales Add $480 Million as Confidence Builds

Ethereum Whales Add $480 Million as Confidence Builds

Data from Lookonchain reveals that Bitmine Immersion Technologies, which is associated with Tom Lee, has gathered 128,718 ETH worth almost $480 million. The tokens were withdrawn from FalconX and Kraken just after the crash, which indicates off-exchange storage.

Source: X

Analysts identified heavy buy walls in the $3,300 to $3,500 range as whales were defending those levels. Although ETH still shows technical fragility, these inflows show that large holders are expecting the real rally to happen. Historically, Ethereum bull cycles peak as retail withdrawals explode, but this time the trend is reversed. Exchange withdrawals are falling, indicating the final top in the market is not yet in.

Analysts believe this trend points to an ongoing build-up phase like the early stages of 2018 and 2021. The lack of euphoric behavior makes ETH’s outlook constructive and implies that the whales are setting up for long-term gains.

Chainlink (LINK) Sees New Strategic Inflow

Zach Rynes of CLG reported a huge addition to the chainlink Reserve, 45,729 LINK tokens worth approximately $1 million. The purchase increased total holdings to 463,190 LINK with a value of nearly $9.9 million at an average price of $22.44.

More than 90% of the buy used USD Coin (USDC) swapped via Uniswap, with the remainder being funded from the fees of the platform. Analysts say the inflow is a strategic MOVE to strengthen confidence in Chainlink’s oracle technology. The announcement came with LINK’s impressive performance in Sibos 2025 and its increasing role in real-world asset integrations.

The steady growth in LINK’s utility and the transaction volume of their network make it a prime candidate for the next round of institutional rotation.

Avalanche (AVAX) Whales Show Growing Conviction

Arkham data indicates that a whale just bought 200,000 AVAX in a classic accumulation move. Another transfer of $12 million in AVAX to a Coinbase wallet also attracted analyst attention. These moves are indicative of growing confidence in Avalanche’s long-term prospects.

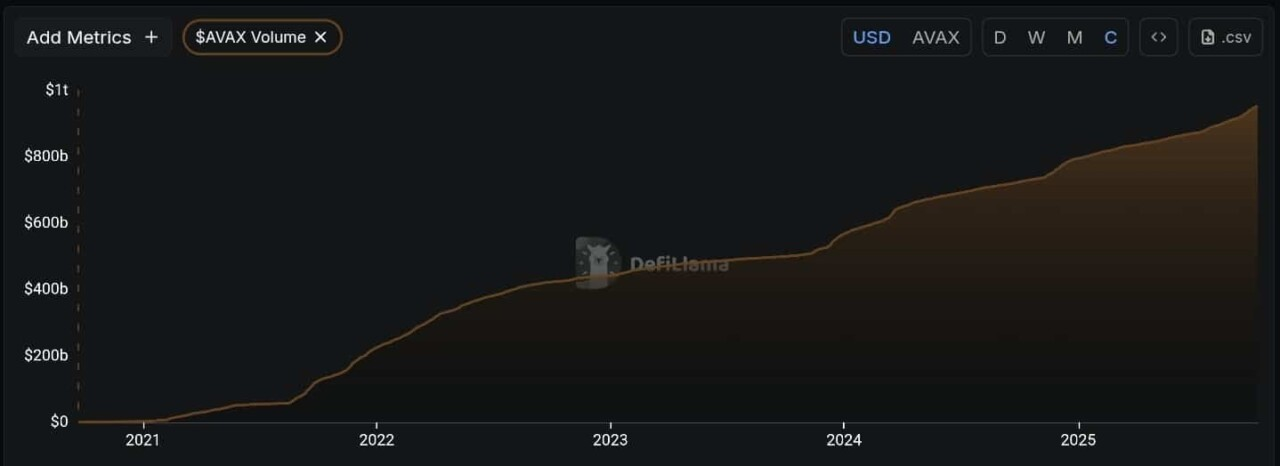

According to DefiLlama, AVAX trading volume increased by $200 million, which propelled it over 950 billion dollars cumulative figure. Decentralized exchange (DEX) transactions now account for 33 percent of daily transactions with $3.74 million in liquidity. Over 44 million smart contracts have been deployed on Avalanche, and 4.8 million AVAX have been burnt, reducing the supply and strengthening the deflationary outlook.

Source: DefiLlama

This combination of increased network use and controlled demand continues to create a bullish base for the Layer-1 project.

Whales Expand Focus Beyond Majors

Whales Expand Focus Beyond Majors

Amid this wave of institutional-style accumulation, analysts have noticed a steady increase in buying around MAGACOIN FINANCE. Large holders appear to be building positions during market lulls, suggesting growing trust in its structure and use case.

Unlike short-term momentum plays, this trend shows investors favoring utility-backed assets with sustainable tokenomics. MAGACOIN FINANCE’s design centers on scarcity and transparent distribution, features that appeal to holders accumulating for long-term returns.

Whale tracking platforms have recorded consistent wallet growth for the project since mid-September. Analysts say this pattern mirrors early accumulation phases seen in larger assets like ETH and AVAX before their major price advances. As capital flows back into quality projects, MAGACOIN FINANCE is quietly emerging as a beneficiary of the broader shift toward fundamental-driven investing.

Accumulation Broadens Across Altcoins

Ethereum’s whale activity and the Fear Index recovery signal that investors are once again willing to take measured risks. Chainlink and Avalanche show parallel patterns of inflows and network expansion, suggesting that the accumulation phase is widening.

Analysts believe this behavior marks the start of a sustained rotation toward utility-driven projects. With whales diversifying into assets such as MAGACOIN FINANCE, the market appears to be favoring long-term fundamentals over short-term speculation. If this trend continues, the current period of calm accumulation could lay the foundation for the next broad-based crypto rally.

To learn more about MAGACOIN FINANCE, visit:Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance