Bitcoin ETF Outflows Trigger Market Shakeup as $23.5M Bitcoin Hyper Presale Attracts Rotating Capital

Digital gold shows cracks as institutional flows reverse course—traders aren't waiting around to see how deep the dip goes.

The Rotation Accelerates

While Bitcoin bled from negative ETF flows, something remarkable happened: $23.5 million flooded into Bitcoin Hyper's presale within days. This isn't just capital movement—it's a strategic pivot toward next-generation crypto infrastructure that promises to bypass traditional financial gatekeepers.

Presale Momentum Defies Market Sentiment

The timing couldn't be more provocative. As established cryptocurrencies face headwinds from institutional profit-taking, emerging projects are capturing the imagination—and wallets—of forward-thinking investors. The $23.5 million presale figure signals more than just interest; it represents a calculated bet against the status quo.

Because nothing says 'financial revolution' like chasing the next shiny object while Wall Street counts its ETF fees.

Bitcoin Price Slides Below $112K as Macroeconomic Jitters Return

Bitcoin has dropped more than 3% in the last day, erasing most of the recovery it made on Sunday and Monday. The coin is now sitting roughly where it was on Sunday morning. Trading activity has cooled off too, with spot volumes down about 17%.

Traders are unwinding, as nearly $630 million in Leveraged positions got liquidated in the past 24 hours. Most of those liquidations were traders betting on Bitcoin’s price to keep going up.

Today’s sell-off is (unsurprisingly) connected to the broader market mood. China just announced sanctions against some U.S. units of a South Korean company, reigniting fears of a trade conflict with Washington.

Today’s sell-off is (unsurprisingly) connected to the broader market mood. China just announced sanctions against some U.S. units of a South Korean company, reigniting fears of a trade conflict with Washington.

Stocks in Asia and U.S. futures fell on the news – and crypto followed right along. It’s yet another reminder that even when things are looking positive, Bitcoin is still vulnerable to the same headlines that sway traditional markets.

Spot BTC ETF Outflows Add to the Bearish Pressure

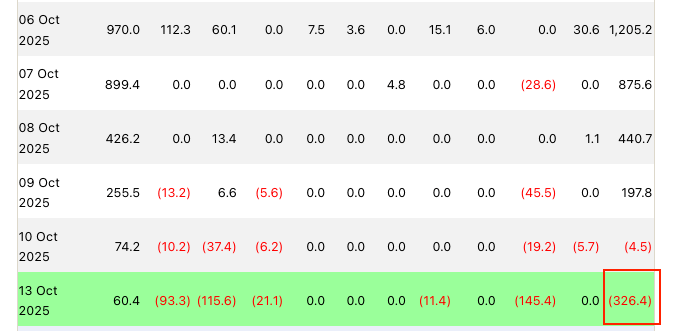

And it’s not just Bitcoin’s price chart that looks shaky. Yesterday, U.S. spot BTC ETFs recorded net outflows of around $326 million – the biggest single-day withdrawal we’ve seen since late September.

BlackRock’s IBIT did pull in over $60 million, but heavy redemptions from funds like Fidelity’s and Grayscale’s easily wiped out that gain. It shows that even as one fund buys the dip, most are still heading for the exits.

This is a clear shift after weeks of money steadily flowing in, and it hints that the big institutions are trimming their positions. It doesn’t feel like outright panic, but rather a cautious MOVE to de-risk, given the cloudy macroeconomic picture.

Still, ETF flows are often a good short-term read on market sentiment. Right now, that read is leaning bearish. Until capital starts flowing back in, the path of least resistance for Bitcoin could remain downward.

Bitcoin Hyper Defies Crypto Weakness & Hits $23.5M in Presale as Demand Spikes

While Bitcoin struggles with external pressures, a project within its ecosystem is bucking the trend. Bitcoin Hyper just sailed past the $23.5 million mark in its presale, pulling in a lot of interest while the rest of the market sold off.

So, what’s the draw? Bitcoin Hyper is trying to solve some of Bitcoin’s oldest problems. The Bitcoin blockchain can still only handle about 3-7 transactions per second (TPS), which is a world away from what other Layer-1s like solana and Sui can do.

Bitcoin Hyper will use the Solana VIRTUAL Machine (SVM) to bring that kind of speed – plus lower fees and DeFi capabilities – to Bitcoin. It’s built as a Layer-2 blockchain, designed to combine Bitcoin’s security with Solana’s high performance.

With the HYPER token presale still live, investors can buy in at a discount ($0.013115 per token) compared to the planned DEX listing price. And a recent whale purchase of $19,600 shows that confidence from high-net-worth investors is growing.

Even well-known crypto analysts like Borch Crypto have been talking up Bitcoin Hyper’s prospects, predicting it could 100x. Ultimately, if today’s market dip highlights Bitcoin’s current limitations, Bitcoin Hyper’s presale success shows how traders are actively seeking projects that solve the chain’s scalability issues.