Ethereum Price Prediction: October Dominates Crypto Gains - Our Top Altcoin Picks Revealed

Crypto's seasonal secret weapon just triggered - and Ethereum's leading the charge.

October's Historical Dominance

While traditional markets wrestle with Fed meetings and inflation data, crypto's October performance consistently leaves Wall Street in the dust. Historical data shows double-digit returns becoming the norm rather than the exception.

Ethereum's Infrastructure Advantage

The Merge completed, layer-2 scaling solutions exploding, and institutional adoption accelerating - Ethereum's ecosystem resembles a well-oiled machine hitting its stride. Network upgrades have slashed gas fees by over 80% while transaction speeds quadrupled.

Our Top Contenders

Beyond ETH, we're tracking three projects with fundamental breakthroughs: A layer-2 solution processing 100K TPS, a DeFi protocol yielding 15% APY without the usual rug-pull risk, and a gaming token that actually has playable content instead of empty promises.

Timing the Market

Entry points matter more than asset selection. We're watching for the classic post-September dip that typically creates 20-30% upside potential by month's end. Because let's be honest - traditional finance still can't tell the difference between a blockchain and a bicycle chain.

Ethereum Price Poised for a Short Squeeze?

Ethereum has been flirting with a breakout level NEAR $4,200, where more than $11 billion in short positions could be liquidated. If ETH pushes above this threshold, the forced covering of positions could create a short squeeze, accelerating gains rapidly.

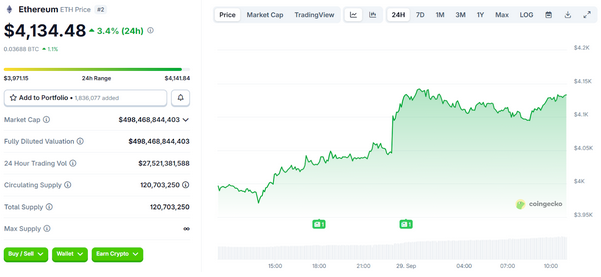

Ethereum Price Chart | Source: CoinGecko

Currently trading around $4,134, ethereum is showing early signs of recovery, aided by improving sentiment after weeks of ETF outflows and bearish pressure. If ETH can close the week above $4,200, analysts suggest it could spark a rally that pushes toward $5,000. With the Uptober hype nearing, ETH holders have several reasons to be optimistic.

Avalanche (AVAX): Onchain Metrics Builds a Strong Case

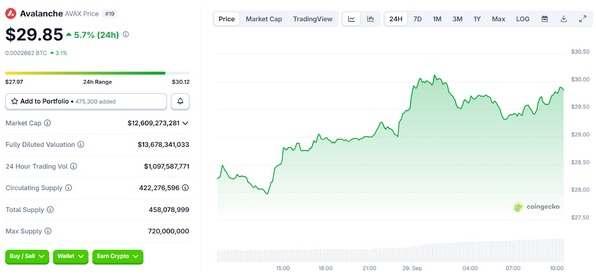

Avalanche remains one of the most compelling Ethereum alternatives heading into October. AVAX has recently traded near $29.50, with trading volume soaring by 86% in a single day.

Avalanche Price Chart | Source: CoinGecko

On-chain data also supports the bullish case. Avalanche boasts 45,100 daily active addresses and has generated nearly $900 million in transaction fee revenue over the past three years, ranking just behind Ethereum, Solana, and Tron. Technical analysts point to the recent golden cross as a bullish signal, with upside potential toward $100 if support holds above $27.

Remittix (RTX): The PayFi Disruptor Gaining Momentum

While Ethereum and Avalanche dominate institutional headlines, Remittix (RTX) is making waves in the payments sector with its PayFi ecosystem. The project has already raised over $26.8 million, selling over 672 million tokens, as investors rush to secure a stake in what some call one of the most promising presales of 2025.

Key features that set Remittix apart include:

- Near-instant crypto-to-fiat transfers in 30+ countries

- Support for 40+ cryptocurrencies and 30+ fiat currencies

- A business-ready Pay API for seamless settlement in fiat

- Privacy-first design, deposits appear as standard bank transactions

Beyond its presale success, Remittix has completed its CertiK audit, secured two CEX listings, and launched a beta wallet. The project also introduced a 15% USDT referral rewards program, giving users instant daily payouts for bringing in new buyers.

With real-world payment utility, strong investor backing, and early adoption drivers in place, Remittix is quickly becoming a standout contender, alongside Ethereum and Avalanche, for Q4 growth.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway