Ripple与Ondo Finance合作将美国国债代币化至XRPL - 十月SEC将对六项XRP ETF申请做出裁决

华尔街传统金融遇上区块链革命 - 美国国债正在走向完全代币化。

Ripple与DeFi巨头Ondo Finance达成战略合作,将价值数亿美元的美国短期国债上链至XRPL网络。这一举措标志着传统金融资产与区块链技术的深度融合,为机构投资者开辟了全新的资产配置通道。

监管风向转变:SEC十月关键裁决

美国证券交易委员会将于十月对六项XRP交易所交易基金申请做出最终决定。这一时间节点恰逢Ripple与Ondo Finance合作公布,市场普遍解读为监管环境可能转向的信号。毕竟,当传统金融大佬们开始认真对待加密货币时,监管机构通常不会落后太远 - 或者至少会假装跟上时代。

代币化国债:机构资金的新入口

通过将美国国债转化为XRPL上的数字资产,机构投资者可以获得传统金融市场的稳定收益,同时享受区块链技术的透明性和效率。Ondo Finance的代币化解决方案允许最小投资单位低至1美元,打破了传统国债市场的高门槛。

Ripple首席执行官Brad Garlinghouse在声明中表示:“这是将万亿美元级传统金融市场引入区块链的关键一步。当华尔街开始用我们的技术重建金融基础设施时,你就能感受到范式转变的真正来临。”

市场影响与未来展望

分析人士认为,此次合作可能为XRP生态系统带来数十亿美元的机构资金流入。如果十月SEC批准XRP ETF申请,将进一步完善数字资产的合规投资渠道。不过,那些仍在等待“合适入场时机”的传统金融机构可能会发现,当他们都准备好时,最好的位置早已被占领 - 这就是金融创新的残酷节奏。

代币化不再只是概念验证,而是正在重塑全球金融体系的现实力量。当美国国债都能在区块链上自由流转时,所谓的“传统金融”与“加密金融”的界限正在快速模糊 - 或许这就是金融进化的必然方向。

TLDRs;

- Apple stock rose nearly 1% premarket after a Seattle court dismissed an antitrust lawsuit over iPhone and iPad prices.

- Judge faulted plaintiffs’ lawyers for misleading the court while trying to add new plaintiffs after the original withdrew.

- The case claimed a 2019 Apple-Amazon agreement reduced resellers on Amazon’s marketplace, inflating device prices.

- Apple and Amazon denied wrongdoing; plaintiffs’ attorneys accepted $223,000 sanctions for mishandling the lawsuit.

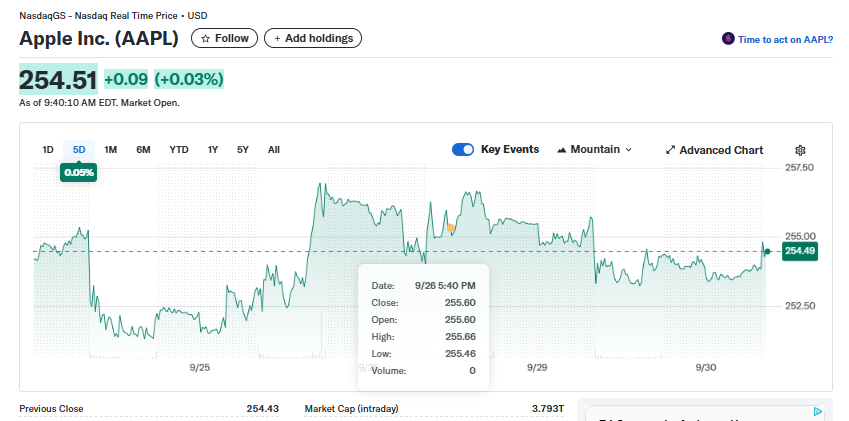

Apple Inc. (AAPL) shares edged higher in premarket trading on Tuesday, climbing almost 1% as investors digested news that a long-running antitrust case had been dismissed in the company’s favor.

The ruling, delivered by U.S. District Judge Kymberly Evanson in Seattle Monday, effectively clears Apple and Amazon of claims that they conspired to artificially inflate iPhone and iPad prices on Amazon’s marketplace.

The case, filed in 2022, centered around a 2019 agreement between the two companies. Plaintiffs alleged that Apple granted Amazon pricing discounts in exchange for reducing the number of independent Apple resellers on its platform. According to the original complaint, the number of third-party sellers dropped from about 600 in 2018 to a far smaller pool following the agreement.

Court faults plaintiffs’ legal handling

Judge Evanson’s dismissal was not based on the merits of the antitrust claims alone but also on how the plaintiffs’ attorneys managed the litigation. The court found that the lawyers misled Apple, Amazon, and even the court itself about their client’s intention to withdraw from the lawsuit, all while attempting to recruit new plaintiffs to keep the case alive.

In a stern rebuke, the judge ordered the plaintiffs’ legal team, Hagens Berman Sobol Shapiro, to pay a combined $223,000 in sanctions covering Apple’s and Amazon’s legal fees.

The law firm did not contest the penalty and admitted in a filing that “the situation could have been handled better,” pledging higher standards of professionalism in future cases.

Allegations of restricted resellers

The plaintiffs argued that Apple’s arrangement with Amazon violated U.S. antitrust laws by suppressing competition among sellers of iPhones and iPads.

By limiting the number of resellers, the lawsuit claimed, Apple ensured tighter control over pricing while Amazon benefited from exclusivity and lower wholesale costs.

Apple and Amazon consistently denied wrongdoing, countering that their agreement aimed to reduce counterfeit products and ensure consumers purchased authentic Apple devices. The companies further argued that buyers still had access to competitive pricing through official channels and other retailers.

Market, legal, and consumer implications

For Apple shareholders, the dismissal removes a cloud of uncertainty that had lingered over the company’s retail practices. Legal experts note that while the case’s collapse was accelerated by procedural missteps from the plaintiffs’ attorneys, the ruling also strengthens Apple’s defense in the face of broader antitrust scrutiny from regulators in the U.S. and Europe.

Amazon, which has faced multiple antitrust probes of its own in recent years, also emerges with a significant legal victory. The outcome signals that consumer-focused lawsuits alleging platform collusion may face higher hurdles if procedural mismanagement weakens their credibility.